Your Guide to Stock Compensation Plans and Taxes

Share this

You’ve probably noticed that stock compensation has become a popular way to pay employees in addition to a traditional salary. This form of compensation gives an employee a stake in the success of the company. When the company does well and the stock price increases, the value of the stock compensation that the employee received increases as well. Tesla, Google, and Snowflake are a few examples of successful companies whose employees have benefited from stock compensation plans.

Given the increased popularity of stock compensation, as an advisor it’s important to gain an understanding of how the different types of stock compensation plans work—there are often misunderstandings, especially when it comes to taxes. Today, we’ll go into detail about the different types of stock compensation, the tax implications, and how a tax professional might help you implement some tax planning strategies to maximize the benefits of stock compensation for your clients.

Taxes and Stock Options

Stock option exercises, or RSU vesting, can result in an employee receiving compensation that is much larger than what they would report if they simply received their traditional annual salary. Of course, a larger income results in a larger tax liability, and because of this, some employees might be reluctant to exercise stock options because of the tax obligation that results. However, even after taxes, the employee stands to benefit greatly from exercising stock options if the company’s stock price has skyrocketed above the exercise price.

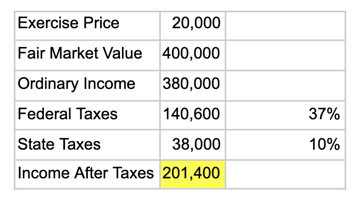

In the example below, the employee earns a gross income of $380,000 from exercising stock options and needs to pay 47% of their earnings to the government (between Federal and State). However, they still receive 53% of the compensation amount, in this case, $201,400. That is a lot of money to give up just to avoid paying a chunk of the total income to the government. Additionally, tax planning can help to reduce the tax burden.

Types of Stock Compensation

There are four main types of stock compensation:

-

Incentive stock options (ISOs)

-

Non-qualified options (NQs)

-

Restricted stock units (RSUs)

-

Employee stock purchase plans (ESPPs)

Often employers will offer employees more than one type of stock compensation plan. Let’s go into more detail about each type of stock compensation plan.

Incentive stock options

Incentive stock options offer employees the greatest opportunity to pay taxes at long-term capital gain rates. There is no income tax impact when an option is granted. There is also no ordinary income reported when an option is exercised. However, an AMT adjustment will need to be made in the year of exercise if the acquired stock is not sold during the current year. The AMT adjustment is the difference between the fair market value and the option cost (exercise price). When the option is sold in a later year, the AMT adjustment reverses. This will not be reflected on the 1099-B and will need to be calculated by the tax preparer.

Form 3921 will be issued to the taxpayer when an incentive stock option is exercised. Form 3921 reports the grant date, exercise date, exercise price per share, fair market value per share on the exercise date, and the number of shares transferred. Form 3921 is needed to calculate the AMT adjustment and the reversal of an amt adjustment made in an earlier year.

If the acquired stock is sold during the same year that the option is exercised, there is no AMT adjustment. However, ordinary income will be recognized for the difference between the exercise price and the fair market value at the exercise date. This should be reflected on the W-2. Even though a disqualified disposition results in ordinary income, a taxpayer may choose to sell in the current year if:

-

The fair value of the stock dropped significantly from when they purchased it.

-

The taxpayer needs the cash from the sale.

-

The taxpayer did not realize the tax implications of a disqualified disposition.

Below is an example form 3921 and an example of the AMT adjustment that would be made.

If the shares are not sold in the current year, the amt adjustment is the difference between the FMV and the exercise price paid, multiplied by the number of shares.

The adjustment is made on line 2i of form 6521 in 2019 (the exercise year). When the ISO is sold in 2020 (after a holding period of more than one year), the basis for regular tax purposes is $4,240 (the price paid), but the basis for AMT is $25,260 (the price paid plus the AMT adjustment). The difference between these two basis amounts is a negative adjustment to AMT on line 2k of form 6251. Note that the negative adjustment in 2020 is the same as the positive adjustment in 2019.

