Year-End Tax Planning: Decisions to Weigh

Share this

For many taxpayers, their 2019 return has been filed and put to rest (finally) and taxes are the last thing on their mind (at least until the 1099s and W-2s start rolling in). For financial planners, this is the perfect time to talk with clients about taxes for 2020. Why? Because there is still time to make some important decisions—or delay actions until next year. In this post, I walk through those decisions. Let's dive in.

Taxpayers with net operating losses in 2019 can file with the IRS for quick refunds this year by fax submission if they fax the loss carryback to the IRS before December 31, 2020. According to the IRS, they're keeping up with these loss submission returns and issuing refunds. If taxpayers miss the December 31 deadline, they have to file for loss carryback using amended returns.

Taxpayers who are considering adding solar, geothermal heat pumps, or fuel cell property to their homes must have the systems installed before December 31 to get 26% credit. For systems installed after January 1, the credit drops to 22%. (Don’t believe the salespeople who say a signed contract is enough to get the credit.)

Now let’s consider the coronavirus stimulus payment. This was an advance refund received on taxpayers 2020 tax return based on either the 2018 or 2019 tax returns filed. Many college-aged dependents were not issued a stimulus, and many taxpayers had income that was too high in 2018 or 2019 to qualify for stimulus. When it comes time to file the 2020 tax return, there will be a reconciliation on what the taxpayers should have received and what they actually did receive as an advance payment. College-aged dependents should consider filing independent of their parents to qualify for a stimulus payment with their 2020 return. Other taxpayers whose income was too high for the stimulus based on 2018 or 2019 returns might qualify for some benefit if their 2020 tax returns reflect low enough income. Therein lies an opportunity to help taxpayers reduce taxable income on their 2020 returns.

This time of the year, it's also worth reviewing salary deferral contributions to employer plans and Health Savings Account (HSA) contributions to consider increasing contributions before end of the year. It’s also a good time to review if income tax withholding is sufficient or needs to be updated.

Under the SECURE Act and for contributions made for tax years beginning after 2019, individuals of any age can make contributions to a traditional IRA, assuming there is enough compensation. Prior to this rule change, taxpayers were not allowed to make an IRA contribution once they reached age 70½ by the close of the year. The rationale for the rule change is that Americans are living longer, and many are continuing to work past 70½ years old. The restriction didn’t apply to Roth IRA contributions.

As you meet with your financial planning clients, it’s a good time to discuss what options they are considering that will affect their tax returns. Are they considering purchasing more equipment or vehicles? Would the deduction be more beneficial in 2020 or 2021? Are they considering selling property? Would the sale be better this year or next? Run tax projections taking the gain in 2020 or 2021 to guide your client for the best tax solution. (XY Tax Solutions can help you with this analysis.)

The usual tax mantra of “taxed deferred is taxes saved” means deferring revenue and accelerating deduction, but in loss years there are tax opportunities where bringing extra income or defer expenses leads to better tax consequences, and all the COVID-related law changes definitely changed the normal year-end planning.

For those taxpayers who had a bad year, delaying deductions until 2021 with the expectation they have a recovery may lead to a better tax benefit. For clients with losses expected in 2020, it might be a good year to bring taxable income into the year with little to no tax cost. A prime example would be to do Roth conversions for these clients, or elect to report all the COVID-related retirement plan distributions as taxable in 2020 instead of taking the three-year inclusion.

The CARES Act also presented an opportunity to draw retirement savings up to $100,000 without paying the normal 10% premature distribution penalty. The draw could be either a loan or spread the income over several years. The loan had to occur before September 23. Not that many taxpayers took advantage of the expanded 401(k) loans, but those who did will need to plan to return the funds or pay tax on the amounts not repaid. Taxpayers can still take COVID-related distributions. People who have been affected by COVID-19 can apply for COVID-Related Distributions (RMD) until December 30, provided their plan sponsor permits the special CARES Act distributions. Eligibility for those distributions is broad, as it applies to people who have tested positive for COVID-19, have a spouse or dependent who tested positive or have experienced financial consequences from the pandemic, including having reduced work hours or resulting from being quarantined, according to the IRS.

