8 Steps to Financial Success

Share this

9 MIN READ

There is no shortage of financial noise out there – and it can be tricky to know what applies to you. Your co-worker may be telling you about how you need to save for your child’s education, but you haven’t yet paid off your own student loans yet – what do you do?

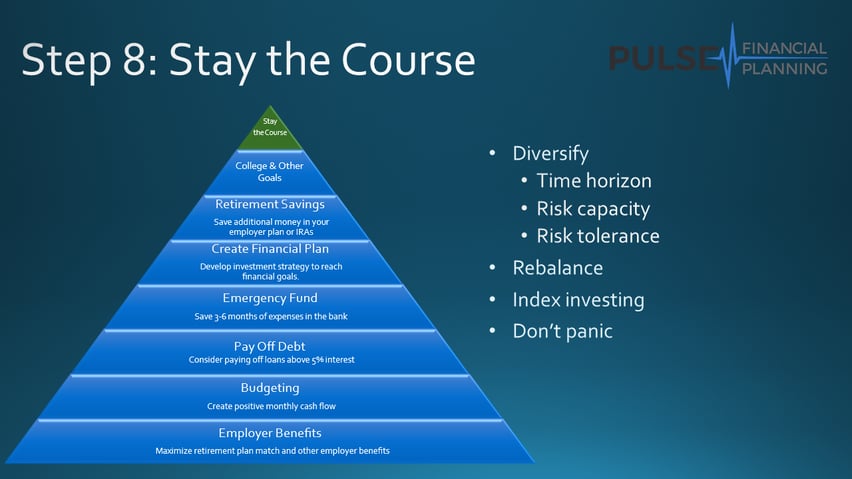

These 8 steps to financial success were designed to outline what to focus on next no matter what stage you’re in with your finances. As long as you take it one step at a time and ignore the noise, you will be successful.

