How to Get the Most Out of Your Investor Policy Statement (IPS)

Share this

You’ve finished reading all about the financial planning process and now that you feel confident in building financial plans with clients, you’re ready to take that further step into building the Investor Policy Statement (IPS), right?

For those financial advisors who offer investment management as a complement to their financial planning services, the IPS is a powerhouse tool that can deliver operational efficiencies and positive client experiences. When written well, the IPS is so much more than an insurance policy to protect advisors against client complaints.

In this blog, I offer a comprehensive review of the building blocks of an IPS, and share the many ways in which an effective IPS can benefit you and your clients.

What’s So Great About the IPS?

Providing investment management services to clients is not a straightforward path. Numerous factors need to be considered in developing, implementing, and monitoring an investment strategy; the IPS simplifies this task by providing a repeatable process financial advisors can use to make investment decisions. This makes discipline achievable, which is necessary for managing the emotions that surface throughout the investment management journey.

The IPS is a touchstone for the advisor and client in times of market uncertainty that inevitably show up along this journey. These are the times when investors are more likely to seek safety and try to time a market exit, which could prove detrimental to achieving their financial goals. Many advisors worry about their ability to guide clients through these turbulent times. They often think being prepared means spending hours reading research reports so they have a “good story”. This doesn’t have to be the case if the advisor has prepared an effective IPS with the client as that will have the answers for how to respond.

Let’s see how the IPS provides these answers by reviewing the building blocks.

What Are the Building Blocks of an IPS?

To briefly summarize, here are the main sections of an IPS:

- Introduction

- Financial Objectives

- Asset Allocation

- Implementation and Monitoring

- Signatures

The first step of creating an IPS for your client is the Introduction. This is where you set the stage for this financial journey. Who are the key players and what are their motivations? Where are they going and when do they want to be there?

If you’ve already created a financial plan, you’ll likely have the answers to all of these questions documented, but it’s worthwhile to restate in the IPS to ensure all of your financial tools are working together towards consistent goals.

Additionally, including the following information provides further clarification about what this IPS is governing and how it’s governing:

- Which assets are to be guided by this IPS: 401(k) plans, taxable accounts, non-taxable accounts, 529 plans

- The responsibilities of the financial advisor and client

- The main tenets of the client’s investment philosophy

With respect to describing the investment philosophy here, resist the urge to be too specific at this point or jump to the asset allocation. Focus on big picture items like views on diversification, passive versus active, and values considerations.

Now you’re ready to move on to delineating the Financial Objectives. This is the part where you translate the client’s goal, such as retiring at age 60 into the quantitative factors that will help them achieve it.

We start with the return objective. This boils down to a percentage point or a range of percentages, and is often the center of attention in any investment performance conversation with a client. In other words, it’s the focus of the “how am I doing” question. But how do advisors arrive at this figure and how should it be described in the IPS? While a discussion on the methodologies for calculating return objectives is beyond the scope of this blog, here are some of the considered factors:

- What is the nature of the cash flows the governed assets are supporting? Is it for a one-time payment, ongoing spending needs?

- What is the expected inflation rate for the governed time period?

- What are the expected fees and tax implications?

Because you can’t have return without risk, this objective needs to be addressed in conjunction with return. What often impedes this discussion is that clients and advisors alike, tend to be more focused on the financial goals and the return objectives needed to make those goals happen. In these scenarios, risk objectives can quickly become an afterthought or clients may engage in rationalizing behavior to make the risk objective fit their return objectives.

