The Changing College Planning Paradigm: Implications and Opportunities for Financial Advisors

Share this

Let’s start with some brutal truths about college costs and their impact on families:

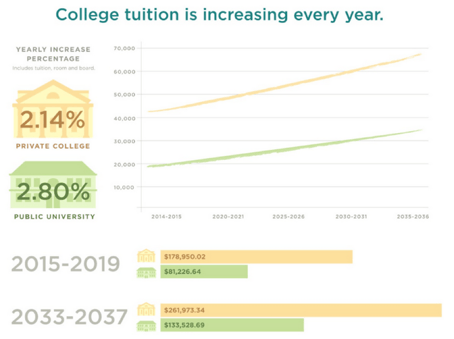

Number 1 - College costs are absurdly high and the projections aren’t encouraging

*Source: Chart created by NerdWallet using data provided by The College Board.

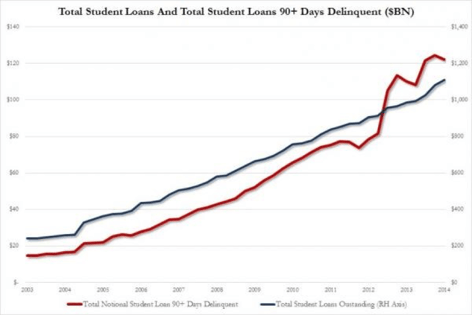

Number 2 – The impact on families is seen in the gigantic amount of student loan debt incurred

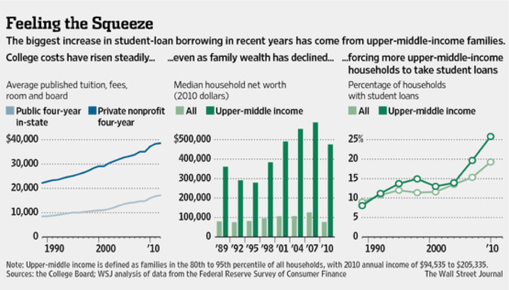

Number 3 - Upper-middle-income families are the ones suffering the most:

Consider these additional facts:

- Over 300 private colleges and public universities have a cost of attendance (COA) in excess of $50,000 a year*

- Less than 60% of freshmen graduate in six years or less (Source: Dept of Education 2014)

- These facts are for ONE child only.

*Source: College Board 2015 data analyzed by Collegiate Funding Solutions, Inc. Includes tuition, fees, room and board. Includes private and out-of-state public

In light of these brutal truths: the cost of college, the significant amounts of resources required to cover them, the inability for most families to save amounts necessary (confirmed by the increase in debt financing) and the effect on upper-middle-income families has changed the dynamic of college planning and its impact on retirement savings. According to a recent Sallie Mae report, here’s how parents attempt to balance paying for college and funding retirement: 50% are focused on college savings, while 60% are focused on retirement. With this overlap, 74% of parents said they’ll use retirement savings to pay college costs.

Parents want to provide for their children’s college education. To many parents, it is a deeply emotional need, which means that when the time comes and it’s a question of saving for retirement or helping pay college costs, the more emotional and urgent need of college funding supersedes retirement savings decisions. They want happy, successful children, but they're feeling the squeeze of paying for college while keeping retirement planning on track.

Unlike in the past, a singular focus on savings strategies doesn’t meet all the needs of families and doesn’t acknowledge or address the possibilities that exist for the client to reduce their total out-of-pocket college costs.

The rapid change in the college cost and funding landscape over the last 20 years has necessitated a new college planning paradigm for financial advisors. Today, consumers want and need more than just college savings strategies from their advisor. They want their advisor to help them identify ways to reduce their out-of-pocket college costs... without compromising their retirement savings goals.

Advisors today who have the specialized capability to provide college savings plans AND college cost reduction strategies have a tremendous opportunity. They are positioned to differentiate themselves from other advisors, deepen the client relationship, generate more revenue and identify other opportunities with the client.

Beyond these, many advisors have a vested interest (personal strake) in helping clients avoid transferring tens and possibly hundreds of thousands of dollars of assets under management to cover college costs.

How To Help

Here are three of the most effective and practical ways for a mass-affluent family to reduce their college costs and how you – the fee-only advisor -can play a valuable role in the process:

- Pick the right schools! – The current average six-year graduation rate is only about 50%! This sad fact is due, in large part, to students not selecting the best college fit for them. How can you help? Affiliate with a reputable college admissions specialist in your area and refer your clients. You have a vested interest in developing this sort of collaboration in your locale. By helping your client avoid transferring tens and possibly hundreds of thousands of dollars of assets under management to cover additional college costs (due to transfers, change of major, etc.) you’ll be helping them and yourself! Visit this website to find a reputable college admissions specialist in your area that might be a good candidate for collaboration.

