The Value of YOU: How to Calculate the Value of Your Time as an Advisor

Share this

When someone finds out you’re in the “money business,” one question inevitably arises: “So what’s a good investment these days?”

My answer is always the same: TIME.

And after a bit of brief banter, they hint at it again. “No really, what’s a good investment?”

My answer to that question is, “That’s exactly the point. If you had more time, you’d research that yourself”.

But people don’t have much time anymore. Not me. Not you. Not your clients. That’s why they’re coming to you. They’d rather spend their time doing something else.

So how do we value the time that we have? And based on how we value our time, what should we be doing with it?

Most of us have seen the studies and calculations of, “If my time is worth $X, anything below that dollar amount should/could be delegated.” But before we can get to that number, we have to understand the various ways to think about it.

And we have to get to a point on a very deep and personal level that we believe our time is actually worth that amount.

So, want to know what your time is worth?

Go Fish!

There’s a cool scene in the movie Catch Me If You Can that perfectly illustrates the value of someone’s time. You can watch it here, but to summarize, Leonardo DiCaprio’s character is in a hotel and sees the familiar face of a model, played by Jennifer Garner.

After exchanging some pleasantries about his car and then asking her for her autograph things take a bit of a racy turn. They enter his room to look for a pen and she notices a deck of cards. She says, “A man like you can buy anything he wants, and he buys a deck of cards in the hotel gift shop.”

Now, this is where things get interesting. Jennifer Garner’s character asks Leo, “If they sold me downstairs at the hotel gift shop, how much would you pay?”

I said it would get racy. After some nerves and lack of confidence, Leo throws out a number and replies, ”$200?” very sheepishly.

His initial proposal is met with a distinct and confident, “Go Fish.”

They go back and forth with Garner saying “Go Fish” three times. Finally, Leo says, “A thousand dollars.”

Jennifer Garner’s character knew the value of her time.

Pro-Tip: Always remember “Go Fish.”

Time is Tough to Measure

Telling time is easy. Measuring time, however, is tough. It’s something even the iWatch, in all its glory, can’t do.

That’s because it’s different for everyone and we have different ways of measuring our time, at different times. If that just got too meta for you, let me explain further.

As a professional, there are a few ways to value OUR time:

- Your actual hourly rate

- Your professional rate

- Your aspirational rate

Note that “your value rate” is not one of these. This is one that people love to debate. The question becomes, “What would you pay to create/save $100, $1,000, $50,000?”

Let’s assume you can provide some killer value to your clients that is tough to measure and that changes for each client. But it’s closer to priceless than you think.

Actual Hourly Rate

This is simply the amount of gross revenue (or salary) divided by your time. Let’s say you’re earning $75,000 a year and working 50 hours a week. Take $75k, divide that by the number of weeks you work per year, and that’s your hourly rate, in a very traditional sense.

Good to know, but unless you are exactly where you want to be for the rest of your life, not all that helpful.

Pro-Tip: Consider the Rule of 1920. People don’t work 52 weeks a year. They work 48. Two weeks of vacation, two dead weeks with holidays and various other aspects.

Professional Rate

As a professional, what is the value of your time? I’m not suggesting you do hourly planning. I’m suggesting that as professionals, our time is worth a “professional rate.”

What’s yours? Do you have it?

Now…

What’s your professional rate again? Repeat it in your head.

Now, add at least 25% to it. Maybe even 50%. That’s your new professional rate.

Now we’re getting somewhere.

Aspirational Rate

This is where things start to get interesting. What are your goals for your business? What is it going to take to get you there? This doesn’t have to mean just revenue. You may have a goal of working 20 hours a week. Maybe it’s taking summers off. There are all sorts of ways to think about your aspirational rate.

For me, when I was getting started it was $1million. Don’t ask why, but it was my number and seemed like a good idea at the time. If my firm could make $1million a year, for whatever reason, I thought I was doing something right. It started out like this:

$1,000,000 / (52 weeks a year * 40 hours a week) = $481

Basic math. But as time moved on, I didn’t want to work 52 weeks a year. I wanted to take 4 weeks of vacation. So, I’m down to 48 weeks. And then I learned over time that no matter how many times I may try to work the week of Christmas or Thanksgiving or the week of March Madness or The Masters (whaaaat?!), I don’t actually do much work those weeks. Plus, there’s always dead time when working with clients, so I accounted for two weeks there. At this point, I was down to 46 weeks. Time to update my math.