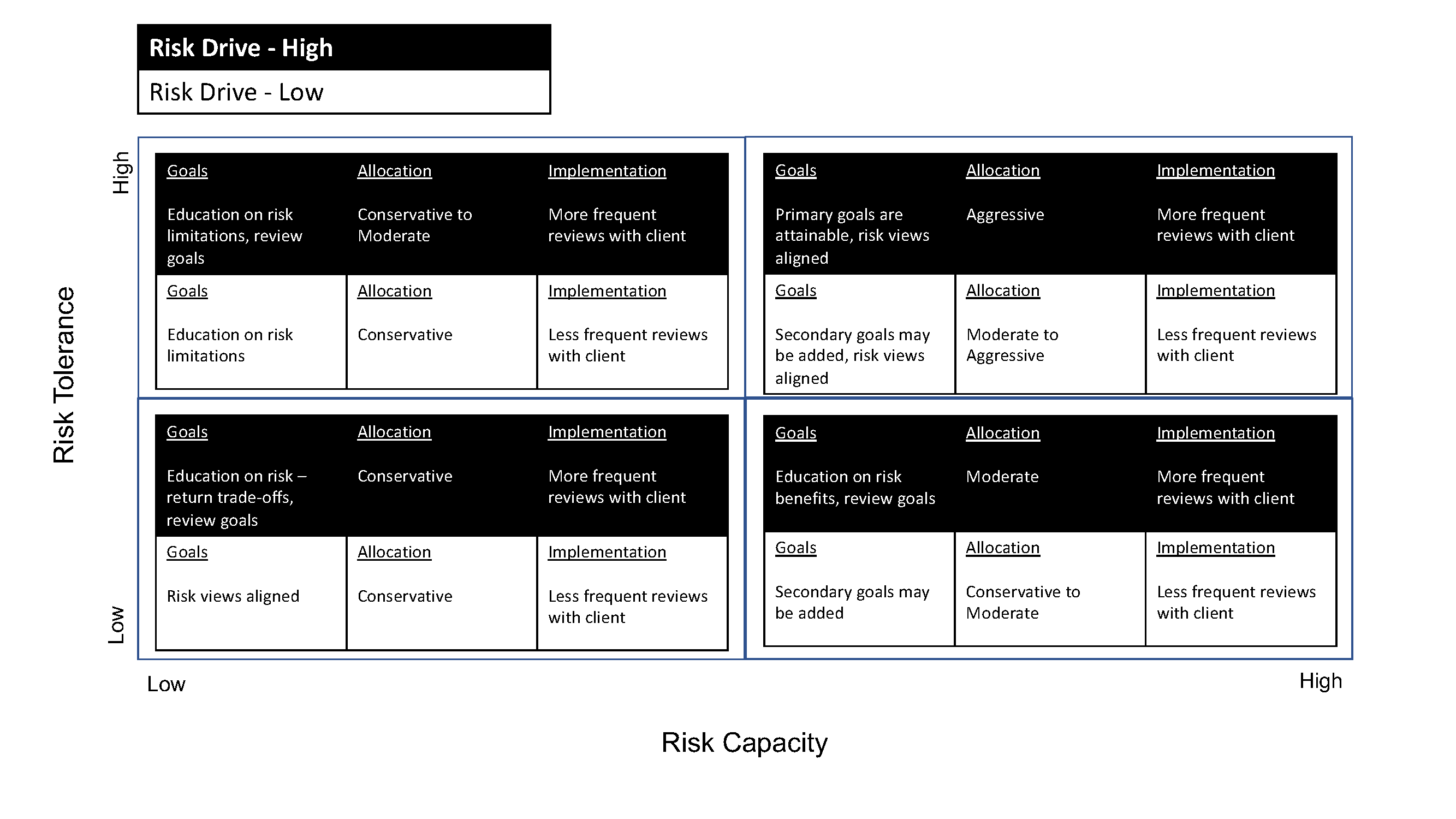

To avoid these scenarios, proper pause is needed when determining the risk objectives. This is the point where you may need to go back a couple of steps before you can progress forward. To understand why you may need to iterate at this step, let’s break down the risk objective into three dimensions:

- Risk Tolerance

- Risk Capacity

- Risk Drive

Risk Tolerance asks the question: does the client understand and want to take risk? This is the most common dimension advisors and clients focus on. The assessment and communication of which have been made easier and more efficient through the use of risk tolerance softwares like FinaMetrica and Tolerisk. This makes it very tempting to rely on risk tolerance as the sole input for your risk objective, but relying on this dimension alone is not advisable.

The challenge with risk tolerance is its subjective nature due to a reliance on emotions. Risk tolerance can change depending on situational influences such as market volatility or perception on general economic health. Think of the clients that are very eager to take on risk in periods of low volatility while the market is heading upwards but call immediately when they see a doubtful news headline and think it’s time to get out of the market. Their perceived high risk tolerance in good times could put them at odds with staying invested over the long term and jeopardize their financial goals. So advisors need to dig further.

Risk Capacity asks the question: can the client take on risk? While risk tolerance is more subjective, risk capacity is more objective and static. It considers what the client’s time horizon is, what amount of resources they’re starting with and what is their expected earning potential. Adding in risk capacity gives a two-dimensional view that can help target the right allocation, but advisors can dig even further to determine whether they can move forward to asset allocation or need to revisit the financial goals.