- Apply for financial aid – Probably the single biggest mistake a family can make that INCREASES the cost of college is NOT to apply for financial aid. Even if your client doesn't think they'll qualify for need-based financial aid, here are three reasons why they MUST apply:

- Clients making $150,000+ often qualify for need-based financial aid, which would significantly reduce out-of-pocket college costs. Factors such as cost of attendance, number of children in college at the same time, opportunities to increase aid eligibility via college financial planning, etc., are all factors that can yield significant need-based financial aid.

- More and more merit-based scholarships favor affluent applicants that have submitted financial aid forms. Many of your mass-affluent clients have high achieving students that are candidates for merit-based scholarships. It would be unfortunate if your client’s children missed out on FREE money for college just because they didn’t submit the financial aid forms! Another reason why your clients MUST send in financial aid forms-no matter what their income level-is that students who come from good financial backgrounds are more attractive to schools in a variety of ways, including ability to pay, opportunity for a future donor, etc.

- The federal student loan programs (Plus and Stafford) require the completion of financial aid forms. Student loans are not necessarily a bad thing. In fact, the strategic use of student loans can be instrumental in helping a family REDUCE the cost of college. Low interest rates (Stafford), simple interest, deferral of payback, student loan interest deduction and refi/consolidation opportunities are all factors that help to make student loans an important component of a well-conceived college funding plan. Among other things, the strategic use of loans allows assets under management to continue to grow, intact – through the college years and possibly beyond.

- Merit-based Scholarships – The very best places to get “free money” for a student’s tuition and room and board is not the federal government, not the local YMCA’s yearly scholarship fund, and certainly not the high school’s guidance department. Only about 4% of scholarships given out every year come from private sources. The number one source for "free money" is colleges and universities themselves! In light of this FACT, here are two things your clients NEED to know about merit-based scholarships:

- Scholarships are NOT JUST for top students. Scholarships are used for “enrollment management.” The goal for a school is to fill seats (they’re a business!). Schools hire consultants to help them figure out how to fill the seats and maximize revenue. One way they accomplish this is to give a “tuition discount” in the form of a “scholarship.” For instance, a private school might give a student $10,000 in order to get another $30,000 from a family that can pay. How do they know they can pay? Because your client FILLED OUT THE FINANCIAL AID FORMS (#2 above)! Many colleges discount tuition for affluent families to attract these families, and they do it via scholarships – often for B and C students!

- A modest increase in test scores can open up additional scholarship opportunities. The key here is to KNOW in advance what the requirements are at a school of interest so that a prudent decision concerning the cost/benefit of test prep can be made by the family.

You don’t have to be an expert in college planning to offer practical suggestions to clients with college-bound children. A little knowledge, shared with your clients, can go a long way when it comes to helping them be informed buyers of a college education. When it comes down to it, there are two very different prices for a college education: the one informed buyers pay and the one uniformed buyers pay. Which price will your clients pay?

About the Author

About the Author

Roger Lorelle is President of Collegiate Funding Solutions (CFS), an XYPN discount partner. CFS equips XYPN members to help clients save ON, and not just for, college costs. CFS’ college-planning software, support, education and marketing material enable fee-only advisors to deliver the college-planning value Gen X parents need today and grow their business and revenue in the process.

Share this

- Advisor Blog (699)

- Financial Advisors (223)

- Growing an RIA (121)

- Digital Marketing (88)

- Marketing (85)

- Community (81)

- Business Development (79)

- Start an RIA (76)

- Coaching (72)

- Running an RIA (71)

- Compliance (69)

- Client Acquisition (65)

- Technology (65)

- Entrepreneurship (61)

- XYPN LIVE (60)

- Sales (49)

- Practice Management (44)

- Client Engagement (41)

- Bookkeeping (40)

- Investment Management (40)

- Fee-only advisor (38)

- XYPN Books (38)

- Scaling an RIA (34)

- Employee Engagement (31)

- Lifestyle, Family, & Personal Finance (31)

- Financial Education & Resources (27)

- Client Services (26)

- Journey Makers (22)

- Market Trends (21)

- Process (14)

- Niche (11)

- SEO (9)

- Career Change (8)

- Partnership (7)

- Transitioning Your Business (7)

- Sapphire (4)

- Transitioning To Fee-Only (4)

- Social Media (3)

- Transitioning Clients (3)

- Emerald (2)

- Persona (2)

- RIA (2)

- Onboarding (1)

Subscribe by email

You May Also Like

These Related Stories

Part III: The Changing College Planning Paradigm: Implications and Opportunities for Financial Advisors

Jul 3, 2017

3 min read

Part II: The Changing College Planning Paradigm: Implications and Opportunities for Financial Advisors

Jun 12, 2017

4 min read