I’ve recently had some questions about consolidating credit card debt. These questions usually come from clients who have 5+ cards or consumer loans with outstanding balances. Any promotional rates on this debt has or will soon expire.

These clients are sick of paying so much toward interest and barely making any progress on the underlying debt. They want to put the debt behind them so that these monthly payments can be re-allocated toward “good debt” or goals.

As a financial planner, I try to determine the following:

- Is there actually any financial benefit to consolidate or is it simply repackaging a problem?

- How to avoid a scam while exploring options?

- What’s the impact of consolidating on credit scores?

- Are there any alternatives to consolidating?

Is There Any Financial Benefit to Consolidating?

Yes, there are immediate benefits of consolidating loans which are 2-fold:

1 – Simplify payments to minimize the potential for missed or late payments. (ie – turn 6 bills with varied amounts and due dates into 1 transparent payment)

2 – Create a more consistent and manageable monthly payment that is in-line with current cash flow. (ie – instead of paying a very high moving target between all payments for an undefined period of time, pay $500/month for the next 10 years)

While that sounds great in theory, there are a couple things to be aware of:

- Not all credit cards and loans will qualify for consolidation. Some may also be more beneficial to keep as-is rather than lumping them in with others. Therefore, out of 6 balances, you may want to keep 1 as-is, consolidate 4, and find 1 is ineligible to change. So you’ll still have to have accept a degree of responsibility in keeping track of multiple payment amounts and dates.

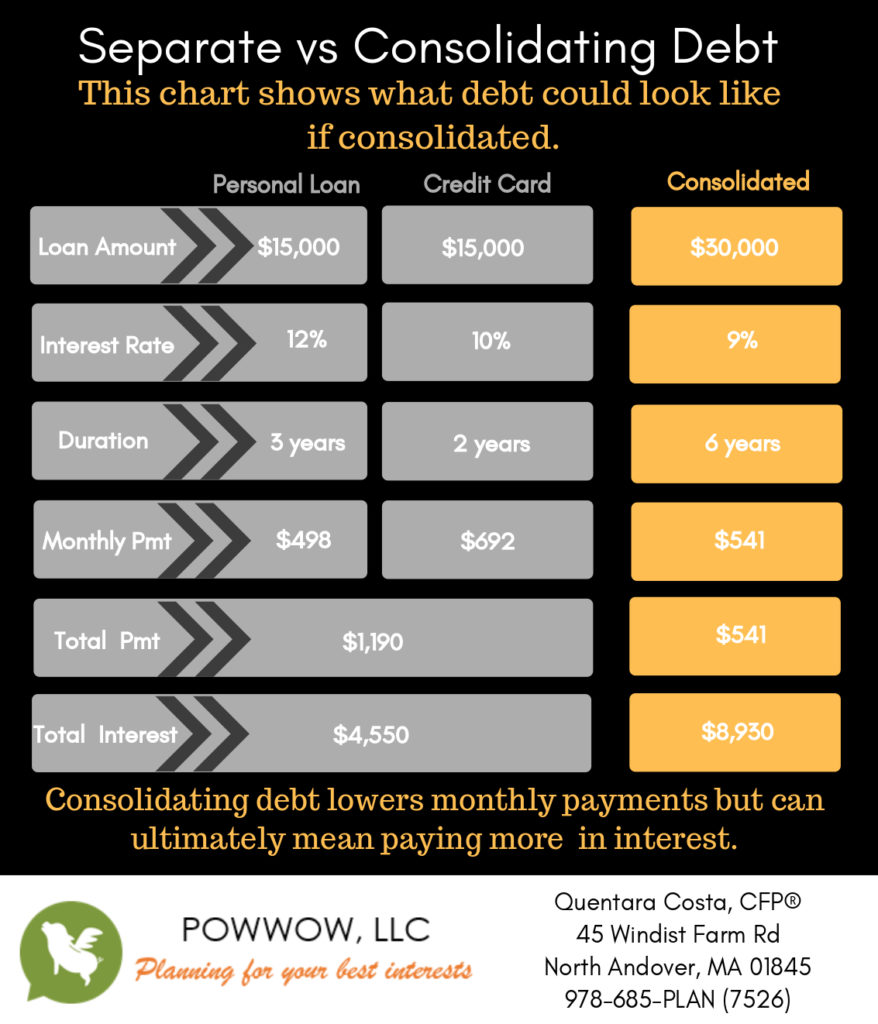

- Yes, consolidating will provide a much more transparent payment amount and timeline, which can provide peace of mind and alleviate pressure on your monthly cash flow. But let’s be realistic about how that is accomplished as it’s very unlikely any of your debt was forgiven or reduced. The only other variables to make an impact are extending the timeframe and reducing the interest rate. The problem is, even if you are able to get a better interest rate, the term is often so extended that you actually end up paying more interest on the underlying debt than you would have at a higher rate over a shorter period of time. However, being able to consistently make payments vs accumulating late payments due to the original amounts being out of reach may be well worth absorbing this latent expense.