Risk Drive asks the question: how much risk does the client need to reach their stated goals? This is the last dimension needed to complete a client’s risk picture and inform not only the asset allocation decision, but what the advisor needs to communicate to the client.

The results of this comprehensive risk analysis and guidance on how to proceed within the IPS can be visualized in the following chart:

Let’s review some hypothetical clients from this chart.

Client A has high risk tolerance, high risk capacity and low risk drive. If we stop at high risk tolerance and risk capacity, we end up with an aggressive portfolio. But if we pause to consider the low risk drive, we uncover greater flexibility in the ability to take on a portfolio with lower risk or advising the client that they could achieve additional goals. This may also mean that this client needs less frequent reviews and adjustments.

Client B has high risk tolerance, low risk capacity and high risk drive. We see in this case that using risk tolerance alone could lead to a mismatched portfolio allocation. Given the conflicting risk dimensions, this client may be better served with a moderate to conservative portfolio and will need more education on the limitations of risk. Because there is a high risk drive and low risk capacity, it may also be necessary to revisit the client’s goals. Perhaps the client needs to work longer to extend their time horizon, thus increasing risk capacity to meet the current goals. Or perhaps, their current goals need to be reduced.

It’s by looking at risk through these three dimensions that advisors can have deeper discussions with clients and create an IPS with risk and return objectives that set them up for success.

As far as Financial Objectives go, the heavy lifting is over and you’re almost ready to move on to describing the Asset Allocation. Constraints are listed in this section to help further steer the direction of the client’s investment portfolio. This list can help guide decisions such as securities to avoid, when to raise cash, how frequently the portfolio should be rebalanced.

- Time Horizon. Though this factor has already been accounted for in determining return objectives, it should also be explicitly stated in the IPS. If the IPS is managing multiple goals for multiple people, any differences in time horizon for each goal or each person should be described in this section.

- Liquidity. In a similar context to time horizon, liquidity constraints should be explicitly stated as they relate to short and medium term cash needs of the client.

- Legal & Regulatory. Identifying any jurisdictional restrictions on investment practices can help manage portfolio through times of regulatory uncertainty.

- Tax Considerations. The intersection of tax planning and investment management is an important concept for advisors to address to better estimate how a client is proceeding towards their goals.

- Security Specific. Qualitative factors are becoming just as important to investors as quantitative factors and these types of constraints are broadly referred to as values-based investing. Clients may specify that they take a positive screening approach and pursue an ESG (Environmental, Social, Governance) investment strategy or a Christian faith-based investing strategy. Alternatively, they can take a negative screening approach and specify that they not invest in tobacco-related stocks.

Defining and assessing Financial Objectives is a laborious process that should not be rushed through. By being thorough in this stage, advisors can lay a strong investment foundation that decreases the amount of uncertainty in decision making down the line.

And now you can finally proceed to the Asset Allocation section of the IPS! With the financial objectives sorted, you’re ready to begin constructing the investment portfolio at the asset class level.

Start with defining the permissible asset classes along with their expected returns and benchmarks. The answers to what’s permissible are guided by all of the groundwork covered in the Financial Objectives section. Caution is warranted in regards to the word, “permissible”. While it’s not advisable to list every possible asset class as permissible to protect yourself legally, you’ll want to ensure that you’re not so limited in making investment decisions that you create inefficiencies or missed opportunities when setting investment strategy at the firm level.

Once you have the permissible asset classes and their expected returns, you need to determine what will be their target ranges and what are the thresholds for percentage drift. This is set keeping in mind the client’s financial objectives and your firm’s capacity to implement. If the client’s IPS calls for quarterly rebalancing do you have the capacity to make that assertion in this IPS?

If you’re following the investment management process, the next step is security selection where you begin to fill the asset classes with specific securities such as mutual funds, ETFs, stocks or bonds. This level of detail is not necessary for the IPS though you may want to specify your use of tactical asset allocation (versus strategic asset allocation) which guides your decisions to make shorter term changes to those securities.

With Asset Allocation sorted, the procedures and policies for Implementation and Monitoring the investment strategy are stated next. Implementation covers what types of trades are permissible. For instance, a stop-loss trading policy could be enforced as a risk management tool. Responsibilities for proxy-voting can be assigned to the financial advisor or the client. A cadence for rebalancing the portfolio and reviewing with the client is usually set here as well.

And finally, assumption for the financial advisor and client’s responsibilities in carrying out the strategy in this IPS are sealed with Signatures.