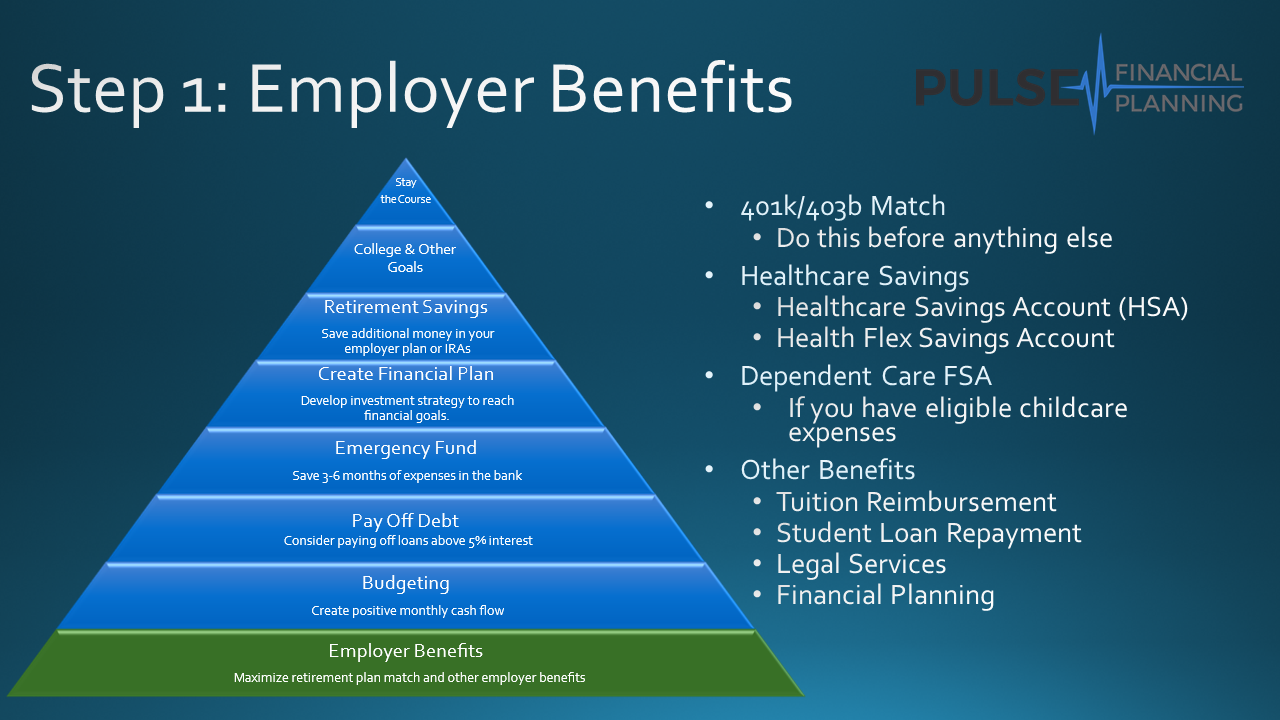

The first place to look when managing finances is your employer benefits. Some of the most commonly used programs are:

401k or 403b: Ensure you’re utilizing your employer match on retirement contributions. Not only does this savings vehicle offer you tax advantages, you are leaving money on the table if your employer matches your contributions and you are not contributing.

For example, let’s say your employer offers a “50% match up the first 6% of your contribution”. This means if you earn $100,000 per year, and save at least $6,000 into this plan, your employer will also add $3,000 to your retirement savings. If you don’t contribute your part, your employer adds nothing, and your benefit is forfeited. Before anything else, at least claim the $3,000 your employer has already agreed to pay you!

Healthcare Savings: If you are eligible for a Healthcare Savings Account (HSA) this is a top program to take advantage of. Money in an HSA is triple tax free and is one of the best accounts to establish early and contribute to if you can. Unused funds can be rolled over to the next year. HSA’s are only available if you have a High Deductible Health Plan (HDHP).

If you don’t have access to an HSA, consider a Healthcare FSA. This account allows you to pay for eligible healthcare expenses tax free. Money in this account is generally “use it or lose it” so only contribute as much as you expect your out of pocket healthcare expenses to be in the upcoming year.

Dependent Care Flex Savings Account (DCFSA): DCFSA’s are special accounts that allow you to set aside money for childcare before taxes are taken out. This can result in big savings on one of your largest annual expenses. There are several things to consider with this benefit, so I recommend you read my guide on how to optimize your childcare tax savings before deciding if this benefit is right for you.

Education: Some employers offer programs to pay for additional college education or certifications. If you plan to further your education, check what your employer may pay for before choosing a program. This is a great opportunity to increase your future earnings potential and have your employer pay for you to do so.

Other unique benefits are becoming more prominent to attract skilled employees, and every plan is different so check with your HR department and co-workers to get to know your specific benefits package.

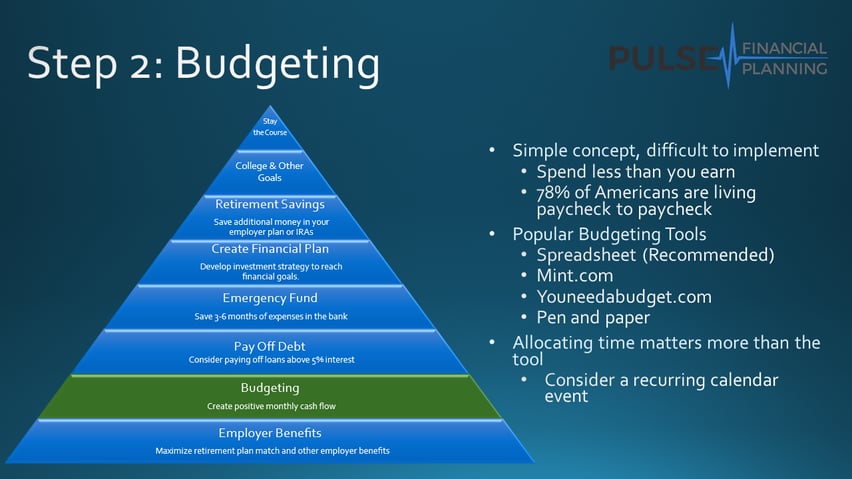

The formula here is not a difficult one to understand – your take home pay should consistently be more than what you are spending each month. That is easier said than done with an estimated 78% of Americans living paycheck to paycheck.

