Homeowners Insurance: How to Review Your Policy

Share this

.png?width=554&name=BLOG%20IMAGES%20TEMPLATE%20(14).png)

15.6 MIN READ

Homeowners insurance is important because it’s often protecting someone’s most valuable asset – a home.

Unfortunately, homeowners insurance is also an insurance many people buy and forget to review.

As building costs go up, it’s really important to review your dwelling coverage. What it costs to rebuild your house today may be many times more expensive than it was in the past.

Perhaps you bought expensive jewelry or art that need a separate rider. Or, you built an addition to your house or remodeled, and that isn’t currently reflected in your homeowner’s insurance.

Even if you bought your house and insured it recently, you may want to review your homeowners insurance to see if changes are needed.

I’ll explain the different coverages available, review common mistakes I see in selecting coverages, provide tips to prepare for a future claim, and discuss the pros and cons of earthquake insurance and flood insurance.

Understanding Homeowners Insurance Coverage

Let’s look at each of the categories you’ll see on your homeowners insurance. I’ll walk you through what it usually insures and how to think about how to select an amount in each category.

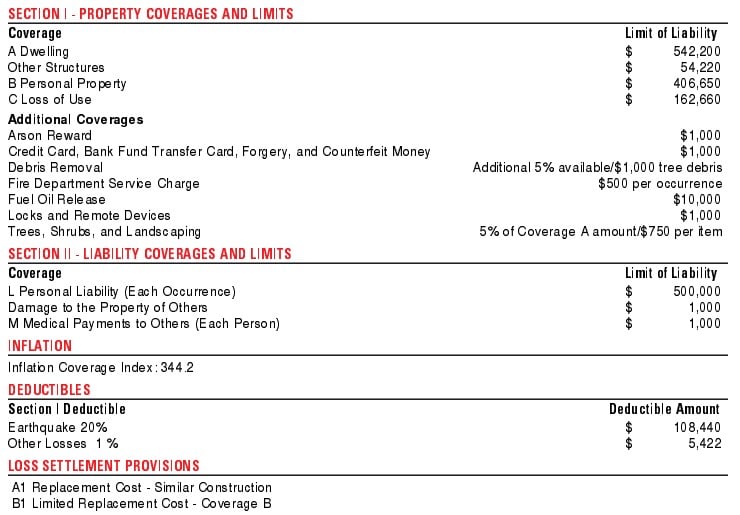

Before we begin, below is a sample policy.

Dwelling Protection

The dwelling protection insures the main parts of the house. Usually, if something is connected to the roof line or bolted down in your house (i.e. air conditioning, water heater, etc.), it’s covered under the dwelling protection.

For example, if you had a garage attached to your house, it is typically insured under the dwelling coverage.

This is an important distinction because if you had a detached garage, it would likely be insured under the “Other Structures” coverage.

However, your home is not protected from every possible catastrophe.

For instance, dwelling coverage usually provides protection when damages occurs from:

- Fire

- Wind

- Lightning

- Hail

- Smoke

- Vandalism

- Theft

Dwelling coverage usually does not cover:

- Floods

- Earthquakes

- Sewer backup/sump pump damage

- Service line leaks or breaks

Please take careful note that sewer back up and service line breaks are often not covered under dwelling coverage.

I’ve seen this catch many people off guard.

The sewer backs up in a basement and does $40,000 worth of damage, and they think they will file a claim, but they actually don’t have coverage for it. This can sometimes be added as an additional coverage for an extra cost, but not always.

Also, the gas and water lines between your home and the street line are often your responsibility and not covered by insurance. For example, if your water line breaks between your home and the street, homeowners insurance usually isn’t going to cover it, unless you added it as an additional coverage or your policy includes it.

Now that you know what the dwelling coverage protects, the next logical question is “how much dwelling coverage protection should I have?”

This is a very difficult question to answer.

One way to approach answering it is to ask, “how much would it cost to build my home if it burned down?”

You typically want your dwelling coverage to be high enough to hire someone to replace your house.

Please keep in mind that when you look at the market value of your home, it includes the land value. Your dwelling coverage shouldn’t include the land value.

