If you’ve been thinking about working with a financial planner then I have some great news for you: modern-day financial planners can meet you virtually over Zoom, Facetime, Skype, etc. So you can get your finances in order while sheltering in place. The best part is your remote meetings will be more effective, you’ll save time and money, you’ll have a much larger pool of financial planners from which to choose, and you’ll even be doing your part to save the environment.

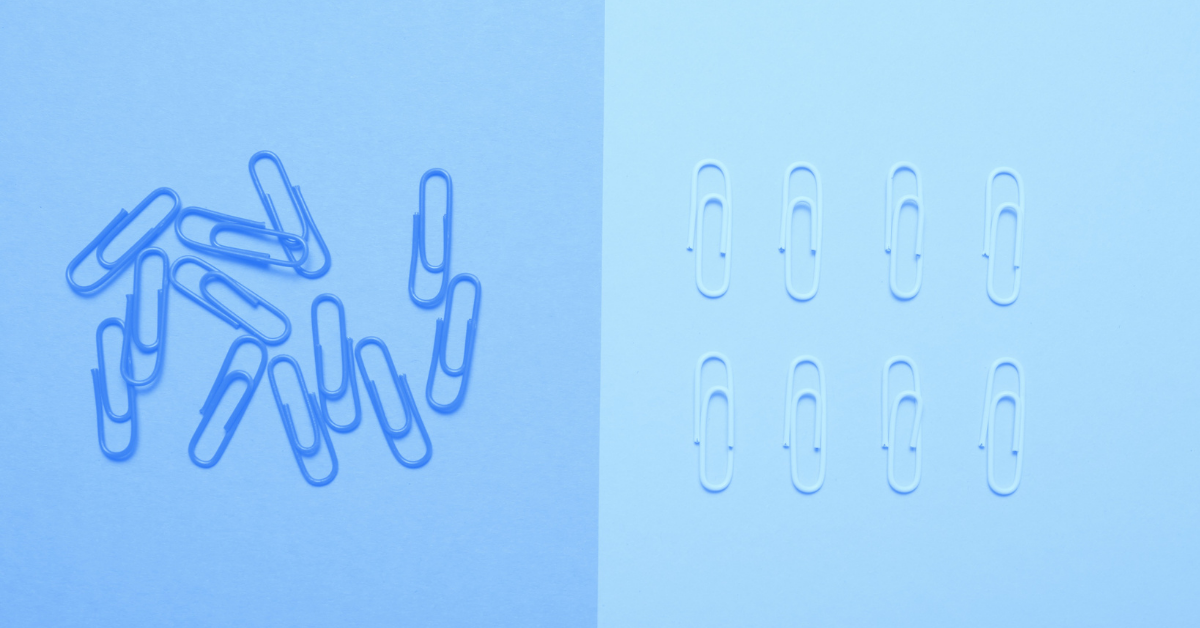

More Effective and Efficient Meetings

Transform financial planning into financial doing

Believe it or not, your meetings will be far more efficient and effective if you meet your financial planner using modern-day videoconferencing technology such as Zoom. You’ll get a lot more done in a lot less time because you have the ability to share screens and easily log in to accounts together. You can log in to your company 401(k) and make the adjustments on the spot. Do you need to review your stock options or RSU vesting schedule? Just quickly log in together with your financial planner to review your company equity package and make a plan for your vesting equity. When you meet with your financial planner virtually there’s an increased emphasis in taking care of everything on the spot, which transforms your financial planning session into a financial doing session.

Save Time

Skip the commute to your financial planner’s office to instead spend time with friends and family

Do you miss the long drive through traffic to and from your financial planner’s office? If your planner is in a city you get the added benefit of sitting in traffic, then sludging around in search of a parking spot. And if you timed it well and arrived early you may be treated to a 10-minute wait in the reception area. Furthermore, because your meeting will be less efficient (see above) you’ll be with your financial planner for an extra 20 minutes or longer. And finally, you’re probably not logging in to your accounts and implementing your plan during your in-person meetings, so you’ll have to spend some time after the meetings logging in to your employer’s online portals to implement your financial plan’s action items (if you even remember to log in and make the changes).

All of the above adds up to a whole lot of wasted time. Your financial planner is probably a lot of fun to hang out with, and I know you look forward to logging in to your employer’s retirement plan portal on your free time, but I’m guessing you’d rather be spending that time with your family, getting a workout in, or simply relaxing.

Save Money

We all want more money to invest (and some to shop with!)

Unfortunately, time isn’t the only precious resource you’re wasting by meeting in person. You’re also wasting your money. No need to pay for fuel, parking or public transportation if you meet virtually. Furthermore, you’ll make your financial planner proud if you tell them you want to meet over Zoom so you can pocket some extra savings (even if it’s only a small amount).

Your financial advisor is also saving money if they ditch the office. Brick and mortar offices aren’t cheap. Furthermore, there’s the cost of a receptionist, food, coffee, etc. All of these savings can be passed on to the client, which means you save more by meeting virtually and you ultimately reach financial independence and/or retirement earlier.

Save the Environment

Less commuting and less paper results in a happier planet

Ditching the commute to your advisor’s office means you’re doing more of your part to help reduce strain on the planet. Once the masses follow suit and stop commuting to their financial planning meetings (and other meetings that don’t need to be held in person), then we’re collectively reducing traffic and smog and actually making a difference. It’s as simple as that.

Work with the Best

You’ll have way more financial planners from which to choose if you don’t limit yourself to your geographic area

Congratulations, you’ve decided to work with your financial planner virtually, which means you can now choose any available advisor in the entire United States. Thanks to modern technology you’re no longer limited to working with an advisor in your immediate geographic area. You’ve just expanded your search radius by over three million square miles, which means you now have hundreds of thousands more advisors as options. You can now easily find a financial planner who specializes in working with people like yourself. Now that’s something to celebrate.

The Downside

Video conferencing just isn’t quite as personal

I fully understand that there are advantages to meeting your financial planner in person. The client–financial advisor relationship is a very personal one. It’s based on trust and mutual respect, and we’re more comfortable trusting someone if we’ve met them in person. Furthermore, there can be technical difficulties and/or kids interrupting if you’re meeting your advisor from home (although your advisor most likely enjoys catching a glimpse of your family as this is mostly who the exercise of financial planning is intended to benefit).

I believe that the pros of meeting virtually far outweigh the cons. And If you haven’t tried meeting a financial planner virtually then it’s time to give it a shot. I think that you too will soon realize the benefits far outweigh the cons.

About the Author

About the Author