$1,000,000 / (46 weeks a year * 40 hours a week) = $543

This is my number. I’ve kept it for a couple of reasons. One, I believe I’m worth a million bucks of value to whomever I am working with. Two, I absolutely LOVE the symmetry and marketability of 5-4-3.

It’s easy for me to step back, take a page out of Mel Robbins’ “5 Second Rule” and remember, if the task I am doing is not worth $543, I should not be doing this. I can literally count backwards from 5, 4, 3, 2, 1 and make a decision.

So, that’s my number but that’s not important because it’s not your number.

So get your number and let’s keep moving.

But…What Am I Actually Good At?

You’re building a business. You don’t have enough time. Or at least you think you don’t.

Unfortunately, advisors often spend their time on the wrong stuff. So many of us are focused around processes (which are important), your financial planning software (which is important), your integrations and zaps and accounting and portfolios and all sorts of number of other THINGS (which are all important).

The problem is none of those matter if you don’t have clients to put through the processes and plans and portfolios. It’s a scary thing to go get clients. It’s easy to bury yourself in work that is important but not impactful.

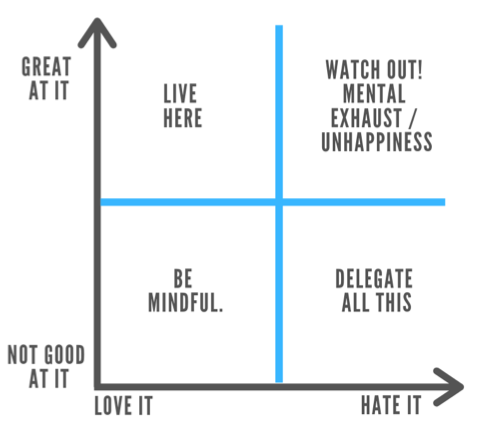

To help combat this idea, check out the “genius chart” below that is a paraphrase of something from JD Bruce of Abacus Wealth Partners. It’s a good reminder of how to think through the value of time, but probably more importantly your overall sanity as a business owner.

The other cool thing about this chart is that it’s easy to simply substitute in “Impact” or whatever else you are trying to measure. Do this a couple of times a year dropping in various tasks, roles, and activities for your firm. It will make tough decisions easier.

Credit: JD Bruce, Abacus Wealth Partners

Opportunity Costs and The Trade-Off Discussion

Just as you do with your clients, you should be having the same discussion with yourself and your firm. I know what my time is worth. I know what I’m good at, what I’m not, and where I can have impact in the lives of my clients and my business.

Now comes the hard part. You have the information, but it’s still tough to make that call to make the big change for big impact.

Ask yourself what is the alternative activity I will engage if not doing this? Will I do it? Could I find a more productive solution? If I continue to do this, how much space will it continue to occupy in my mind? If I wasn’t do this, would I be happier, would it allow me to spend more time with those I care about? Don’t discount the mind space equation!

We also tend to forget the opportunity cost we miss when doing something we could otherwise delegate. All that time you’re spending in your spreadsheets, on your books, or rebalancing your portfolios could otherwise be spent with clients or doing other things in your life. Whether it’s growing your firm or creating a more ideal lifestyle for yourself, know the trade-off and know the opportunity cost.

An Example

Let’s assume you are spending four hours a week on an activity you’re “good at” but that doesn’t exactly fall into the “love it” category. Let’s call it investment management (see, not even the author can be objective). At a professional rate of a mere $150/hour for 48 weeks (using the rule of 1920), that’s approximately 192 hours and $28,800 annually.

Think you could do something with almost 200 hours and $30K?

Objectivity Lost

There are two things you need to remember and ingrain in your memory.

First and foremost, as a CFP® (or soon to be!), you are a professional. You execute professional services and, in most cases, the value you provide far outweighs the cost of your services. You make significant, positive impact in the lives of your clients.

Secondly, you’re a fiduciary. And as a fiduciary, you know the value of objectivity.

Unfortunately, it’s really tough to be objective about your own firm. It just is! You have confidence and doubts at the same time, you know and trust what you are doing is right, but until you can be totally objective, you may want someone looking over your shoulder a bit.