If you’re struggling to consistently save each month, you need to create and maintain a budget. When it comes to budgeting, the most difficult part is just getting started. If you don’t already have a system in place, some popular tools are:

- Free budget spreadsheet template

- This is my recommended method. Allows for customization and encourages you to regularly look at your budget.

- mint.com

- Link your accounts online to automatically pull in your transactions. More automation, but still requires manual updating and review for this to work.

- youneedabudget.com

- Like Mint, but instead of being supported with ads, it costs around $11/month. Designed for forward-budgeting which is generally more effective in reaching long term goals.

- Pen and paper

- Old fashioned, but it works.

- Get organized with a financial planner

- Not all advisors will work with budgeting – make sure you find one that will include this service.

The biggest indicator of if you will be successful budgeting is not the tool you use, but the amount of time you dedicate regularly to budgeting. Consider blocking off a recurring time on your calendar each week to review your budget.

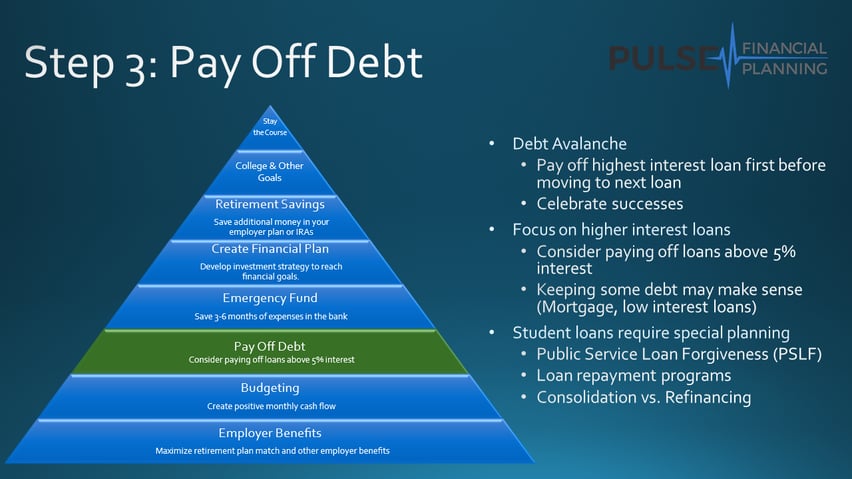

When tackling debt, I recommend using a “Debt Avalanche” strategy. This involves making minimum payments on all your loans and allocating extra dollars towards your highest interest rate loan. Once your highest interest rate loan is paid off, begin chipping away at the next one. This strategy minimizes the amount that you will end up paying in total interest over the life of your loans.

If credit cards are a problem, consider closing each card after you pay it off. Just keep the 1 or 2 cards you have had opened the longest and pay off the balance every month. You should use this opportunity to reanalyze your relationship with debt and form new healthy habits to avoid dipping back into indebtedness.

If you have high interest debt that will take several years to pay off, it may make sense to refinance your loans. Whether or not that makes sense depends on your credit, current interest rates, ability to pay off a potentially higher payment, and balances on each loan type. You will need to get some quotes and run some numbers to identify the best debt paydown strategy for your situation.

The reason I recommend you focus on “high interest debt” here is that it may not make sense to pay off all your debt before moving on to the next step. For example, if you have a low interest mortgage that is well within your means, you may have better uses for your capital at this stage than simply paying down your loan.