The idea of a consolidation is especially appealing if the need to finesse cash flow is temporary. This hits home for many people losing income in the midst of the corona pandemic. Consolidation allows you to pay a more feasible amount while income is low with the intention of paying more down the road once income bounces back. Prepaying once possible would mitigate the longer timeline creating more interest due despite the lower rate. With that said, it’s very important to keep yourself accountable so this strategy isn’t forgotten.

Lastly, read all the fine print of your new arrangement. Ensure there are no pre-payment penalties or anything else that would sabotage your original intent to pay off the debt ASAP.

How to Avoid a Scam

A client sent me a picture of their most recent consolidation offer. You know it’s bad when even the fine print is additional manipulative marketing statements rather than any attempt at financial or legal disclosure. Also, don’t assume it’s legitimate just because they splash reputable lender names all over the place. This letter in particular starts off with, “Re: Bank of America, Discover, Capital One, American Express, Wells Fargo Accounts.” They have NOTHING to do with any of these companies. It’s just a gimmick to create instant credibility.

Instead of responding to solicitations, reach out to well researched options or recommendations made by friends who have had positive outcomes. When you call around, you should find that their process involves a cash flow review and general counseling to help ensure you won’t simply rack up new debt with your new found cash flow (that’s supposed to be allocated toward savings, “good debt,” or goals.) They should also help determine if the situation really warrants a less or more aggressive strategy than debt consolidation. While Powwow does not endorse any specific lender, through research these options appeared consistently well regarded:

- SoFi.com

- NFCC.org

- CCCSMD.org

- PowerPay.org – A program developed for consumers to self-help their situation. While they themselves do not offer loans or services, they help you determine whether it’s a good solution and how to best move forward.

What Happens to Your Credit Score

- Consolidating will require both soft and hard inquires to your credit history. Hard inquires shave off points. One isn’t much to worry about, but multiple can become meaningful. Ask how many will be needed throughout the process.

- Some credit repair sites require you close out all credit cards. Part of the logic is to help ensure you don’t continue to use them and put yourself further in debt now that cash flow is freed up. While well intentioned, accounts with longevity are usually a boost to your score. Therefore, closing out your longest held cards can be a negative to your score. Scores are strengthened by showing you can handle credit responsibly, they call this credit utilization. Having a mix of credit cards (that are not maxed out), utility bills, rent/mortgage, and personal loans is ideal.

- Hopefully with the new arrangement you’ll be paying on time consistently, which will positively influence your score. Also, if your cards aren’t officially closed out, your lower credit utilization will look better and your score should increase.

Other Options

- HELOC or Mortgage Refinance: See your banker or mortgage broker about leveraging equity from your home to pay off the balances. This is likely the best way to obtain the lowest interest rate as it’s considered secured debt. HOWEVER, you’re putting your home on the line, so you want to make sure you can make the agreed payments.

- Balance Transfer: I’ve found these to be unhelpful for clients with significant debt, but for those with a number of smaller amounts due, this could be an excellent option. A balance transfer means rolling over the balance of one card to a new one that offers a more appealing rate. In particular, their introductory rates can’t be beat, ie) 0% for a 12-18 month term. You can also expect a one-time transfer fee of 2-5%. If you’re able to transfer your entire balance, you can aggressively pay down the balance so that you’re mostly if not completely paid off by the time the promo term expires. Every dollar paid goes toward principal with none wasted on interest. Conversely, if you’re not able to transfer the whole balance, you could work on aggressively paying down the balance of the higher interest cards first since the transferred balance isn’t accumulating any additional interest. Once the term expires, you could then attempt another roll-over to focus on getting that remaining amount paid in the second term.

- 401(k) Loans: Depending on the amount of debt and situation, it may make sense to pay down high interest debt by taking a loan against your active 401(k) account. The rules around this option have recently and temporarily expanded under The CARES Act. Just understand that if you were to leave your employment for any reason, the loan needs to be repaid in a short period of time, otherwise it’s considered a taxable (and potentially penalized) distribution from the plan.

- Bankruptcy: Unfortunately it can come to this and make more financial sense than to constantly flounder. This is a likely outcome if there is no possibility of being able to cash flow the existing debt even with reduced rates or prolonged term arrangements. While your credit takes a big hit, you can put the past behind you and start to rebuild your credit with a new financial outlook over the next 7-10 years.

About the Author

About the Author