For example, if you could sell your home for $2,000,000, but the land is worth $1,200,000, you don’t need dwelling coverage for $2,000,000 because you won’t have to replace the land.

Now, you may be thinking, don’t I insure it for $800,000 then since that is the value of the home?

Not necessarily.

Remember, you need the value to replace your home – not what it’s worth.

It may cost more or less than the current value of your home.

Determining Average Cost Per Square Foot

A back of the envelope calculation to determine an appropriate amount of dwelling coverage is to determine the average cost per square foot to build in your specific area and multiply it by the square footage of your home.

For example, if the average cost per square foot to build in your area is $300 and your home is 2,000 square feet, you could consider dwelling coverage of $600,000.

The downside to this method is the average cost per square foot may not reflect your home build. If you have custom cabinets, higher quality wood, better carpet, expensive siding, and other improvements that are higher quality than the average home, this method may severely underestimate the amount of dwelling coverage needed.

You may want to get the average cost per square foot to build in your area for your particular type of home. For example, the average cost per square foot to build in Seattle can vary dramatically.

A modern house might be $500-$750 per square foot while a Victorian house might be $300-$600 a square foot.

If you had a 2,000 square foot house, that could mean a cost of $600,000 to $1,500,000 to rebuild.

You wouldn’t want to be underinsured and only find out when you need to rebuild your home.

Insurance companies use calculators to estimate costs, but I’ve seen this fluctuate wildly.

I’ve seen them estimate the average cost per square foot to build at $150 in smaller towns, where builders and contractors are harder to come by, and most builders would charge $300 a square foot. These calculators also may not reflect upgrades in your home.

It’s fine to use a calculator, but I would look up local building costs in your area from multiple sources. One calculator you could start with is https://www.costtobuild.net/ and then compare it to your other research. You could even call a few different builders.

In my experience, much of the information online underestimates the cost to build. I’ve seen calculators suggest the cost per square foot to build in Seattle is $200 a square foot, and I don’t know any builder who would touch a project for that amount.

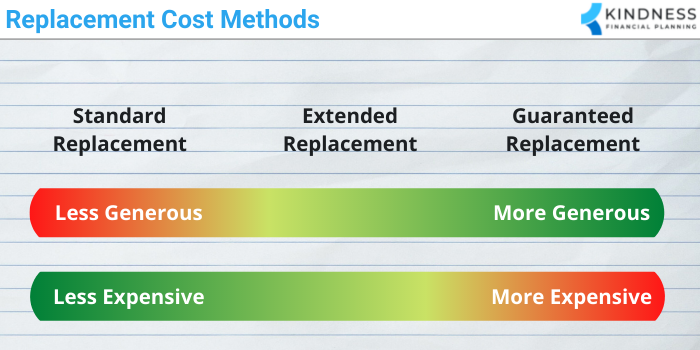

Replacement Cost Methods

Once you determine the amount of dwelling coverage, you’ll need to decide between three different replacement cost methods.

- Standard replacement cost

- Extended replacement cost

- Guaranteed replacement cost

Not every insurance company offers these three replacement cost methods, but it’s good to be aware of what your policy says.

The standard replacement cost allows you to rebuild your home with similar materials without a deduction for depreciation.

The extended replacement cost allows you to set the same dwelling coverage, but allows a certain percentage over that amount if the building costs are more than anticipated.

For example, the extended replacement cost might allow for 25% over the dwelling coverage, meaning if you had dwelling coverage of $400,000 and building costs were up to $500,000, you would still have enough.

The guaranteed replacement cost is the most generous, and typically the most expensive option, because it will cover the costs to rebuild your home regardless of the costs.

For example, if your dwelling coverage was $400,000, but because of higher labor and material costs it cost $800,000 to rebuild, they would still pay for it.

Fewer insurers offer this type of coverage, so you may be stuck with extended or standard replacement costs.

Pandemics, Wildfires, and Other Natural Disasters

Another variable to keep in mind is that labor and building materials may skyrocket during certain events.

For example, during the California wildfires, there were not enough contractors for the number of people who wanted to rebuild. The cost to replace a home skyrocketed, and many people found themselves underinsured.

If just your home burns down, your dwelling coverage may be enough, but when a whole area is affected, your dwelling coverage may not be adequate.