Due to the unique nature of student loans, you may need to have a separate strategy for student loans than your other debt. Various types of student loans, repayment programs, benefits, and forgiveness options make this an area that you will want to analyze based on your own circumstances and not necessarily just include in your “Debt Avalanche” strategy.

There is no perfect answer to the “Paydown debt or invest?” question. As a general rule of thumb, eliminate any debt above 5%. If you look at the interest rate you’re paying and ask yourself “If I could get this return guaranteed in an investment account, would I take it?” If the answer is yes, you should probably just focus on paying off that loan rather than trying to invest the money somewhere else.

If the interest you’re paying on a loan isn’t much more than inflation (generally around 2%), it may be appropriate to begin allocating funds towards other things besides paying down additional principal on your loan. Continue to monitor your relationship with debt, and work towards paying down any remaining loans throughout your financial journey.

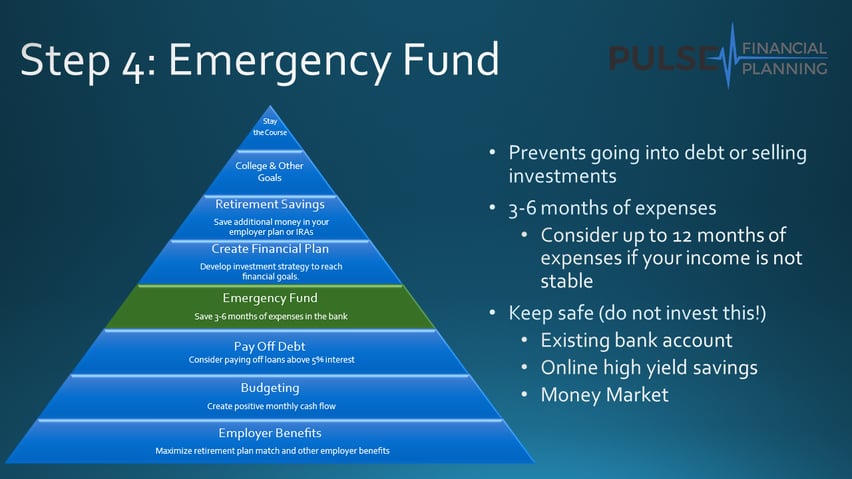

Having a properly funded emergency fund can prevent you from going into debt or selling investments at a bad time to cover an unexpected expense.

Ideal emergency fund balances can vary person-to person, but should generally be about 3-6 months of expenses. If you work in an industry with potentially unstable future income or are approaching retirement – consider increasing your emergency fund to up to 6-12 months of expenses. If you’re not sure how much you should keep in your emergency fund, check out my free emergency fund calculator.

Once this savings goal has been met, you can go out and make other investments and know you won’t need to sell them in a down market or go into debt to meet your immediate living expenses.

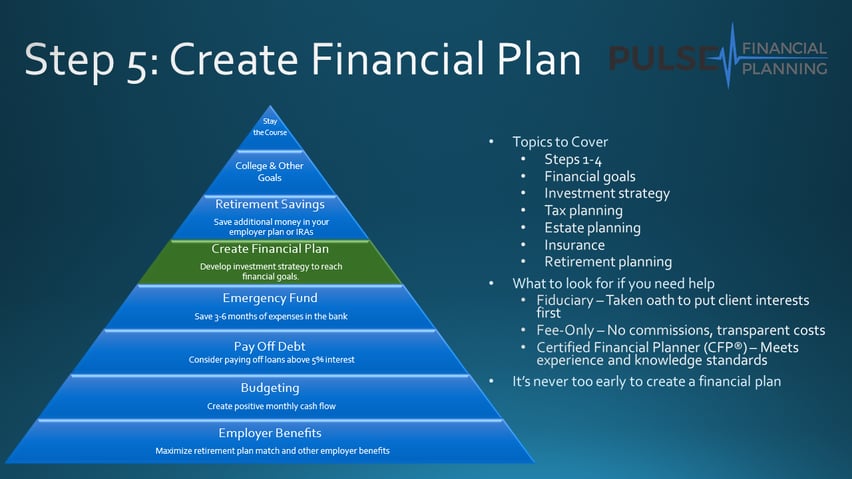

Once you’ve conquered steps 1-4, your financial decisions can become more complex and may have major long-term trade-offs. To handle the growing number of financial decisions you face, you should have a financial plan in place.