The CARES Act enabled any taxpayer with an RMD due in 2020 from a defined-contribution retirement plan, including a 401(k) or 403(b) plan, or an IRA, to skip those RMDs this year. This includes anyone who turned 70½ in 2019 and would have had to take the first RMD by April 1, 2020. This waiver does not apply to defined-benefit plans, inherited plans, or inherited IRAs. The repayment was due August 31 for distributions that occurred before that point. If your client typically takes their RMD late in the year, it is not too late to stop that from happening. If a distribution was taken after August 31, then consider using the 60-day rollover rule to redeposit it.

For clients with businesses that took PPP loans, it may be time to apply for loan forgiveness. The loan forgiveness application must be filed in the 10 months deferral period after the measurement period. To receive loan forgiveness, a borrower must complete and submit the Loan Forgiveness Application (SBA Form 3508, 3508EZ, or lender equivalent) to its lender (or the lender servicing its loan). As a general matter, the lender will review the application and make a decision regarding loan forgiveness. The lender has 60 days from receipt of a complete application to issue a decision to SBA.

The law around the measurement dates changed more than a few times. I only wish I was kidding when I say the SBA posted additional interim or final rules on April 3, 2020, April 14, 2020, April 24, 2020, April 28, 2020, April 30, 2020, May 5, 2020, May 8, 2020, May 13, 2020, May 14, 2020, May 18, 2020, and May 20, 2020, and the Department of the Treasury (Treasury) posted an additional interim final rule on April 27, 2020. But I'm not kidding. That really happened.

Note that there is a typo on the loan forgiveness application form 3508EZ; it would be impossible to use the 24-week covered period from loan funding of loans that were still being processed, let alone funded in August and still meet the expiration period of October 31, 2020 printed on the form. The date should most likely be October 31, 2021. Loan payments will be deferred for borrowers who apply for loan forgiveness until SBA remits the borrower's loan forgiveness amount to the lender. If a borrower does not apply for loan forgiveness, payments are deferred 10 months after the end of the covered period for the borrower’s loan forgiveness (either 8 weeks or 24 weeks). For smaller clients, it may not matter which measurement date is used. While a forgiven loan might otherwise be treated as income to the borrower, the CARES Act provides that for federal income tax purposes. Any amount of the PPP loan that is forgiven will be excluded from gross income and therefore from income tax.

While the loan forgiveness is not taxable, there is still some uncertainty that loan funds used to pay expenses may not be deductible. Notice 2020-32 outlines the IRS’s position that, based on existing tax law intended to prevent such a double benefit, otherwise deductible business expenses that are paid with forgiven PPP funds will be disallowed as tax deductions in computing the recipient’s taxable income. The nondeductible treatment applies for any payment of eligible PPP expenses to the extent of the loan forgiveness. Some members of Congress have expressed publicly that their intent was to have both tax-free forgiveness and deductibility of the business expenses. Such a result will most likely need to be achieved through legislative action such as the Heroes Act currently being debated in Congress. It is possible that a future economic response bill will attempt to ensure deductibility of expenses paid with forgiven PPP funds.

This creates an interesting and somewhat frustrating situation where the funds were mostly intended to be used for payroll and those wages may not be deductible due to the loan forgiveness, so the taxpayer's annual payroll reports on W-4 and 940 series filings do not agree to the deductible payroll expense. Going one step further, if rent was one of the items reduced, the taxpayer’s 1099 to their landlord based on payments would not agree to the rent expense deducted due to PPP loan forgiveness. Another wrinkle to consider is that loan forgiveness might occur in 2021 on expenses paid in 2020. Taxpayers should consider filing extensions for their 2020 tax returns to hold off on filing until forgiveness is determined or potentially Congress acts to address this issue.

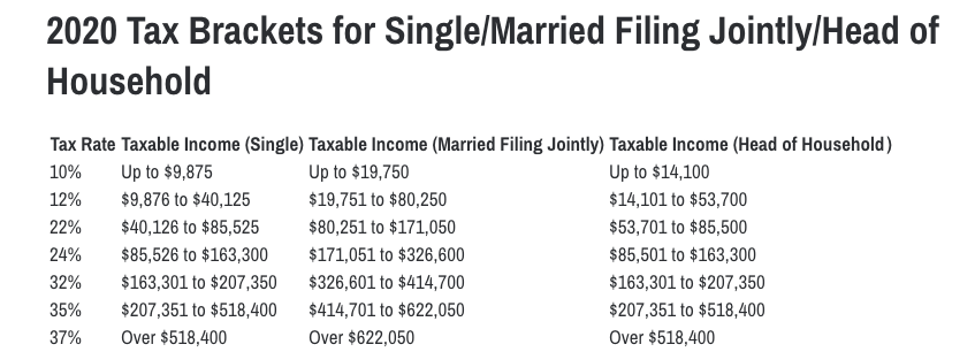

Tax rates on long-term capital gains and qualified dividends did not change for 2020, but the income thresholds to qualify for the various rates did go up. In 2020, the 0% rate applies for individual taxpayers with taxable income up to $40,000 on single returns ($39,375 for 2019), $53,600 for head-of-household filers ($52,750 for 2019), and $80,000 for joint returns ($78,750 for 2019).