Also, during the pandemic, certain building materials, such as lumber, tripled in cost. Imagine trying to rebuild your home during that time. Your dwelling coverage during normal times may have been enough, but then life happened.

It’s something to keep in mind when you select the amount of your dwelling coverage and replacement cost method. A little higher dwelling coverage or a more generous replacement cost method can go a long ways during a difficult time of needing to rebuild, especially when everyone else is trying to rebuild at the same time.

Other Structures Protection

Other structures is usually a percentage, such as 10%, of your dwelling coverage.

For example, if your dwelling coverage is $800,000, your other structures protection might be $80,000.

Other structures commonly include garages, fences, guest houses, sheds, etc.

If you have more expensive structures on your property, you may want to contact your insurer to ask about raising the other structures protection if the default amount provided is not adequate.

Personal Property Protection

Personal property protection covers everything else in the home, such as clothes, furniture, electronics, musical instruments, sports equipment, appliances, etc.

Typically, personal property protection is 20%-50% of your dwelling coverage. For example, if your dwelling coverage was $800,000, the personal property protection might be $160,000 to $400,000. You’ll have to look at your policy to determine your personal property protection limit.

There are typically two types of personal property coverage:

- Actual cash value

- Replacement cost value

Actual cash value reimburses you for the actual cash value of your possessions if they are destroyed and covered under your policy. It takes into account depreciation.

For example, if you bought a couch for $1,500 five years ago, it may only be worth $250 today. If you had an actual cash value policy, the policy would pay $250 to replace the couch.

As you can imagine, most people don’t want to be paid $250 – they want a new couch, which is where replacement cost value can be a good option.

Replacement cost value will you pay the current market value to replace an item. It does not take into account depreciation.

For example, using the same couch example, the policy would pay $1,500 if that was the cost to buy that couch today.

The biggest mistake I see people make with personal property protection is not realizing that policies usually have limits on certain items or categories of items.

For example, policies typically limit how much they will pay for:

- Musical instruments

- Jewelry

- Furs

- Stamp or coin collections

- Art

- Antiques

- Guns

- Bicycles

- Cameras

When you have these items, they can sometimes be worth a significant amount of money and require being scheduled in the policy.

For instance, if you had a $15,000 necklace, your policy may only pay up to $2,000 per item or category of item, meaning if it was stolen, the policy would only pay $2,000 to replace it if it was not scheduled.

I would ask your insurer what dollar limits they have on certain items or category items and what needs to be scheduled.

Typically, if you have any single item or category of items that are worth more than $1,000 or $2,000 (common limit amounts), I would ask about scheduling the item.

You can also go without scheduling it. For example, if you have a $3,000 bicycle that is stolen from your home and the policy only covers $2,000, you may be okay covering the extra $1,000 if you need to replace it.

However, with higher dollar value items, you may not want to cover the difference. For instance, if you have a rare cello worth $75,000, you may not be comfortable accepting $2,000 if it was stolen.

The other big mistake I see people make is that they underestimate the value of all their possessions. Since most possessions are accumulated over time, we often have no idea what it would cost to replace them all at once.

Go around your house – add up your kitchenware, desks, computers, art, furniture, clothes, beds, televisions, tables, musical instruments, etc. The amount may shock you.

Loss of Use

Loss of use is the amount provided to help pay for increased living costs if your house is temporarily uninhabitable due to a covered event.

For example, if your house has a fire and needs to be repaired, loss of use may pay for you to get a hotel nearby. It may also pay for you to rent a home similar to your own home if it will take longer to repair.

It can also pay for increased food costs, such as restaurant meals if you don’t have access to a kitchen, boarding a pet, and increased commuting expenses.

Loss of use coverage is meant to offset the increase in living expenses because you can’t live in your home.

Loss of use is often 20%-30% of your dwelling coverage limit. For example, if your dwelling coverage limit is $800,000, your loss of use coverage might be $160,000-$240,000.

Something to double check is whether you can rent a comparable home in your area for your loss of use amount.

For example, if your home takes two years to rebuild because of a shortage of contractors or supplies and comparable homes rent for $5,000 in your area, you might want loss of use coverage limits of around $120,000 ($5,000 x 24 months).