In addition to steps 1-4, topics that your financial plan should cover include:

- Financial goals

- Investment strategy

- Tax planning

- Estate planning

- Insurance

- Retirement plan

If you have the time and desire to do this effectively – make sure you allocate the time to educate yourself to get this done. A financial plan isn’t a “one and done” thing you do and check off your list. Inevitably, your circumstances will change many times throughout your life. Having a plan in place ahead of time will help you make intelligent decisions as these changes arise. Remember to check and update your financial plan at least annually.

If you don’t have the time or desire (or thought you did, and 6 months have passed and still you don’t have a written plan) consider hiring a professional. If you delegate this – make sure you hire a fee-only, fiduciary, CERTIFIED FINANCIAL PLANNER™ so you know the person you’re paying has transparent fees, is required to act in your best interest, and is a competent professional.

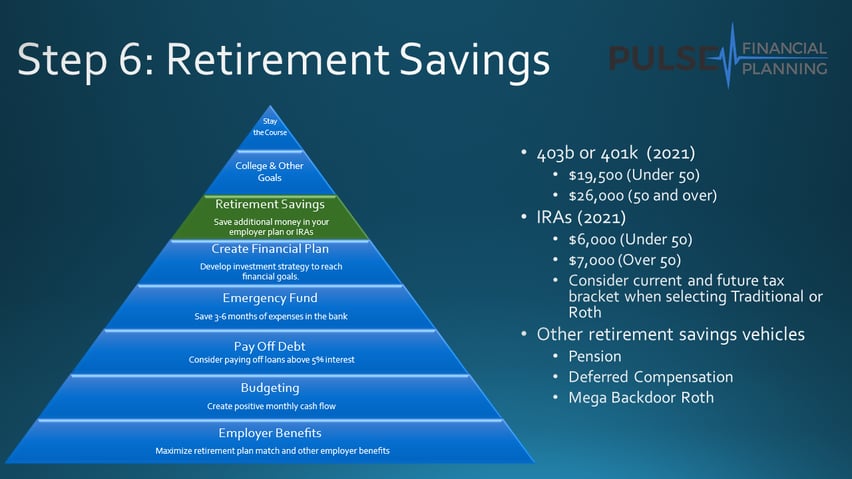

Once you’ve got your near term goals met and a financial safety net, you can begin adding more to your retirement accounts. Common types of tax-advantaged retirement savings vehicles are:

- Employer Retirement Plan: Depending on your investment options, your existing employer retirement plan may be a good place to increase your retirement savings.

- Traditional / Roth IRA: Depending on your Modified Adjusted Gross Income (MAGI), you may not be eligible to contribute directly to a Roth IRA or deductible Traditional IRA. IRAs offer more flexibility and options than most employer retirement plans, but come with some income restrictions and lower contribution limits. Updates to the tax code may impact IRA strategies in 2022 and beyond.

- 457 Deferred Compensation (If Available): These plans are only available if your employer offers it for employees earning more than $130,000 (2021) per year. Deferred compensation is at risk of your employer’s creditors, so only contribute if your employer is financially strong.

- Mega Backdoor Roth (If Available): This strategy only works if your employer retirement plan allows after tax contributions and in-service non-hardship withdrawals. Many plans do not allow this which makes the Mega Backdoor Roth unavailable. If they do allow it, make sure the plan sponsor understands what you are doing and you file the proper tax forms. Updates to the tax code may impact this strategy in 2022 and beyond.