Non-qualified stock options

Another type of stock option compensation is non-qualified stock options. Non-qualified (NQ) options have some similarities to incentive stock options in that they also do not have an income impact when granted. You need to exercise NQs to receive the stock. Similar to ISOs, NQs will usually have an exercise price. However, NQs differ from ISOs in that ordinary income is recognized at exercise regardless of whether the acquired stock is sold in the exercise year or not. Ordinary income is the difference between the fair market value at exercise and the exercise price paid. Ordinary income from the exercise of non-qualified stock options is reported on an employee’s W-2 in box 12 with code V.

The capital gain treatment on sale depends on the holding period after exercise:

-

Short-term if sold within one year (sell to cover taxes and any option costs)

-

Long-term if held one year

The sale can be reported as a “covered” or “non covered” sale, but it often has the exercise price reported as the basis on the 1099-B. This means the tax preparer will need to adjust the basis on sale to add in the W-2 income inclusion from the exercise year. To determine the basis for sales of non-qualified stock options, the tax preparer needs information similar to what is provided on the 3921 for ISOs, but this form is not issued for NQs. The employer should be able to provide the grant date, exercise date, exercise price (cost to the taxpayer), and FMV at exercise date for each NQ sale during the year.

We can use the same example as before, but we will assume the option is an NQ instead of an ISO.

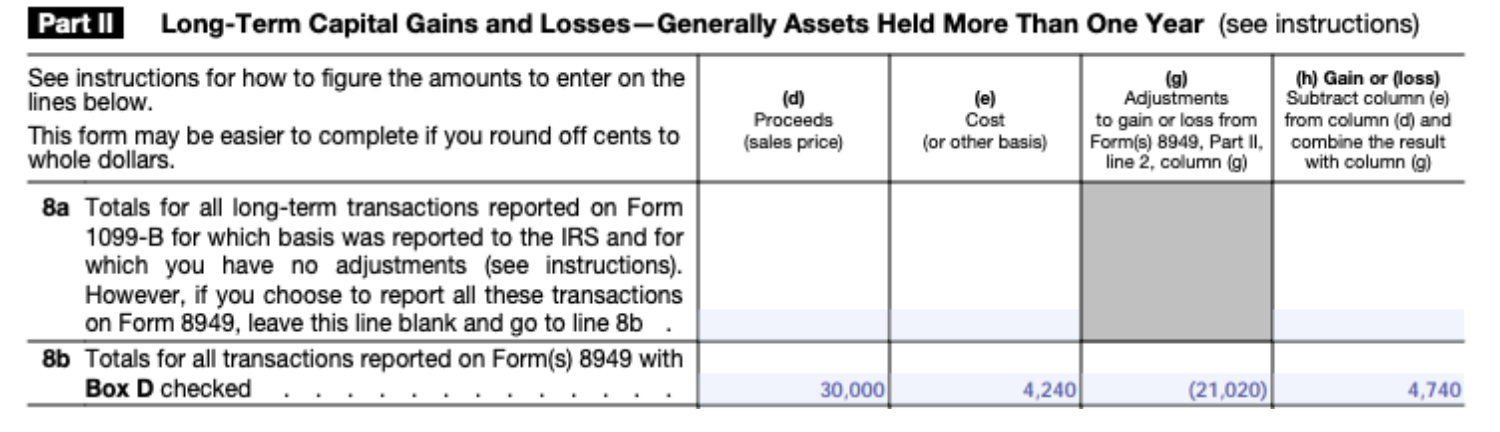

In this case, ordinary income is recognized at exercise for the difference between the FMV and the exercise price. Note, if this was an ISO, an AMT adjustment would be made instead. The ordinary income amount increases the basis for the stock sale and decreases the capital gain recognized so that the employee is not double-taxed on this same income. The adjustment would appear on the schedule D as shown below.

Image Credit: IRS form 1040 Schedule D

Restricted stock units

Restricted stock units (RSUs) differ from ISOs and NQs because you do not need to exercise them. You receive stock from RSUs when they vest. Generally, there is a service requirement (ex: two years of service) and/or an event (such as an IPO) that triggers vesting. After the vesting requirements are met, RSUs usually vest on a regular schedule such as quarterly or monthly. Income is recognized when RSUs vest, and it is the fair market value of the stock on the vesting date. Income should be reflected on the W-2 in box 14 with code RSU.

