You’ve probably heard the term financial planner thrown around a lot. It’s confusing because being a financial planner can mean many different things. You probably won’t receive the same level of services from one financial planner compared to another.

To put simply, a real financial planner (shoutout to Carl Richards) helps articulate why money is important to you and then guides your financial decisions so your money enables you to live your ideal lifestyle. For most people, this means the ability to spend your time in a way that is directly aligned with your values and passions.

But people don’t come to a financial planner asking for this. They typically come with a specific problem in mind – how do I handle student loans, how should I be investing, how should I be saving for education, etc. A financial planner will provide answers to these problems, but also provide many more services that people are not aware of.

Most of us don’t really know what to expect when working with a financial planner, let alone how to find the right one. This blog will help clear that up.

Why people get confused about a financial planner

Simply put, there is no title protection for being a financial planner. Anyone can go around calling themselves one as long as they meet state licensing requirements. One financial planner could work at an insurance company and sell insurance. Another financial planner could work at a broker dealer and sell investment products. Another financial planner could work at an investment firm and just manage investment portfolios.

WTF? How are people supposed to understand this?

Compare this to going to the doctor – you know the doctor graduated from medical school, completed residency and then passed the grueling state board exam. There is title protection for being a doctor – you need to fulfill all of these requirements in order to provide medical advice. You can’t just go around calling yourself a doctor.

The financial planning industry needs to evolve to protect the title of a financial planner. A financial planner should, at a minimum, be two things:

- A Certified Financial Planner™. This essentially means they completed an intense educational program (similar to medical school), passed an exam (similar to the state board exam) and then have a fiduciary duty to act in the client’s best interest.

- Be fee only. This means the financial planner should only be compensated by their client. If a doctor is providing you with 3 different options for medicine, they should not be incentivized to prescribe you with the medicine that puts more money in their pocket. The same concept applies for a financial planner – they should not be compensated differently based upon the advice that they provide.

Money is too important not to have these minimum standards. You should never have to question whether or not the professional you are hiring is acting in your best interest. Are there great people who act in their client’s best interest and also sell insurance? Of course. However, there are far too many bad actors for people to be able to determine who is good and who is bad. Working with a fee only financial planner helps eliminate that uncertainty.

I’d argue that nowadays, it’s not enough to be fee only. I think the industry is trending towards fixed fees. The most common way that fee only financial planners charge is based upon a percentage of investment assets they manage (1% is the standard). On the surface, that makes sense – they are only compensated by you and they don’t have other incentives.

Except when it comes to investing…

What if you are asking your financial planner whether you should invest or pay down debt? Well, if the financial planner charges based upon the investment assets they manage, they may be incentivized to tell you to invest the money so their fee goes up. Vice versa, if they are acting in your best interest and tell you to pay down the debt, their fee shouldn’t be reduced as a result of that.

This is why fixed fees are in the client’s best interest. It allows a financial planner to truly be indifferent about the action you take and provides you with the piece of mind that their fee is not changing based the advice they give.

How to find the right fee only financial planner

Luckily, there are organizations that help people find fee only financial planners. Some of these include NAPFA, Fee Only Network and XYPN Find An Advisor. NAPFA and Fee Only Network are more focused on geography (finding one local to you) and XYPN is more focused on specialties/values.

Most financial planners work with clients virtually, so you shouldn’t feel the need to only work with one that lives close to you. There are amazing financial planners all over the country that can serve your unique situation.

You want to work with a financial planner that specializes in your situation. If you are in your mid 30’s with children, you probably don’t want to work with a financial planner that focuses on retirement planning and social security. You are more concerned with getting your finances organized, saving for education, paying down debt, etc.

If you are speaking to a financial planner and it’s clear you aren’t their target client, they will very likely know two or three other financial planners that target their services towards you.

What a financial planner helps you accomplish

Set direction and communicate about money

Here is a question that I ask my clients – why is money important to you?

My guess is you have never really thought about what you want your money to do for you and that’s okay. Most people don’t really know how to answer this.

We’ve been taught that we need money, but for what? Outside of paying your day to day expenses, what do you want your money to accomplish for you? What’s the point of budgeting, saving and investing if you don’t know what you want to accomplish?

Working with a financial planner helps you define what your ideal lifestyle looks like and then guides your financial decisions to put you in the best position to accomplish that. If you don’t have a clear vision of what you want your money to accomplish for you, you run the risk of sacrificing time and experiences in the endless pursuit of more money.

In addition, talking about money is really challenging. Money represents some of our most deeply held and valued beliefs. On top of that, we’ve never really learned how to talk about it. Money is taboo, right? This is a big reason why money is a leading cause of divorce – it’s a necessary element of our lives that represents our deepest values and yet, we don’t know how to communicate about it. A financial planner helps navigate you, and potentially a partner, through these difficult conversations.

Provide a financial health check

Most people don’t think they need to work with a financial planner until they have a lot of money. This couldn’t be further from the truth. In fact, the most impactful decisions are when you are making your money, not when you have already made your money.

Think of it this way – would you go to the doctor for the first time when you are 50 years old because you have a health problem? No! You go to the doctor every year to make sure you are doing the right things for your health and proactively making decisions in your life to keep you in the best possible health.

Your money is too important to never seek expert guidance. Yes, you can google nearly everything now, but google won’t tell you how those specific topics apply to your unique situation.

