Many of us find ourselves working from home, homeschooling our children, cleaning out our garages, and exercising and cooking more. Now is also a good time to organize your finances.

Get Rid of That Pile of Papers – We may live in a digital world, but many documents still come by mail. Many of us have a pile of papers that need to be sorted and saved or shredded. The following is a general guideline on how long to keep certain documents.

- 1-3 Months: ATM stubs, sales receipts (unless needed for tax purposes)

- 1 Year: Bank/investment/credit card statements (unless needed for tax purposes), paystubs, cancelled checks, paid bills.

- 7 Years: Tax returns and any supporting materials, W-2s, K-1s.

- Varies: Property deeds, vehicle titles, loan documents (keep as long as you own the property/vehicle and/or for tax purposes), insurance documents (for as long as the policies are in force or if needed for tax purposes)

- Forever: Birth certificates, Social Security cards, citizenship papers, marriage licenses, divorce decrees, adoption papers, military records, most recent estate planning documents, death certificates.

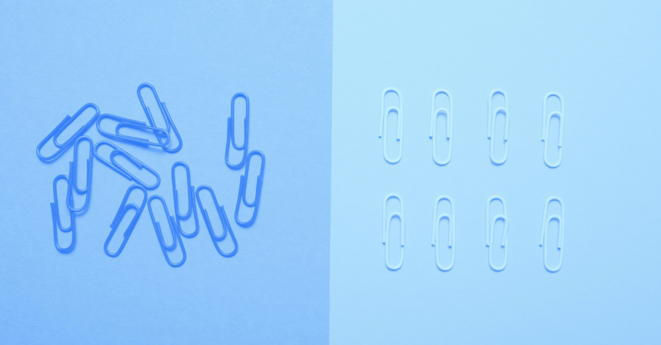

Consolidate and Simplify – Too many accounts can get unruly and you may lose track of accounts.

If you’ve had multiple jobs, you may have several employer retirement plans, such as a 401(k), 403(b), SEP IRA or Simple IRA. Once you leave an employer, you are usually allowed to roll over your employer plan to an IRA at a financial institution of your choosing. You may also be allowed to rollover your retirement accounts to your new employer’s retirement plan, depending on the type of account and the rules of the new plan.

If an account becomes dormant for too long, the account can be transferred to the state treasury under what is called escheatment. The dormancy period for most state is five years. Unclaimed property remains with the state, unless it is reclaimed. You can search for unclaimed money through the following websites, or through your state’s unclaimed property website.

Automate Savings – If you don’t see your money, you won’t spend it. Set up and maximize direct, automated contributions to your employer sponsored plans. Contributions to work retirement plans, Health Savings Accounts and Flexible Savings Accounts are pre-tax, so these contributions also lower your overall taxable income. A win win situation!

You can also automate direct savings to a savings, investment or other type of account, like a 529 college savings account.

You’ll need to define a savings target, or work with your financial advisor to determine realistic spending levels and savings target.

Create or Update your Estate Planning Documents – This is an area where many people kick the can down the road. No one wants to think about incapacity and death, but it is highly recommended that you have current documents in place, so the best people of your choosing are in the right roles and your wishes are known. An estate planning attorney can help you create or update the following documents.

- Will: Establishes your wishes regarding distribution of your property (real and personal) and who should manage your property until it is distributed.

- Living Will (a.k.a Medical Directive): Establishes your wishes for end-of-life medical care. This document includes your specific wishes for medical care if you are unable to communicate. For example, do you want to be on life support or not? The people caring for you will know what exactly you want instead of guessing.

- Trust: Trusts can be used in a variety of ways. For example, your assets can be held in trust and managed on your behalf if you are incapacitated. Upon death, your assets can be distributed without going through probate, or they can be held in trust for your beneficiaries, such as young children.

- Financial and Medical Power of Attorneys: Financial and medical Powers of Attorney allow you to choose a person to make financial and medical decisions if you are injured or incapacitated. You can name a different person for each role.

Remember to update your beneficiary designations (retirement and non-retirement accounts, annuities, life insurance, etc.) if you update your estate planning documents, or in other situations, such as divorce. Otherwise your wishes may not be carried out as you intend.

Review Your Insurance Needs – Insurance is another area that is often overlooked. Auto and health are usually kept up to date, but home owners, umbrella, life and disability insurance are often forgotten. These different types of insurances are important and can safeguard against financial catastrophe.

- Home Owners Insurance: If you’ve made major home improvements to your house, or you have not discussed your coverage with an agent for many years, check in with your home insurance carrier.

- Umbrella Insurance: This type of insurance offers coverages above auto and homeowner’s policy limits. As your assets and net worth grow, so should your umbrella insurance.

- Life Insurance: As your life changes (i.e. marriage, divorce, birth of a child, employment and lifestyle changes, or other life events), so should your life insurance coverage. Many people may forego or get too little life insurance. A qualified insurance agent and/or financial advisor can help you determine the appropriate amount of insurance needed.

- Disability Insurance: Most people receive disability insurance through their employer. For those who are self-employed or if your employer doesn’t offer any or not enough disability insurance, you can purchase an individual policy. While individual policies are typically more expensive than group policies through an employer, it is still important that you and your family are protected in case of an injury.

Work with a Financial Advisor – The financial choices you make now can significantly impact your family’s financial future, for better or worse. You don’t want to make the mistake of being close to retirement or in retirement and realizing your finances do not match your needs and wants. Having a trusted financial advisor is an investment in your financial future. A financial advisor can help advise you on various financial needs, such as investment management, determining when you can retire comfortably, charitable giving strategies and managing your finances in retirement.

Use this extra time at home wisely. Organize your finances now to help ensure financial security later.

Stay safe and healthy.

About the Author

About the Author