As A Millennial, Should You Pay Your Mortgage Off Early?

Share this

7 MIN READ

As we (young professionals/young families) continue to “grow up,” we find ourselves receiving financial advice from our parents or grandparents about things they have done or something they wished they would have done sooner. While this information can be quite valuable, sometimes the information they provide does not apply to our situations. One of those pieces of advice is paying off your mortgage as quickly as you can. While it is good to be debt-free, try thinking about debt in two different categories: good debt and bad debt. A mortgage is good debt because it is linked to an appreciating asset, while an auto loan is a bad debt because it is attached to a depreciating asset. Before I go into my rant, I want to set the stage to explain why our parents/grandparents would offer this piece of advice.

If you were to look at mortgage interest rates from 30 years ago (1989) on a 30-year mortgage, you would find that interest rates were around 10% on average. If you were to go back another ten years, you’d see that they were between 13% - 16% on average for a 30-year mortgage. If you were to compare these rates to today’s rates, you’re looking at a 6% difference from the interest rates 30 years ago and a 9% - 12% difference from 40 years ago. Let’s look at an example comparing interest rates from 30 years ago versus today’s interest rates.

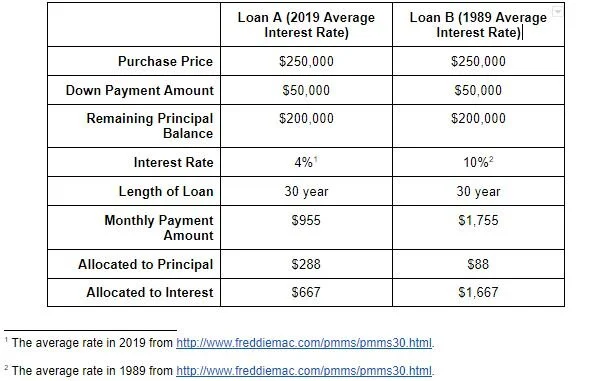

You purchase a home for $250,000, and you put 20%, so you don’t have to pay for PMI (Private Mortgage Insurance) insurance. Below is a comparison of the monthly payment you’d pay and the breakdown between the amount that will go towards principal and interest.

As you can see from the table above, you have a lower monthly payment with Loan A's interest rate than Loan B's monthly payment. You will notice more of the monthly payment going towards the principal at the start of the loan for Loan A compared to the amount going to the principal in Loan B. About 30% of the monthly payment is going toward the principal balance in Loan A, while about 5% is going towards the principal balance in Loan B.

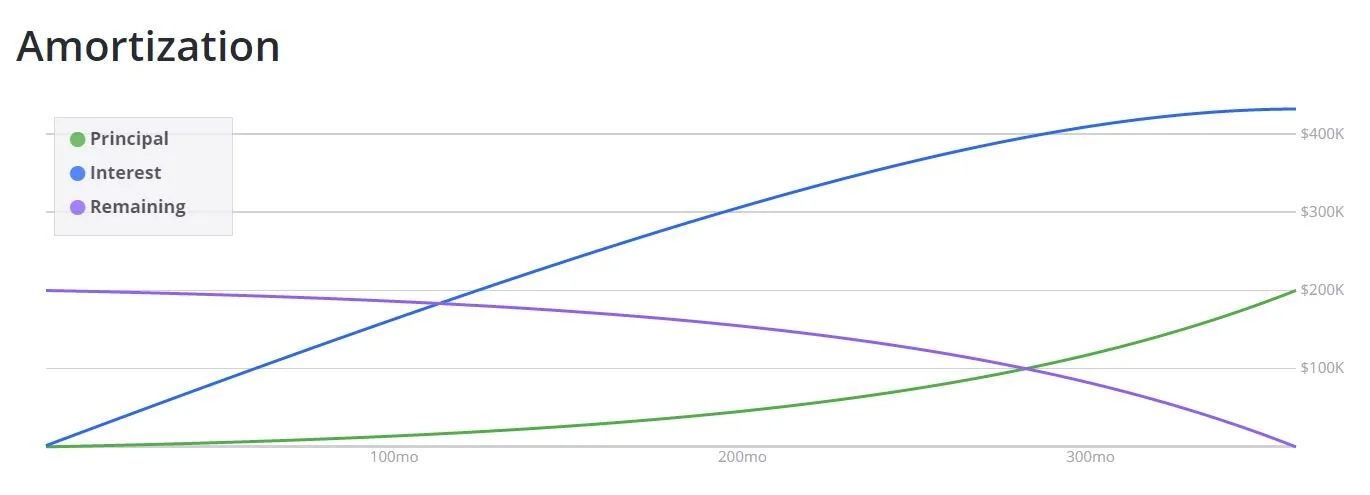

Figure 1

How does this relate to what our parents/grandparents are saying by paying off our mortgages early? If they purchased their house for $250,000 with an interest rate of 10%, continuing to use the example above, they would end up paying about $430,000 in interest for the loan. See Figure 1 to the left. Therefore, it was more beneficial for them to pay off their mortgage faster because they would pay more in interest than the house's worth (assuming the $250,000 purchase price). If you were to look at the cost in interest for the loan based on the 2019 average interest rate of 4% on a $250,000 home, continuing to use the example from above, you would be looking at $140,000 paid in interest. See Figure 2 below. Now, I know what you are thinking, that still is a lot of money to spend on a house in interest when you purchased the home for $250,000, so I'll share with you my thoughts for why you shouldn't pay off your mortgage as fast as possible.