The 20% rate for 2020 starts at $441,451 for singles ($434,550 for 2019), $469,051 for heads of household ($461,700 for 2019), and $496,601 for couples filing jointly ($488,850 for 2019).

The 15% rate is for filers with taxable incomes between the 0% and 20% break points.

The 3.8% surtax on net investment income stays the same for 2020. It kicks in for single people with modified AGI over $200,000 and for joint filers with modified AGI over $250,000.

Now that the election is over, there is already discussion on turning back the Trump tax reductions. The Tax Cuts and Jobs Act (TCJA) brought forth the biggest changes in taxation since the Reagan administration, and reversing those changes will affect many taxpayers. You might be surprised to learn I don’t have a crystal ball indicating when the tax rates will go up, or which tax codes will be adjusted. Generally, taxpayer favorable legislation is made effective as the beginning of the current tax year, and taxpayer unfavorable legislation is made effective for the beginning of the next tax year, and then sometimes gets postponed. An example of this delay would be where the Alimony tax treatment was changed to nondeductible for divorces occurring after 2018.

What that in mind, I suggest you consider that tax rates likely won’t change much for the 2021 tax year, but 2022 may bring tax increases. (It’s also worth noting that many of the TCJA provisions had sunsets in 2025.) With that in mind, consider whether bringing additional income into 2020 or 2021 would result in a lower overall tax on client income. Also, between now and year-end would be the time to lock in purchases for long-term investments so as we approach the end of 2021, you and your clients can qualify for long-term capital gain rates if it appears the rates will be higher in 2022 and beyond.

And there you have it. There are a lot of decisions to make around year-end tax planning, but as a financial advisor, you're well positioned to walk and talk your clients through these conversations.

About the Author

Michael Law, CPA, is a Senior Tax Manager for XY Tax Solutions, a wholly-owned subsidiary of XYPN offering an outsourced tax team for XYPN members. Michael has 22 years of experience including time spent as Vice President of Tax Operations at Goldman Sachs. Other hats he has worn throughout his career include Supervising Senior Accountant, Tax Manager, Audit Manager, and Tax Partner.

He's been published or quoted in Accounting Today, Small Biz Daily, Business News Daily, and more. Michael holds a Masters of Science in Taxation from Golden Gate University and a Bachelor of Science in Business Administration from California State University.

Share this

- Advisor Blog (697)

- Financial Advisors (222)

- Growing an RIA (121)

- Digital Marketing (87)

- Marketing (84)

- Community (81)

- Business Development (78)

- Start an RIA (76)

- Coaching (72)

- Running an RIA (71)

- Compliance (69)

- Client Acquisition (65)

- Technology (65)

- Entrepreneurship (61)

- XYPN LIVE (59)

- Sales (49)

- Practice Management (44)

- Client Engagement (41)

- Bookkeeping (40)

- Investment Management (40)

- XYPN Books (38)

- Fee-only advisor (37)

- Scaling an RIA (33)

- Employee Engagement (31)

- Lifestyle, Family, & Personal Finance (31)

- Financial Education & Resources (27)

- Client Services (26)

- Journey Makers (21)

- Market Trends (21)

- Process (14)

- Niche (11)

- SEO (9)

- Career Change (8)

- Partnership (7)

- Transitioning Your Business (7)

- Sapphire (4)

- Transitioning To Fee-Only (4)

- Social Media (3)

- Transitioning Clients (3)

- Emerald (2)

- Persona (2)

- RIA (2)

- Onboarding (1)

Subscribe by email

You May Also Like

These Related Stories

8 Simple Tips to Optimize Tax Planning as an Advisor

May 9, 2022

6 min read

Your Guide to Tax Preparation and Tax Planning as an Advisor

Sep 6, 2021

8 min read