One issue with RSUs is that federal tax is automatically withheld at the supplemental rate of 22%. Often this is not enough withholding since the employee may be in a higher tax bracket. Employees may elect to have more tax withheld or they can make estimated payments to cover the difference. States also have supplemental rates, but usually the state supplement rate is sufficient to cover the taxes owed. A quick Google search can reveal the supplemental rate for a given state. It is 10.23% for CA and 9.62% for NY.

When stock acquired through RSU vesting is sold, the capital gain treatment depends on the holding period after vesting.

-

Short-term if sold within one year

-

Long-term if held for one year or more

The sale can be reported as a “covered” or “non covered” sale, but sometimes zero basis is reported on the 1099-B, and a basis adjustment is needed. There is no IRS form reporting RSUs vested. However, the employer should be able to provide the information on the vest dates and fair market values at vesting. The ordinary income recognized at vesting is the basis for the stock sold.

Employee stock purchase plans

The last type of employee stock compensation is the employee stock purchase plan (ESPP). An ESPP allows an employee to purchase stock for a discount. Typically the discount is 15%, so the employee can purchase stock for 85% of the market value. ESPPs generally have the highest stock basis for any option plan because the discount isn’t substantial. Additionally, not as many shares are granted for ESPPs as for other plans. ESPP income will appear on the W-2 in box 14 with code ESPP. The ordinary income recognized will depend on whether the sale is a qualifying or a disqualifying disposition.

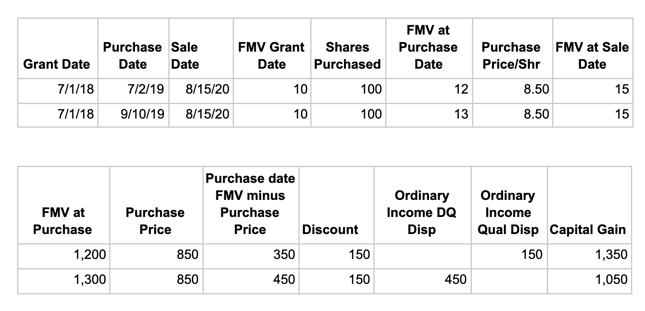

To be a qualifying disposition, the sale must occur at least one year from the purchase date and two years from the grant date. Ordinary income will be the discount (the difference between the purchase price and the grant date fair market value) or the total gain if it is less than the discount.

A disqualifying disposition occurs when the sale is within one year of the purchase date or two years of the grant date. In this case, ordinary income is recognized as the difference between the actual purchase price paid and the purchase date fair market value. The example below shows the ordinary income for a qualifying disposition and a disqualifying disposition. Note that the capital gain is long-term for the qualifying disposition and short-term for the disqualifying disposition.

A form 3922 is issued when stock is purchased through an ESPP. This form is similar to the 3921 issued for ISOs. This form is used to adjust the basis for sales of shares acquired through an ESPP. Brokers are not allowed to include the ordinary income in the basis of the 1099-B, so tax preparers will always need to make the ordinary income adjustment for ESPP shares.

The sale treatment for ESPPs will depend on the holding period

-

Short-term if sold within one year (disqualifying disposition)

-

Long-term if held one year

The sale can be reported as a “covered” or “non-covered” sale. The basis will always need to be adjusted for the ordinary income reported on the W-2.

