Good Financial Reads: Emergency Fund 101

Share this

Do You Have Enough in Your Emergency Fund?

by Matt Elliott, Pulse Financial Planning

What is an emergency fund?

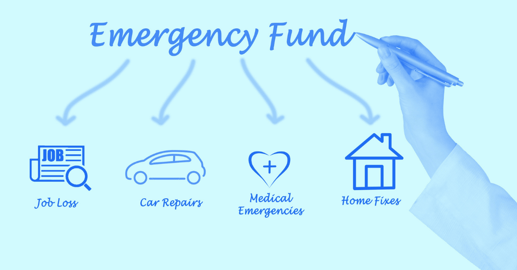

Your emergency fund is the amount of cash you have in a safe place to cover an unexpected expense (such as a car repair) or event (such as a layoff). You should always aim to keep the money in this account untouched unless an unforeseen event occurs.

How to Find Financial Stability in Uncertain Times

by Eric Roberge, Beyond Your Hammock

These days, it seems everyone has one big question on their minds:

What should I be doing with my money right now?

The economy is at a standstill, unemployment claims are soaring, the market continues to feel shaky after its recent fall from the peak, events from now through the end of the year are postponed or canceled, and nothing feels certain right now.

The Personal Finance Trick that Can Save You From Turmoil

by Sahil Vakil, MYRA Wealth

One of the most difficult things to bear in personal finance is when you’re meeting all of your goals and then tragedy strikes. It happens to everyone inevitably - maybe your car breaks down, you need a new roof on your house, or there’s an unexpected medical bill.

The key to getting through these situations unscathed is to prepare for them ahead of time. With a certain finance trick, you’ll be able to cover these unexpected expenses and still meet your financial goals.

Emergency Savings 201

by Britton Gregory, Seaborn Financial, LLC

Everyone knows that you should have 3-6 months of basic living expenses in emergency savings. (Right? Well, if you didn't, now you do.) But -- where should you keep the money? When should you use it? Where does it fit in your overall portfolio? Can you invest it? Does everyone really need that much in emergency savings, or are there exceptions?

All good questions. Welcome to emergency savings 201.

Following along with the blogs of financial advisors is a great way to access valuable, educational information about finance — and it doesn’t cost you a thing! Our financial planners love to share their knowledge and help everyone regardless of age or assets.

Share this

Subscribe by email

You May Also Like

These Related Stories

Build an Emergency Fund: 5 Questions to Consider As You Save

Good Financial Reads: How To Effectively Build & Use Your Savings for Emergencies and More