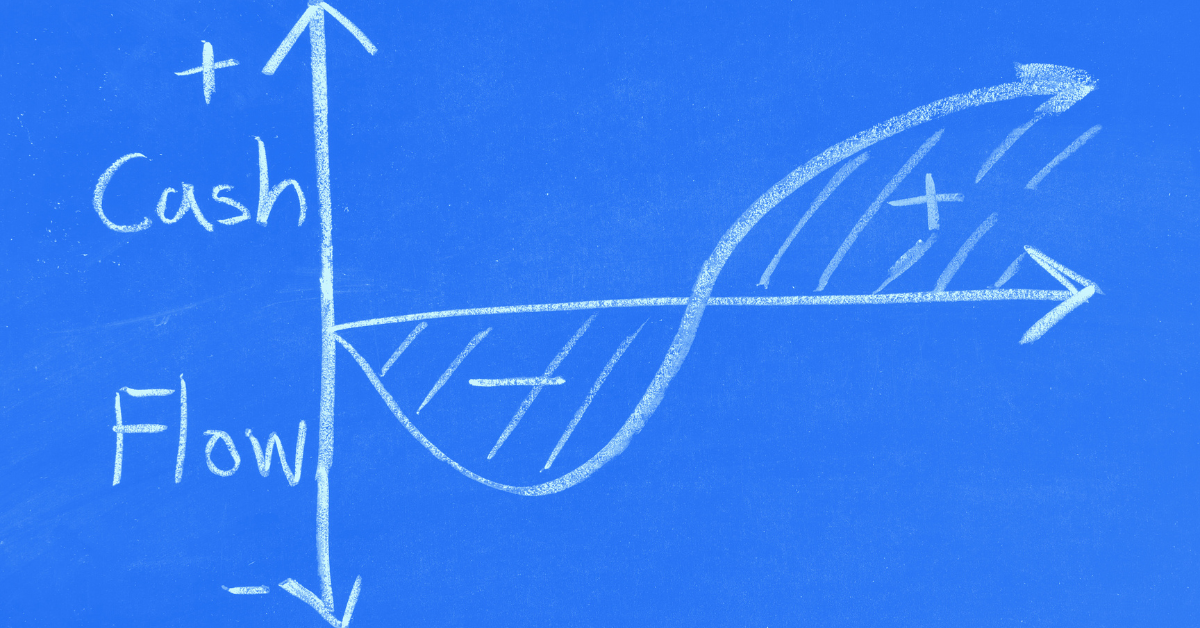

After helping you define why money is important to you (I call it creating your financial lens), a financial planner fully diagnoses your financial health. There are many things in your financial life – cash flow, debt, investments, employee benefits, insurance, estate, etc. It’s overwhelming for most people.

A financial planner helps identify what you should or should not be doing in your financial life as it relates to your values and goals. All decisions flow through your financial lens which are created from understanding why money is important to you. Most commonly, they will immediately identify financial decisions you should be doing differently. But what if they have nothing to add? You have the peace of mind you are doing the right things with your hard-earned money.

Help you implement changes and keep you accountable

While I believe everyone should receive a financial health check, not everyone needs an ongoing relationship with a financial planner. It depends on your unique situation and boils down to a few key questions.

- Do you enjoy and feel comfortable making financial decisions?

- Is money a key point of tension in your relationship?

- Do you have the time and energy to stay on top of your finances? What is the opportunity cost of that time?

- Will you stay accountable for doing what you agree to? What happens when things change?

Sticking with a health analogy, it’s similar to hiring a personal trainer. Working with a personal trainer will very likely make you healthier than if you tried working out on your own. It’s easier to blow off working out when nobody is keeping you accountable. It’s easier to fall into the same, routine workout habits without understanding any new and exciting ideas to improve your health. A trainer will constantly be assessing your physical health and tweaking the exercises you do based upon how your body is changing. The same concept applies with financial planning.

Working with a financial planner will provide you with:

- The peace of mind that someone who knows your values and goals is guiding your financial decisions. They will let you know when changes need to be made, especially when your values and goals change. Life doesn’t follow a straight path – there are constant changes and what you want now probably won’t be what you want in 5 or 10 years. You can outsource your financial stress to a professional. When the market is tanking and everybody is freaking out, you have your financial planner to speak with.

- A constant, reoccurring environment for you and your partner to talk about money. This is literally healthy for your marriage – I’m still waiting on the statistics to show how divorce rates drop when people work with a financial planner 😃. It’s important to make talking about money a priority.

- An objective, third party thinking partner. It’s very difficult to make decisions with your money because you’re too close to the situation. This is why companies bring in consultants – they need fresh perspectives to identify the blind spots that they may not be seeing. A financial planner provides outside perspectives on all of your financial planning decisions and has the ability to draw on other client situations to demonstrate how similar decisions have played out in the past.

- The free time to spend on work, with family or pursuing other passions. Even if you do like this financial stuff, is it the best use of your time? For the first time, I hired a CPA for taxes this year. Could I have done my own taxes? Sure. However, paying someone to do my taxes allowed me to focus more time on my business and my clients and I have the peace of mind that an expert is taking care of it.

Key Takeaways

- Get your financial health checked. Seriously. Don’t wait 20 years to have someone look at your finances. Pay someone to help make sure you are doing the right things with your money and help you avoid potentially devastating mistakes.

- Search for a fee only financial planner using one of the search engines I mentioned. Be sure to find someone that works with people like you.

- Always understand how the financial planner is compensated and what actions they take to minimize any conflicts of interest. You should never be asking yourself “what’s in it for them?” when they are providing you with advice.

About the Author

About the Author