Stock Compensation Planning

As mentioned earlier, tax planning can be used to help a taxpayer determine the best methods for using stock-based compensation to their advantage. A tax professional can assist with planning for:

-

Quarterly estimated tax needs (if extra income is expected due to exercise of options or vesting of RSUs)

-

When to exercise options and what quantities to exercise

-

Determining tax implications for exercise in different scenarios (ex: if the FMV at exercise is $10, $15, or $20)

-

Determining if it is a good idea to exercise and sell options to diversify a stock portfolio

-

Putting together multi-year plans for the implications of ISO exercises

-

Helping with state tax issues

-

Determining how to best utilize stock options before they expire

Multi-State Tax Issues

You may be unable to escape a state tax liability with regard to stock compensation even if you move to a no-tax state. New York, California, and some other states require some RSU or stock option income to be reported as earned in-state even after moving. The allocation may be based on days worked in that state between grant and vest or grant and exercise. Taxpayers are often surprised they have to pay tax in a state they left. Depending on the grant date, the tax liability can extend back many years after a taxpayer moves. A tax professional can help you understand and plan for multi-state tax issues regarding stock compensation.

Stock compensation can be a lucrative supplement to a traditional salary that benefits both employees and employers. However, as you can see, stock compensation can get complicated, especially when it comes to taxes. Employees have to watch out to ensure they make basis adjustments on their tax returns to avoid double-taxation. A tax professional can prepare accurate tax returns that properly reflect stock-based compensation.

Tax professionals can also help you develop a plan to take full advantage of the stock compensation alternatives your employer offers while mitigating the tax impact. As stock compensation increases in popularity, it is important to gain an understanding of how the different plans work and to seek out tax professionals who can help you along the way. If you’re looking for tax professionals to have in your corner, check out XYTS and the services our expert team offers.

About the Author

Katrina Ivancic, CPA, is a Tax Manager on team XYTS. She is a master of tax return preparation and reviews and looks forward to taking on tax planning projects. When Katrina isn't working in the world of taxes, she's likely outside getting active. Her main hobby is running, and in her free time, she can usually be found getting in miles, enjoying every stride.

Share this

- Advisor Posts (433)

- Fee-only advisor (388)

- Advice (316)

- Business Development (245)

- Independent Financial Advisor (204)

- Growing Your Firm (160)

- Marketing (132)

- Financial Planning (104)

- What Would Arlene Say (WWAS) (81)

- Firm Ownership (78)

- Business Coach (77)

- Training (76)

- Compliance (71)

- Business (69)

- Building Your Firm (68)

- Financial Advisors (65)

- Online Marketing (61)

- Events (60)

- Starting a Firm (50)

- From XYPN Members (48)

- Technology (48)

- Launching a firm (45)

- Advisors (42)

- Entrepreneurship (39)

- Taxes (39)

- Staffing & HR (38)

- Networking & Community (33)

- Interviews and Case Studies (32)

- Investment Management (32)

- XYPN Invest (28)

- Tax Preparation (27)

- Business Owner (25)

- Social Responsibility (25)

- Sales (24)

- Small Business Owner (20)

- Industry Trends & Insights (19)

- From XYPN Invest (18)

- Financial Planners (17)

- Independent Financial Planner (17)

- XYPN (17)

- Leadership & Vision (16)

- XYPN News (16)

- Tech Stack (15)

- How to be a Financial Advisor (14)

- RIA (14)

- Investing (13)

- Media (13)

- NextGen (13)

- Press Mentions (13)

- Financial Education (12)

- Goals (12)

- RIA Owner (12)

- XYPN Membership (12)

- Assets Under Management (AUM) (11)

- First Year (11)

- Niche (11)

- SEC (10)

- Advisor Success (9)

- RIA Registration (9)

- Communication (8)

- Lessons (8)

- Study Group (8)

- Time Management (8)

- Virtual Advisor (8)

- Growth (7)

- Mental Health (7)

- Pricing Models (7)

- From Our Advisors (6)

- Independent RIA (6)

- Money Management (6)

- Motivation (6)

- Preparing to Launch (6)

- Processes (6)

- Risk and Investing (6)

- Automation (5)

- Behavioral Finance (5)

- Broker-Dealers (5)

- College Planning (5)

- Filing Status (5)

- How I Did It series (5)

- Investment Planner (5)

- Michael Kitces (5)

- Preparing to Launch (5)

- Retirement (5)

- S Corpration (5)

- Scaling (5)

- Support System (5)

- TAMP (5)

- Wealth (5)

