What Financial Advisors Need to Know About Custody

Share this

In the financial services industry, we often hear (or see) the word “custody” and cringe. With several layers to the rule, it is crucial to have a clear understanding of which business practices trigger the Custody Rule and which do not.

Let’s start by defining custody. This term refers to financial professionals taking possession of clients’ securities, cash, ownership deeds, jewelry, coins, etc. as a means of protection and in order to manage those assets. Custody is defined in Rule 206(4)-2 of the Investment Advisers Act of 1940 as, “holding, directly or indirectly, client funds or securities, or having any authority to obtain possession of them.” The underlined portion of the rule is an important element that is oftentimes overlooked.

The Custody Rule is triggered when a Registered Investment Adviser:

- enters into any arrangement authorizing or permitting the firm to withdraw client funds or securities, including the direct debiting of advisory fees (more on this a little later!);

- acts in any capacity that gives the firm legal ownership of or access to client funds or securities (GP of an LP, Managing Member of an LLC, Trustee/Executor/Conservator);

- handles client securities or assets;

- has check-writing authority for the client;

- has an affiliate who has triggered the rule (your affiliates are all of your officers, partners, or directors; all persons directly or indirectly controlling or controlled by you; and all of your current employees);

- serves as general power of attorney for a client;

- requires prepayment of fees of more than $500 six months or more in advance (for State-registered firms) or of more than $1,200 (for SEC-registered firms); or

- obtains client login credentials for accounts containing funds/securities.

When the Custody Rule is triggered, advisors are required to:

- maintain client funds and securities at a Qualified Custodian;

- have a reasonable basis to believe that the Custodian sends account statements directly to the client on at least a quarterly basis. If the firm also sends reports to the client on a regular basis, those reports must contain a statement that urges the client to compare the statement and the report and to promptly communicate any discrepancies to you.

- Undergo an Annual Surprise Examination by an independent public accountant of assets over which the firm has custody.

You may be thinking, “Aren’t there exceptions?!” You’re in luck—there are a few!

If client funds or securities are received inadvertently and returned to sender within three business days, the Custody Rule is not triggered. The advisor must return the funds to the client directly, rather than forwarding to the originally intended recipient.

Advisors with custody of client assets solely due to having the authority to deduct advisory fees directly from client accounts are not subject to the Annual Surprise Examination requirement of the rule. In most cases, advisors still answer “no” on Form ADV Part 1A, Item 9A.

An exception is made when an advisor acts as trustee, executor, or conservator for a client solely as a result of family or personal relationship, and not as a result of the client/advisor relationship. In these circumstances, it is best practice to execute a letter of understanding to demonstrate that the personal relationship existed prior to the business relationship.

Firms advising any unregistered pooled investment vehicle that is subject to annual financial statement audit, and that distributes audited financial statements to the pool’s investors within a specified time frame are not subject to the Annual Surprise Examination element of the Custody Rule.

Certain exceptions to the rule are also made when a Standing Letter of Authorization (SLOA) is in place that allows the advisor to make transfers on behalf of a client without obtaining a signature each and every time. The SEC released a no action letter in February 2017 that clarifies an Annual Surprise Examination is not required when an SLOA is in place as long as all seven provisions below are met:

- Client provides signed instruction to Custodian that includes third party’s name, address, or account number;

- Client provides written authorization to direct transfers to third party either on a specified schedule or from time-to-time;

- Client’s Custodian verifies instructions and provides notice of completed transfer to client promptly after each money movement;

- Client can terminate or change instructions;

- Firm has no authority/ability to change identity, address, or any other information about third party;

- Firm maintains records showing that third party is not a related party or located at the same address;

- Custodian sends an initial and annual notice confirming instructions.

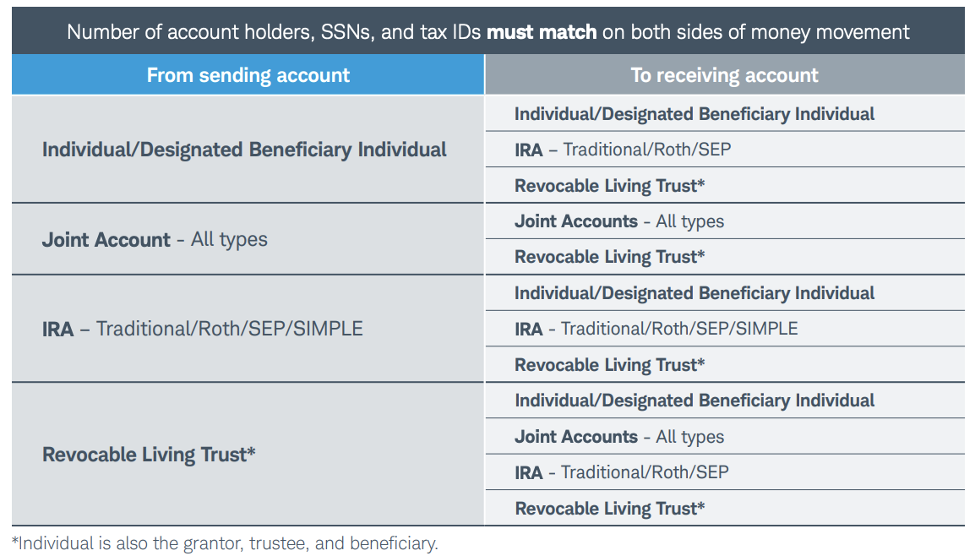

For advisors with first-party SLOAs in place, review the existing documentation on file to ensure the instructions include the destination account number and details. A first-party transfer is a transfer between accounts owned by the same individual(s) or entity(ies). A good rule of thumb is to consider whether both accounts are associated with the same taxpayer ID number(s).