Perhaps you want someone who’s been there before. Paved roads weren’t always that way. Someone who came before you cleared the path and paved that road.

There are a ton of resources that come along with XYPN membership, from our forums and the various services we offer, such as coaching, marketing, and investment management. We even have an Advisor Success Team whose singular goal is to help our advisors succeed!

We are here to help provide an objective voice and foster your success, whatever that means to you.

About the Author

A creative innovator and collaborator, Brandon Moss has had a front-row seat to the digital advice revolution, helping build one of the most innovative national RIAs on the planet. He’s acquired a 360* view of the RIA landscape, from being an advisor and running his own firm to designing and integrating some of the most innovative tools in the industry. He has lead, trained, coached, onboarded, integrated, transitioned, (you name it) over 100 RIA firms/wealth management teams. Additionally, he's evaluated, prospected, pitched (again...you name it) countless other firms. Consequently, he's an exceptional listener and comfortable in many different conversations! Occasionally, he's asked to opine on varying topics, typically Gen X+Y, innovation, client experience and technology. Beyond those topics, he's typically “winging it”. Brandon graduated from Texas Tech University's globally recognized personal financial planning program, then made it through some Executive Education at UC Berkeley's Haas School of Business. He’s also perpetually in online classes trying to figure out something new. Brandon resides in the Dallas/Ft. Worth area with his wife, Shelby, and his identical, mirror-image twin boys, Will and Reese. When he's not with them, he's probably in his garage tinkering, building, or buying way too much golf equipment.

Brandon is the Director of XY Investment Solutions (XYIS), XY Planning Network’s digital hybrid investment platform. It’s a turnkey asset management platform (TAMP) designed and curated to the specific needs of XYPN members.

This information is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, XY Investment Solutions, LLC (referred to as "XYIS") disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement and suitability for a particular purpose. XYIS does not warrant that the information will be free from error. None of the information provided is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall XYIS be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if XYIS or an XYIS authorized representative has been advised of the possibility of such damages. In no event shall XY Investment Solutions, LLC have any liability to you for damages, losses and causes of action for this information. This information should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.

Share this

- Advisor Posts (433)

- Fee-only advisor (388)

- Advice (316)

- Business Development (245)

- Independent Financial Advisor (204)

- Growing Your Firm (160)

- Marketing (132)

- Financial Planning (104)

- What Would Arlene Say (WWAS) (81)

- Firm Ownership (78)

- Business Coach (77)

- Training (76)

- Compliance (71)

- Business (69)

- Building Your Firm (68)

- Financial Advisors (65)

- Online Marketing (61)

- Events (60)

- Starting a Firm (50)

- From XYPN Members (48)

- Technology (48)

- Launching a firm (45)

- Advisors (42)

- Entrepreneurship (39)

- Taxes (39)

- Staffing & HR (38)

- Networking & Community (33)

- Interviews and Case Studies (32)

- Investment Management (32)

- XYPN Invest (28)

- Tax Preparation (27)

- Business Owner (25)

- Social Responsibility (25)

- Sales (24)

- Small Business Owner (20)

- Industry Trends & Insights (19)

- From XYPN Invest (18)

- Financial Planners (17)

- Independent Financial Planner (17)

- XYPN (17)

- Leadership & Vision (16)

- XYPN News (16)

- Tech Stack (15)

- How to be a Financial Advisor (14)

- RIA (14)

- Investing (13)

- Media (13)

- NextGen (13)

- Press Mentions (13)

- Financial Education (12)

- Goals (12)

- RIA Owner (12)

- XYPN Membership (12)

- Assets Under Management (AUM) (11)

- First Year (11)

- Niche (11)

- SEC (10)

- Advisor Success (9)

- RIA Registration (9)

- Communication (8)

- Lessons (8)

- Study Group (8)

- Time Management (8)

- Virtual Advisor (8)

- Growth (7)

- Mental Health (7)

- Pricing Models (7)

- From Our Advisors (6)

- Independent RIA (6)

- Money Management (6)

- Motivation (6)

- Preparing to Launch (6)

- Processes (6)

- Risk and Investing (6)

- Automation (5)

- Behavioral Finance (5)

- Broker-Dealers (5)

- College Planning (5)

- Filing Status (5)

- How I Did It series (5)