- Year-End (5)

- Bear Market (4)

- CFP Certification (4)

- Outsourcing (4)

- Selling a Firm (4)

- Small Business (4)

- State Registration (4)

- Succession Plans (4)

- Benchmarking Study (3)

- Bookkeeping (3)

- Budgeting (3)

- ESG Investing (3)

- Emotional Decisions (3)

- Engagement (3)

- Fiduciary (3)

- Financial Life Planning (3)

- Getting Leads (3)

- IRA (3)

- Life planning (3)

- Lifestyle practice (3)

- Membership (3)

- Millennials (3)

- Monthly Retainer Model (3)

- Monthly Subscription Model (3)

- Partnership (3)

- Pricing (3)

- RIA Audit (3)

- Recordkeeping (3)

- Risk Assessment (3)

- Staying Relevant (3)

- Wellness (3)

- Work Life Balance (3)

- Advice-Only Planning (2)

- Building Your Firm (2)

- Career Changers (2)

- Charitable Donations (2)

- Community Property (2)

- Design (2)

- Differentiation (2)

- Exchange-Traded Funds (ETF) (2)

- FINRA (2)

- Finding Your Why (2)

- Graphic design (2)

- Growing Income (2)

- Health Care (2)

- Inflation (2)

- Key performance indicator (KPI) (2)

- Keynote (2)

- Negative Rates (2)

- Operations (2)

- Organization (2)

- Outsourced Asset Management (2)

- Outsourced Bookkeeping (2)

- Portfolio Management (2)

- Productivity (2)

- Psychology (2)

- Quickbooks (2)

- Recommended Reading (2)

- Recruiting (2)

- Registered Representative (2)

- Registration (2)

- Restricted Stock Units (RSU) (2)

- Start Ups (2)

- Stock Options (2)

- Team Communication (2)

- Virtual Assistant (2)

- Virtual Paraplanner (2)

- Accounting (1)

- Arlene Moss (1)

- Assistant (1)

- Bonds (1)

- Bull Market (1)

- Careers (1)

- Certified Public Accountant (CPA) (1)

- Childcare (1)

- Client Acquisition (1)

- Client Services (1)

- Common Financial Mistakes (1)

- Consulting (1)

- Consumerism (1)

- Credit (1)

- Custodians (1)

- Custody Rule (1)

- Data (1)

- Daycare (1)

- Definitions (1)

- Designations (1)

- Direct Indexing (1)

- Disasters (1)

- Earn More (1)

- Family (1)

- Fidelity (1)

- Finance (1)

- Financial Freedom (1)

- Financial Goals (1)

- Financial Life Management (1)

- Financial Success (1)

- Financial Wellness (1)

- Form 8606 (1)

- Form 8915-E (1)

- Grief (1)

- Guide (1)

- How to Budget (1)

- Impostor Syndrome (1)

- Interns (1)

- Investor Policy Statement (IPS) (1)

- Job burnout (1)

- Liquidating your business (1)

- Loans (1)

- Moving Forward (1)

- Part Time (1)

- Paying Yourself (1)

- Paystub (1)

- Perfectionism (1)

- Project Management (1)

- Projecting Returns (1)

- Purpose (1)

- Quarterly Estimated Payments (1)

- RIA Operations (1)

- Recession (1)

- Referrals (1)

- Regulations (1)

- Regulators (1)

- Reinvention (1)

- Relationships (1)

- Remote (1)

- Required Minimum Distributions (RMD) (1)

- Risk Management (1)

- Roth Conversations (1)

- Roth IRA (1)

- Sabbatical (1)

- Spending (1)

- Strategy (1)

- Systems (1)

- Target Audience (1)

- Teamwork (1)

- Terms (1)

- To-Do List (1)

- Traditional IRA (1)

- Transitions (1)

- Virtual (1)

- Vulnerability (1)

- XYPN Books (1)

Subscribe by email

You May Also Like

These Related Stories

5 Investment Management Options To Consider When Launching Your RIA

Your 2021 (Tax) Year In Review from Your Team At XY Tax Solutions