For advisors with third-party SLOAs in place, document in the client’s that each third party is not a related party to the advisor and is not located at the same address. A third-party transfer is a transfer to any account that is a different registration than the original.

Each firm will need to make its own determination about whether a transfer is considered first-party or third-party. Please look to your custodian for further guidance on how they define first- and third-party transfers. For example, this is Schwab's take:

Here are some pandemic-related custody considerations, according to the SEC’s COVID-19 Risk Alert (issued in August 2020):

- Verification of client requests: The risk alert suggests that advisors consider “implementing additional steps to validate the identity of the investor and the authenticity of disbursement instructions, including whether the person is authorized to make the request and bank account names and numbers are accurate.”

- Helping sick clients without a POA

- Mail is inaccessible

- Pressure to accept login credentials

- Client meeting locations

It may be an appropriate time to perform a check of your policies and procedures as they relate to custody to determine if any pandemic-specific updates are necessary.

References & Resources:

- The Custody Rule (FINAL)

- The Custody Rule (condensed)

- SEC Custody FAQs

- SLOA No Action Letter

- FAQs regarding the SLOA No Action Letter

- SEC COVID-19 Risk Alert - August 2020

- Kitces.com article on SLOA and Custody

- ADV Glossary

- Schwab's take (and FAQs) on the No Action Letter

About the Author

About the Author

Shelby Brown joined XY Planning Network as a Compliance Consultant in May 2019. Prior to joining XYPN Shelby gained extensive experience filing initial registration applications for State- and SEC-Registered investment advisors of all sizes as well as assisting in the design and development of a compliance program that can be immediately implemented.

Shelby’s Investment Advisor Certified Compliance ProfessionalÒ (IACCPÒ) designation, earned in 2016 through National Regulatory Services (NRS), certifies that she is equipped with the knowledge and tools necessary to implement and manage a successful compliance program at any investment advisory firm.

Growing up in Lake Tahoe, Nevada has instilled a love of the outdoors in Shelby. You can find her on the golf course, at the beach, or in a campsite in the summer and snowshoeing, crafting, or soaking up a good book by the fire in the winter. Home is where the heart is, but Shelby and her husband also love to travel and take photographs to display around their home. They are always planning their next adventure!

Share this

- Fee-only advisor (381)

- Advice (305)

- Business Development (248)

- Independent Financial Advisor (203)

- Growing Your Firm (161)

- Marketing (133)

- Financial Planning (129)

- What Would Arlene Say (WWAS) (81)

- Business Coach (80)

- Firm Ownership (78)

- Training (75)

- Compliance (72)

- Business (69)

- Building Your Firm (65)

- Financial Advisors (63)

- Online Marketing (61)

- Events (59)

- Starting a Firm (52)

- Staffing & HR (49)

- Technology (49)

- From XYPN Members (48)

- Launching a firm (46)

- Advisors (41)

- Entrepreneurship (38)

- Taxes (37)

- Networking & Community (33)

- Interviews and Case Studies (32)

- Investment Management (31)

- Sales (27)

- Social Responsibility (27)

- Tax Preparation (27)

- XYPN Invest (26)

- Business Owner (25)

- Small Business Owner (20)

- Financial Management & Investment (19)

- Industry Trends & Insights (19)

- Financial Education (17)

- Financial Planners (17)

- Independent Financial Planner (17)

- Tech Stack (17)

- XYPN (17)

- Leadership & Vision (16)

- Investing (15)

- Niche (15)

- How to be a Financial Advisor (14)

- NextGen (14)

- RIA (14)

- Media (13)

- Preparing to Launch (13)

- Press Mentions (13)

- RIA Operations (12)

- RIA Owner (12)

- XYPN Membership (12)

- Assets Under Management (AUM) (11)

- First Year (11)

- Goals (11)

- Scaling (10)

- Advisor Success (9)

- Building Your Firm (8)

- Communication (8)

- Lessons (8)

- Study Group (8)

- Time Management (8)

- Virtual Advisor (8)

- Behavioral Finance (7)

- Growth (7)

- Pricing Models (7)

- From Our Advisors (6)

- Independent RIA (6)

- Money Management (6)

- Motivation (6)

- Processes (6)

- Automation (5)

- Broker-Dealers (5)

- College Planning (5)

- Filing Status (5)

- How I Did It series (5)

- Investment Planner (5)

- Mental Health (5)

- Michael Kitces (5)

- Preparing to Launch (5)

- RIA Operations (5)

- Retirement (5)

- Risk and Investing (5)

- S Corpration (5)

- Support System (5)

- TAMP (5)

- Wealth (5)

- Year-End (5)

- Client Services (4)

- Outsourcing (4)

- Selling a Firm (4)

- Succession Plans (4)

- Benchmarking Study (3)

- Budgeting (3)

- Career Changers (3)

- Engagement (3)

- Fiduciary (3)

- Getting Leads (3)

- Membership (3)

- Millennials (3)

- Monthly Retainer Model (3)

- Partnership (3)

- Pricing (3)

- Recordkeeping (3)

- Risk Assessment (3)

- Small Business (3)

- Staying Relevant (3)

- Work Life Balance (3)

- Advice-Only Planning (2)

- Bookkeeping (2)

- Charitable Donations (2)

- Client Acquisition (2)

- Differentiation (2)

- Health Care (2)

- IRA (2)

- Inflation (2)

- Productivity (2)

- Implementing (1)

Subscribe by email

You May Also Like

These Related Stories

How Financial Advisors Can Keep Compliant Amid COVID: 5 Tips

Executing Firm-Wide Risk Assessments and Annual Reviews of Your Compliance Program