- Investment Planner (5)

- Michael Kitces (5)

- Preparing to Launch (5)

- Retirement (5)

- S Corpration (5)

- Scaling (5)

- Support System (5)

- TAMP (5)

- Wealth (5)

- Year-End (5)

- Bear Market (4)

- CFP Certification (4)

- Outsourcing (4)

- Selling a Firm (4)

- Small Business (4)

- State Registration (4)

- Succession Plans (4)

- Benchmarking Study (3)

- Bookkeeping (3)

- Budgeting (3)

- ESG Investing (3)

- Emotional Decisions (3)

- Engagement (3)

- Fiduciary (3)

- Financial Life Planning (3)

- Getting Leads (3)

- IRA (3)

- Life planning (3)

- Lifestyle practice (3)

- Membership (3)

- Millennials (3)

- Monthly Retainer Model (3)

- Monthly Subscription Model (3)

- Partnership (3)

- Pricing (3)

- RIA Audit (3)

- Recordkeeping (3)

- Risk Assessment (3)

- Staying Relevant (3)

- Wellness (3)

- Work Life Balance (3)

- Advice-Only Planning (2)

- Building Your Firm (2)

- Career Changers (2)

- Charitable Donations (2)

- Community Property (2)

- Design (2)

- Differentiation (2)

- Exchange-Traded Funds (ETF) (2)

- FINRA (2)

- Finding Your Why (2)

- Graphic design (2)

- Growing Income (2)

- Health Care (2)

- Inflation (2)

- Key performance indicator (KPI) (2)

- Keynote (2)

- Negative Rates (2)

- Operations (2)

- Organization (2)

- Outsourced Asset Management (2)

- Outsourced Bookkeeping (2)

- Portfolio Management (2)

- Productivity (2)

- Psychology (2)

- Quickbooks (2)

- Recommended Reading (2)

- Recruiting (2)

- Registered Representative (2)

- Registration (2)

- Restricted Stock Units (RSU) (2)

- Start Ups (2)

- Stock Options (2)

- Team Communication (2)

- Virtual Assistant (2)

- Virtual Paraplanner (2)

- Accounting (1)

- Arlene Moss (1)

- Assistant (1)

- Bonds (1)

- Bull Market (1)

- Careers (1)

- Certified Public Accountant (CPA) (1)

- Childcare (1)

- Client Acquisition (1)

- Client Services (1)

- Common Financial Mistakes (1)

- Consulting (1)

- Consumerism (1)

- Credit (1)

- Custodians (1)

- Custody Rule (1)

- Data (1)

- Daycare (1)

- Definitions (1)

- Designations (1)

- Direct Indexing (1)

- Disasters (1)

- Earn More (1)

- Family (1)

- Fidelity (1)

- Finance (1)

- Financial Freedom (1)

- Financial Goals (1)

- Financial Life Management (1)

- Financial Success (1)

- Financial Wellness (1)

- Form 8606 (1)

- Form 8915-E (1)

- Grief (1)

- Guide (1)

- How to Budget (1)

- Impostor Syndrome (1)

- Interns (1)

- Investor Policy Statement (IPS) (1)

- Job burnout (1)

- Liquidating your business (1)

- Loans (1)

- Moving Forward (1)

- Part Time (1)

- Paying Yourself (1)

- Paystub (1)

- Perfectionism (1)

- Project Management (1)

- Projecting Returns (1)

- Purpose (1)

- Quarterly Estimated Payments (1)

- RIA Operations (1)

- Recession (1)

- Referrals (1)

- Regulations (1)

- Regulators (1)

- Reinvention (1)

- Relationships (1)

- Remote (1)

- Required Minimum Distributions (RMD) (1)

- Risk Management (1)

- Roth Conversations (1)

- Roth IRA (1)

- Sabbatical (1)

- Spending (1)

- Strategy (1)

- Systems (1)

- Target Audience (1)

- Teamwork (1)

- Terms (1)

- To-Do List (1)

- Traditional IRA (1)

- Transitions (1)

- Virtual (1)

- Vulnerability (1)

- XYPN Books (1)

Subscribe by email

You May Also Like

These Related Stories

How to Create Personalized Investment Strategies Using Model Sleeves

Your Fiduciary Moment of Truth: Are You a Fake Fiduciary?