Figure 2

We'll start by making sure that your needs are covered. If you do not have 3 - 6 months of your expenses saved in an emergency fund, then I'd say you should not be making extra payments to your mortgage. That extra money should be going into your savings account until you have built up a savings of at least 3 - 6 months’ worth of expenses. You should put the additional funds into an emergency fund and not towards your mortgage because real estate is not a liquid asset. If you are not familiar with the term liquid asset, it means having access to cash. Let's look at an example:

Let's say you don't have 3 - 6 months of expenses as an emergency fund, but you have about $1,000 in the bank, and you've been making extra payments towards your mortgage. One day, the HVAC unit stops working, and you have to call someone to come out and take a look at it. After the technician can inspect it, they come back with some bad news stating that you need a new unit (that's not the answer anyone wants to hear). The technician says that it is going to cost $8,000 to get a new unit. You have $1,000 in the bank, so now you have to find a way to pay the remaining $7,000.

In this example, by making extra payments to the mortgage before establishing an emergency fund, you put yourself at risk of taking out another loan to cover the HVAC cost, whether it's a personal loan or a Home Equity Loan. Having to take loans out to cover the cost of unexpected events can become a vicious cycle that won't be broken until you can establish that emergency fund. If you feel that having an emergency fund of that magnitude is not needed, you should reach out to a family member or friend that you know lost their job at the start of the pandemic that would be willing to share their experience. I bet their story would be eye-opening for you.

What if you're someone that does have an emergency fund? Should you start making extra payments towards your mortgage? If you purchased your home in the past five years, you probably have an interest rate under 5%, and I'd still say that it is still not worth it for multiple reasons. The first reason being the returns you can get in the market will more than likely be higher than your interest rate, and the second being that the likelihood of you residing in your current home for the entirety of the mortgage term is unlikely.

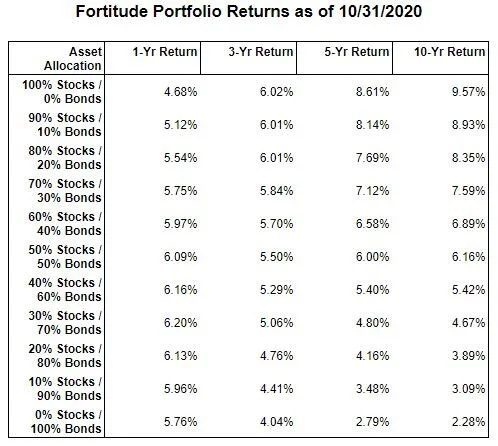

Let's discuss what I mean by the financial markets' returns are higher than your current interest rate first. If you look at the market over time, it is increasing, recently hitting new highs. Over 30 years, the S&P has averaged about 8% in returns. If you compare that 8% to the 2019 average interest of 4%, you will notice that you can capitalize on a 4% net return. This net return assumes that you are 100% in the S&P 500 and not in a diversified portfolio. Well, let's look at 1-year, 3-year, 5-year, and 10-year returns on diversified portfolios. Below is a chart of returns for asset allocations based on Fortitude Financial Planning's recommended portfolios.

Please note these returns are based on Fortitude Financial Planning asset allocations comprised of index mutual funds invested in large-cap, mid-cap, small-cap, and international stocks, and short-term and intermediate-term treasury bonds. These results are from past performance and do not guarantee future results. The information provided above does not constitute as financial advice.

As you can see from the chart above, you'd have to be allocated very conservatively (at least 20% stock / 80% bonds or lower) in the market not to net a positive return. For young professionals, families, or entrepreneurs, conservative asset allocation would be rare if you were looking for long-term growth. Therefore, if you were to have a 3 - 6 emergency fund, check your mortgage interest rate; it's probably better that you not make the extra payment towards your mortgage and invest that payment into a diversified portfolio.

Now let's discuss my second point; the likelihood of you staying in your current home for the entirety of the mortgage. You probably have a 30-year mortgage because that is the most common mortgage term borrowers apply for, at least for young adults. Per this article from the National Association of Realtor's website, the median duration of homeownership is 13 years in the U.S as of 2018. As young professionals, families, and entrepreneurs, there are a variety of reasons why we would not stay in the house we purchase forever, such as job relocation, moving into a better school district for our kid(s), or the decision to live in a different city, etc. Therefore, if you currently have a 30-year mortgage and studies show you're more than likely not going to stay in your current home for the length of the mortgage, then it may not be the best decision to make extra payments towards your current mortgage. As I stated above, redirect that money and invest it into a diversified portfolio and get that money working for you. As they say, "cash is king," but you don't want to tie that cash up in an illiquid asset if you don't have to.

As we continue to receive financial advice from our parents/grandparents, it's important to remember that the information they're giving to us is not wrong; it's more that not all the advice will fit our situation. We are in a different economic environment than they were at our ages. We have access to lower interest rates than they did, market returns are strong, and we do not stay in one place as long as they have. I strongly suggest that you consult with a fee-only financial advisor to get a second opinion before you go implementing any financial advice from family. We are here to serve you. No one knows what the future holds for us; while it's essential to think about it now, it's just as important to think about the future. You have to think about “how this dollar I spend today will affect me 5 to 10 years from now.” Although, I would highly suggest purchasing a home over renting, in order to build wealth and save money over time. I would have to say that putting more money into it than you have to is not necessary. As a fee-only advisor, my job is to do what's best for you and your family, and to ensure that you are doing the best for yourself now AND looking to the future.

About the Author

About the Author

Travis Tracy is a Certified Financial Planner™ and Enrolled Agent with seven years of experience in the financial industry. He created his firm to help people like you build the courage to take control of their finances and to make better decisions to reach their goals. He's very passionate about helping young professionals, families, and entrepreneurs living the lives that they want to live.

Did you know XYPN advisors provide virtual services? They can work with clients in any state! View Travis' Find an Advisor profile.

Share this

Subscribe by email

You May Also Like

These Related Stories

What Is Financial Planning?

Financial Planning for Millennials