How to Use the Stock Market as a Tool

Share this

4 MIN READ

What if I told you what happens today in the market has no impact on your goals? Would it change the way you invest and think about the market?

In this article, I am going to show you how to use the stock market as a tool for achieving your long-term goals.

How the Market Really Works

In order to use the stock market as a tool for achieving your long-term goals, it’s important to understand how the stock market works. The stock market is made of millions of participants. From corporate investment companies to hedge funds to active day traders — all these participants approach the market with different objectives. For some, capturing short-term mispricing is crucial while for others, not so much. For individual investors and for my clients, our goal is to capture long-term growth. We have the luxury of being able to approach the market with a several decade-long time horizon whereas a hedge fund may only have a few years to earn a profit. These short-term participants tend to panic during any time of uncertainty, which causes prices to go down. However, markets do eventually recover and reward the long-term, patient investors.

The first step in applying this knowledge comes down to understanding your time horizon. This means before you invest in anything, have an idea when you will need your money back. For example, in my Roth IRA, I don’t need the money for another 30 years. Given that, I can invest more aggressively in that account. However, money I need within a few years is stored in a bank account separate from stock market volatility.

Since my Roth IRA has a multi-decade long time horizon, news now has no impact whatsoever. As I get closer to needing that money, that’s when I’ll shift how that account is invested. Your investment strategy should be dictated by you not what’s going on in the headlines.

The biggest mistake I see with new investors is using the market as a short-term tool. Let the power of the stock market work for you.

Mindset & Behavior

Over the years, you’ll be tested. They’ll be more recessions and you’ll be thinking, “This time is different.” You’ll question if you should take the money out and then invest once the market rebounds. Sounds great in theory, but the market is very odd in the short-term. History has shown that one of the greatest risks in investing is staying on the sidelines and missing out on gains.

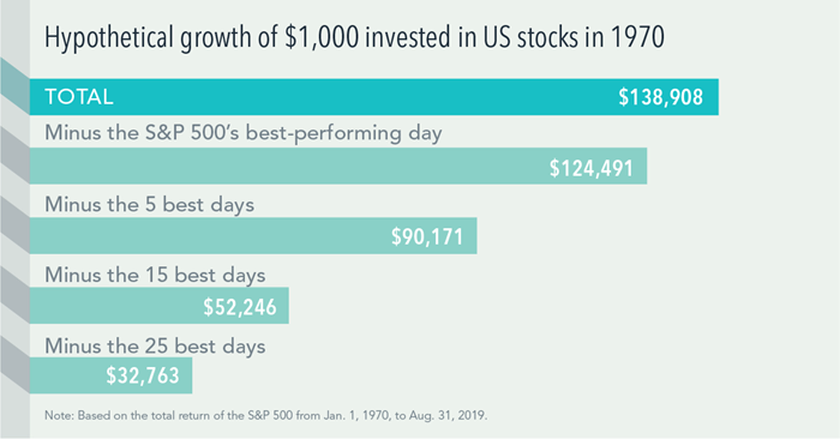

Research from Dimensional Fund Advisors shows that missing the best day has some serious consequences:

Down markets, up markets, flat markets — long-term investors should remain invested. A proven approach to make sure you’re always invested is to use dollar-cost average. By investing the same dollar amount every month or quarter, you're effectively removing timing decisions from the investment process. No matter your net worth, this is an approach all investors can use.

Predictable but not Guaranteed

As mentioned earlier, the stock market is very odd in the short-term and impossible to model. However, if you stretch the market out over the course of a decade, it becomes more predictable. The U.S Stock Market averages an annualized return of 10%. However, don’t bank on that 10%. Certain years can vary drastically and even decades, like the lost decade, have shown otherwise.

This means that while we can generally expect our money to double in value every 7 years, according to the Rule of 72, it is not guaranteed. Instead, use rules and averages like this as a way to think about the benefits of long-term investing.

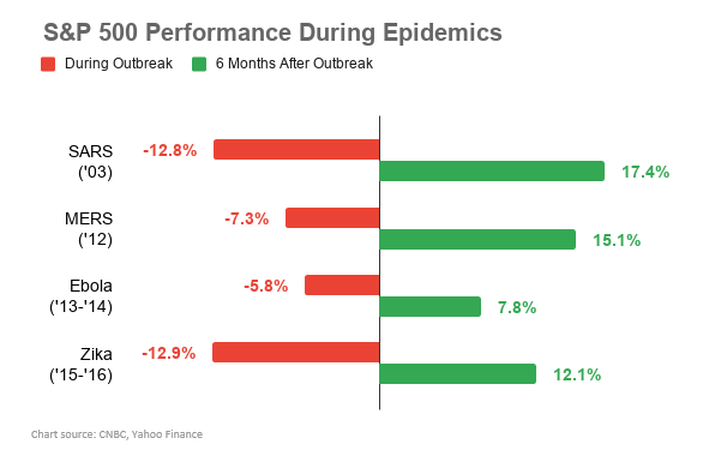

How do Markets Respond after Pandemics?

While it’s still uncertain how the market will respond to Covid-19, history suggests that we should rebound. While history cannot predict the future, it serves as a powerful reminder of the resiliency of the stock market.

Markets are unpredictable in the short-term and should never be relied upon as a quick way to generate cash. Before investing, define your time horizon, write down your goals, and ignore the headlines. The markets have a wonderful way of rewarding long-term and disciplined investors.

Lastly, if you haven't already, contact a CERTIFIED FINANCIAL PLANNER™ Professional. They can spot-check your current investment strategy and tie it in with the rest of your financial plan.

About the Author

About the Author

Riley Poppy is the Founder of Ignite Financial Planning, a fee-only firm located in Seattle, WA. Ignite provides financial planning and investment management services to tech and medical professionals. As a firm that provides value beyond the numbers, we help our clients use their financial resources as a tool for living their great lives.

Did you know XYPN advisors provide virtual services? They can work with clients in any state! View Riley's Find an Advisor portal.

Share this

Subscribe by email

You May Also Like

These Related Stories

Reflections on a Fearful Market

Good Financial Reads: So You Want to Learn About the Stock Market?