Something to be aware of is that loss of use coverage only applies to covered events. For example, if your home floods, but you don’t have flood insurance, the loss of use would not apply.

Additional Coverages

You may find additional coverages in your policy. Often, these are coverages like sewer back up and extra contents coverage.

These tend to be coverages not included as a standard in your policy, but you can add for additional costs. For example, sewer back up is usually not covered, but some insurers allow you to add limited coverage for it for an additional premium.

You should review this area to see if it needs updating. Feel free to ask your agent what sort of coverages you may need in your policy.

Liability Protection

Liability protection is a critical part of a homeowners insurance policy because it may help protect you in the event that someone is injured on your property and sues you.

For example, if someone slips on your stairs because you didn’t repair a broken banister, they sue you, and you are found liable, your liability coverage may help defend you in a lawsuit.

It could also be helpful if your kid throws a baseball through a neighbor’s window by accident. Or, if your dog bites a person while you are out for a walk in the neighborhood, your liability protection may help protect you.

It’s important to know that it doesn’t cover you or your family member injured in your home. It helps protect you if you accidentally injure a guest or their property.

Unless you have a solid reason not to have the highest level of coverage, I usually suggest the maximum coverage amount, which is often around $500,000. Then, you can consider an umbrella insurance policy on top of it.

Guest Medical Coverage

Guest medical coverage may provide money for a guest accidentally injured in your home. Guests can submit medical bills to your insurance company and often have them paid, which is a way to reduce the likelihood someone submits a liability claim.

Liability coverage may cover expenses when you are at fault, whereas guest medical coverage can cover expenses even if you didn’t cause it. With guest medical coverage, it doesn’t matter who is at fault.

For example, if your guest trips over themselves, hits their head, and needs to get stitches, your guest medical coverage could potentially cover the costs.

If they tripped over a wrinkle in your carpet instead of themselves, then you could potentially be liable, which could open up a liability claim.

I like to think of guest medical coverage as a first line of defense for guests. If someone trips, you may be able to offer your guest medical coverage to pay for their bills to hopefully reduce the likelihood that they sue you.

For example, if a guest does trip over a wrinkle in your carpet, you might be found liable, but if your guest medical coverage can pay their bill, it may reduce the likelihood that they sue and open a liability claim.

Guest medical coverage often comes with $1,000, $5,000, and $10,000 limits. It does not cover you or anybody living in the house – only guests.

Deductible

The deductible is the amount you will pay before your coverage pays.

For example, if you have a $5,000 deductible, you would need to pay $5,000 before the insurance company pays anything.

If you choose a higher deductible, your premium is usually lower and vice versa.

If you are looking to increase your coverage, but not raise your premium as much, one option may be to choose a higher deductible. There are many homeowners who can go 20+ years without a claim and are willing to accept a higher deductible in return for a lower premium.

Plus, it’s often suggested not to file small claims on a homeowners insurance policy because if you have enough claims, your insurer may raise rates or elect not to renew your policy.

Summary of Homeowners Insurance

| Coverage Type | Questions to Ask |

| Dwelling Protection | Could I rebuild my house for this amount? Do I know the cost per square foot to rebuild a house like mine? Do I have or want extended or guaranteed replacement cost? |

| Other Structures Protection | Do I have additional structures that would cost more than my current coverage if I needed to rebuild? |

| Personal Property Protection | Do I understand actual cash value vs replacement cost value? Have I considered every single item in my home and what it would cost to replace everything? Do I need to schedule any items? |

| Loss of Use | If I was out of my home for an extended period while my home is being repaired, would this be enough to offset the costs of renting, commuting, and eating? |

| Additional Coverages | Do I need to schedule property, such as jewelery, or add sewer back up or service line coverage? |

| Liability Protection | Have I purchased the maximum amount and if not, do I have a very good reason for why I don’t need it? |

| Guest Medical Coverage | Do I want higher coverage as a way to pay for guests who injure themselves on my property? |

| Deductible | Have I looked at raising or lowering my deductible to see how it affects my premium? Am I willing to accept a higher deductible to lower my premium? |

Prepare for a Future Claim – Take a Video of Your House and Belongings

I know nobody ever wants to think they will need to file a claim on their homeowners insurance policy, but taking 15 minutes to record a video of your house may really help if you ever find yourself in that position.