Consider your current and future tax brackets carefully when deciding to make Traditional (pre-tax) or Roth (after-tax) contributions.

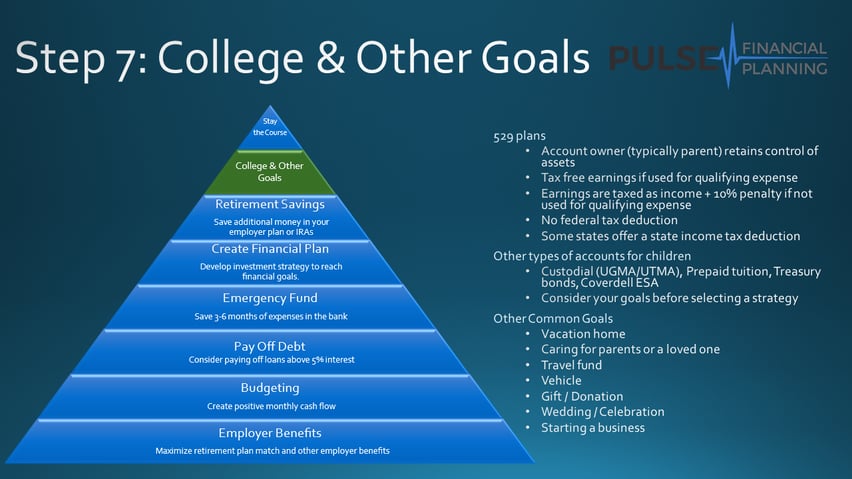

If you’ve identified paying for a child’s education as a priority, consider a state sponsored 529 plan as a good place to start. This is not the only way to save for college, and the type of account should be considered in light of your overall financial goals.

Check if your state allows 529 contributions to qualify you for additional tax savings. For example in Minnesota, you can deduct up to $1,500 (or $3,000 if married filing jointly) from your state taxes for your 529 contribution in 2021. Depending on your tax bracket, you may be able to take a state tax credit instead of the deduction up to a maximum credit of $500. 529 plan contributions are not deductible for federal income tax, but gains on the investments are tax free if used for a qualifying education expense.

Other common college savings techniques are to utilize Roth IRAs, Coverdell ESAs, custodial (UGMA/UTMA) accounts, taxable savings accounts, trust accounts, prepaid tuition, and treasury bonds. Review the advantages and disadvantages of different plan options or consult with a financial planner to make an informed decision on the right account type for you.

Once you have your money invested, consider your investment strategy in light of when you plan to spend the money (time horizon), and how comfortable you are with the risk (risk tolerance). Be realistic with yourself about your ability to pick investments. Most of the time a simple portfolio using diversified, low cost index funds is the best strategy.

Remember to stay the course and not panic when we see market volatility (which you will happen many times over your investment horizon). Seeing your account values fluctuate is a normal piece of a healthy long-term investing strategy.

While not necessarily a “worst case scenario”, you should plan to handle similar levels of volatility as we saw during the financial crash in 2008. The downturn lasted about 4 years, and you should plan for an extended bear market like this in your portfolio in the future. If you need the money you have invested within the next 5 years, you shouldn’t be investing it heavily in the stock market in the first place. If you don’t need it within 5 years, you shouldn’t be worrying about the short term moves in the stock market, so stay the course!

About the Author

About the Author

Matt Elliott is a CERTIFIED FINANCIAL PLANNER™ and founder of Pulse Financial Planning. Pulse Financial Planning is a fee-only, fiduciary financial planner and advisor for healthcare professionals and never earns a commission of any kind.

Share this

Subscribe by email

You May Also Like

These Related Stories

Good Financial Reads: How To Set Up Your Child With Special Needs for Success

5 Steps to a Stronger Financial Plan