What’s Next?

While you can’t predict the markets for your clients, you can provide some peace of mind through a sound approach for how to respond when the markets do the unexpected. That’s delivering real value you can’t get from a robo-advisor.

Let us know how we can help you implement an IPS with your clients.

About the Author

About the Author

As the Managing Director of XY Investment Solutions (XYIS), Lisa leads the charge in communicating and continuously improving upon the value of XYIS’s services to XYPN members. She has a diverse background spanning over a decade in the financial services industry. Prior to joining XYIS, Lisa served as operations and technology leader for Clearnomics, a SaaS company for financial advisors, and for Fragasso Financial Advisors in Pittsburgh, PA.

This information is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, XY Investment Solutions, LLC (referred to as "XYIS") disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement and suitability for a particular purpose. XYIS does not warrant that the information will be free from error. None of the information provided is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall XYIS be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if XYIS or an XYIS authorized representative has been advised of the possibility of such damages. In no event shall XY Investment Solutions, LLC have any liability to you for damages, losses and causes of action for this information. This information should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.

Share this

- Fee-only advisor (381)

- Advice (305)

- Business Development (248)

- Independent Financial Advisor (203)

- Growing Your Firm (161)

- Marketing (133)

- Financial Planning (129)

- What Would Arlene Say (WWAS) (81)

- Business Coach (80)

- Firm Ownership (78)

- Training (75)

- Compliance (72)

- Business (69)

- Building Your Firm (65)

- Financial Advisors (63)

- Online Marketing (61)

- Events (59)

- Starting a Firm (52)

- Staffing & HR (49)

- Technology (49)

- From XYPN Members (48)

- Launching a firm (46)

- Advisors (41)

- Entrepreneurship (38)

- Taxes (37)

- Networking & Community (33)

- Interviews and Case Studies (32)

- Investment Management (31)

- Sales (27)

- Social Responsibility (27)

- Tax Preparation (27)

- XYPN Invest (26)

- Business Owner (25)

- Small Business Owner (20)

- Financial Management & Investment (19)

- Industry Trends & Insights (19)

- Financial Education (17)

- Financial Planners (17)

- Independent Financial Planner (17)

- Tech Stack (17)

- XYPN (17)

- Leadership & Vision (16)

- Investing (15)

- Niche (15)

- How to be a Financial Advisor (14)

- NextGen (14)

- RIA (14)

- Media (13)

- Preparing to Launch (13)

- Press Mentions (13)

- RIA Operations (12)

- RIA Owner (12)

- XYPN Membership (12)

- Assets Under Management (AUM) (11)

- First Year (11)

- Goals (11)

- Scaling (10)

- Advisor Success (9)

- Building Your Firm (8)

- Communication (8)

- Lessons (8)

- Study Group (8)

- Time Management (8)

- Virtual Advisor (8)

- Behavioral Finance (7)

- Growth (7)

- Pricing Models (7)

- From Our Advisors (6)

- Independent RIA (6)

- Money Management (6)

- Motivation (6)

- Processes (6)

- Automation (5)

- Broker-Dealers (5)

- College Planning (5)

- Filing Status (5)

- How I Did It series (5)

- Investment Planner (5)

- Mental Health (5)

- Michael Kitces (5)

- Preparing to Launch (5)

- RIA Operations (5)

- Retirement (5)

- Risk and Investing (5)

- S Corpration (5)

- Support System (5)

- TAMP (5)

- Wealth (5)

- Year-End (5)

- Client Services (4)

- Outsourcing (4)

- Selling a Firm (4)

- Succession Plans (4)

- Benchmarking Study (3)

- Budgeting (3)

- Career Changers (3)

- Engagement (3)

- Fiduciary (3)

- Getting Leads (3)

- Membership (3)

- Millennials (3)

- Monthly Retainer Model (3)

- Partnership (3)

- Pricing (3)

- Recordkeeping (3)

- Risk Assessment (3)

- Small Business (3)

- Staying Relevant (3)

- Work Life Balance (3)

- Advice-Only Planning (2)

- Bookkeeping (2)

- Charitable Donations (2)

- Client Acquisition (2)

- Differentiation (2)

- Health Care (2)

- IRA (2)

- Inflation (2)

- Productivity (2)

- Implementing (1)

Subscribe by email

You May Also Like

These Related Stories

6 Steps to Fully Utilize Your Portfolio Management Software

Investment Management: Communicating Your Value as a Financial Advisor