Open your cell phone, go to video mode, and start walking around your house showing everything in it. Back it up to the cloud or on a thumb drive in a separate location.

Now you have proof of what you own if you ever need to file a claim.

It’s much easier to create an inventory of what you own from a video than try to remember and substantiate that you bought everything.

In a perfect world, you’d create a spreadsheet of every item, but who has time or wants to do that?

Most people don’t.

A video backed up to the cloud is an easy way to prepare for a future claim.

Think Twice About Filing Claims

I mentioned it earlier, but it is worth repeating – be smart about filing claims.

If you file too many claims, the insurer may raise your premium or drop you.

For example, if your deductible is $2,500 and you file a claim for $3,000, you may want to think carefully about whether that makes sense.

You will pay $2,500 and your insurer is going to pay $500.

Depending on your resources, you may be better off absorbing $500 by not filing the claim in case you need to file larger claims in the future.

Claims will usually stay on your record for 5-7 years.

Earthquake Insurance

Most homeowners insurance does not cover damage caused by an earthquake.

Earthquake insurance usually needs to be purchased separately.

Earthquake insurance tends to be expensive and has a high deductible, but it doesn’t mean you should ignore it entirely.

For example, many earthquake insurance policies have deductibles around 10%-20%, meaning if you have dwelling coverage of $800,000 and an earthquake insurance policy, you may need to pay $80,000-$160,000 as your deductible before your insurance policy pays.

For people in high risk areas where their home is a substantial asset or they plan to use some of the equity in their home during retirement (selling and downsizing), earthquake insurance may be something to consider.

You can ask your agent or consider a separate policy from another provider.

For what it’s worth, I have earthquake insurance because I’d much rather pay my premium each year and a high deductible if my home decides to slide off the hill during an earthquake. I don’t have the funds to build a new home entirely from savings.

Flood Insurance

Flood insurance also doesn’t usually come standard on a homeowners insurance policy.

There is a National Flood Insurance Program (NFIP) managed by FEMA and sold by a network of insurance companies.

Flood insurance can cover both your building and the possessions inside.

You can contact your existing agent or find a flood insurance provider here.

Flooding can occur anywhere, but you can also estimate your risk of flooding using FloodFactor.

Flood insurance is different from homeowners insurance in that the maximum coverage you can secure is limited. For homes, it is $250,000 for the building and $100,000 for possessions.

There are also waiting periods for coverage, which is why it’s important to decide whether you want it early.

Final Thoughts – My Question for You

Reviewing your homeowners insurance policy is an important part of a financial check up.

As labor costs go up, material prices rise, and you remodel your house, your homeowners insurance policy may need adjusting.

Go through each line item using this guide and determine if what you have today is adequate. Also, don’t forget to do a review with your insurance agent. They are there to help make sure you understand your policy and help you decide on levels of coverage.

Make a video walking through your house. It might be invaluable if you ever need to file a claim.

If you are considering filing a claim, think twice about it if it’s going to be only slightly over your deductible. You may want to pay out of pocket to avoid the claim going on your record.

Lastly, consider earthquake or flood insurance as most homeowners insurance policies do not cover earthquake or flood damage.

I’ll leave you with one question to act on.

When will you review your homeowners insurance policy?

About the Author

About the Author

Elliott Appel, CFP®, CLU®, RLP®, is a Financial Planner and Founder of Kindness Financial Planning, LLC, a fee-only financial planning firm located in Madison, WI that works virtually with people across the country. Kindness Financial Planning is focused on helping widows, caregivers, and people affected by major health events organize and simplify their financial lives, do proactive tax planning, and make sure insurance and estate planning is coordinated with smart investment advice.

Did you know XYPN advisors provide virtual services? They can work with clients in any state! View Elliott's Find an Advisor profile.

Share this

Subscribe by email

You May Also Like

These Related Stories

Beyond the Basics: Quoting and Comparing Home and Auto Insurance

How Much Umbrella Insurance Do I Need?