How to Choose a TAMP for Your Financial Planning Practice

Share this

If you’ve started your own business—even if it’s not a financial planning firm—and gone through the process of selecting vendors for all your business needs, you know how daunting the task can be. Before you even get to the point of selecting vendors, you must decide what services to offer. You’re the boss so like most other decisions, the choice is yours. But choose wisely because these are monumental decisions that will significantly impact your business for years to come.

For firm owners without prior investment management experience, the decision to offer investment management services can be especially overwhelming. After all, very few firm owners want to take on the responsibilities of Chief Investment Officer, Trader, and Portfolio Administrator on top of all the other hats they’re already wearing.

But when bringing on new financial planning clients, conversations naturally flow to investments and how the client is managing their money (especially during times of greater market uncertainty). Often, they will look to you as a trusted source for guidance.

If you've been referring clients out to investment managers you trust and you want to keep it that way, keep doing what you’re doing. But if you’ve had those conversations and watched enough of your clients walk out the door to other advisors, maybe it’s time to explore how to add investment management services to your firm.

What is Investment Management?

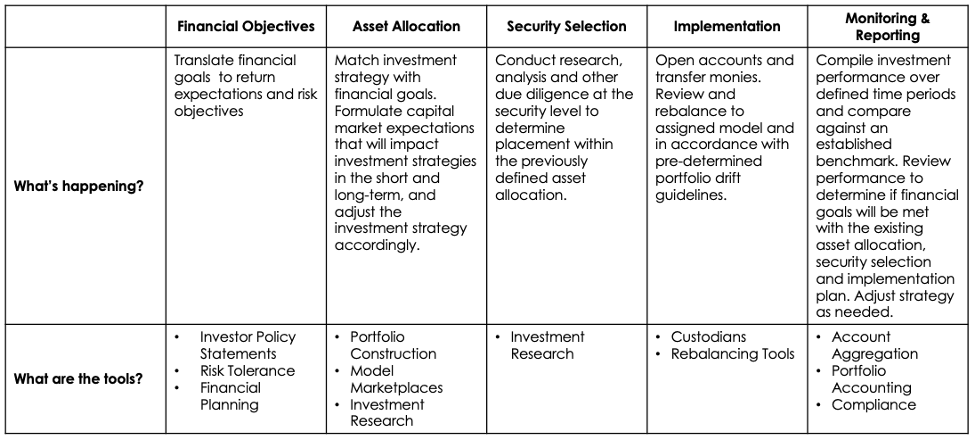

Before we start looking at technology and solutions providers, let’s define what we’re talking about when using the term "investment management”. The investment management process has five stages, depicted below.

Investment management begins during the financial planning process by defining your client’s financial objectives. This is a little cliche, but if you don’t know where you’re going, you don’t know how to get there.

Next, you choose the appropriate asset allocation to help your client achieve those goals from step 1. After the allocation is set, you are now responsible for selecting the individual securities to fill those allocations. This requires a lot of research and due diligence to select the right investment vehicles for your clients.

The last two steps are where the rubber meets the road. You implement the plan—purchasing the securities selected—and then monitor and report on them on an ongoing basis to ensure you’re on track to meet your client’s goals. This is no small task.

As you can imagine, there are many ways to take on investment management in your firm, starting with taking on every step of the process yourself all the way to outsourcing each piece to a partner . Not every step needs to be outsourced, so you can mix and match what you do and what your investment partner takes off your plate.

There are many firm owners who are willing and eager to handle the entire process themselves—more power to them. Others will enlist the help of a Turnkey Asset Management Platform (TAMP) such as XY Investment Solutions (XYIS).

Choosing a TAMP is a process in and of itself. Whether you have 20 years of investment management experience or you are learning how it all works for the first time, we can help you establish and think through the most important criteria to consider when shopping around.

The proliferation of TAMPs in the last several years is pretty staggering. We believe that if you can define your position on each of the following areas, you can easily weed out the TAMPs that aren’t a fit and make an informed choice. If you choose the wrong vendor, you’re looking at one headache after another: excess paperwork, frustrated clients, and potentially painful experiences on all sides of the relationship. To ensure you make the right decision, consider the following:

1. Investment Philosophy

Are you an active or a passive manager? Do you support values-based investing such as impact or ESG investing?

Knowing where you and your potential clients stand on how the investment selection process is executed sets the stage for the rest of your search. If you’re not sure what your philosophy is yet, your first order of business is to figure it out.

Once you’ve gotten a handle on your philosophy, ask potential vendors what they do. If your vendor can’t support your investment philosophy, the relationship won’t last long. Many TAMPs offer portfolios constructed by a wide variety of managers, which allows you to select from many investment philosophies. But if you are looking at a TAMP that doesn’t stray from its preferred methodology, make sure you know that up front.

2. Investment Options

What sort of investment options does your TAMP offer and what are you looking for? Some TAMPs have a strict set of rules and guidelines for how funds are transferred and invested. Others have a more flexible approach, allowing you to add custom models and hold legacy positions inside managed accounts.

Do you and your clients prefer to have structure and easy predictability or do you need some flexibility to tailor your accounts slightly according to your clients’ needs?

Each approach comes with a list of pros and cons. With limited flexibility, the experience remains consistent and repeatable for any client no matter the situation. Sometimes being told what to do is easier than having to figure it out yourself. But when a client has a special request, you will have to say no, which you may not be comfortable doing.

If most of your clients want to have some say over how their money is invested, you might consider a more flexible TAMP that allows you to make changes. You may even be able to work with the TAMP to create models that are specific to your niche and clientele—that’s pretty powerful.

However, it may come at a financial cost. More options means more time and expertise to execute for the TAMP. It also may create headaches and processes that differ between clients. Part of the appeal of a TAMP is scalability; flexibility can be difficult to scale.

Finally, can the TAMP manage across a wide variety of account types? You want to know which accounts are or aren’t available and can or can’t be managed by the TAMP. Also pay attention to whether or not the TAMP offers proprietary funds that can’t be held by other custodians. This could potentially force your clients into unfortunate tax situations if the account ever has to go elsewhere. You should consider how portable the account is once open.

3. Custodians

Also consider where client funds are custodied. Some TAMPs self-custody or limit you to one custodian option while others allow for multiple custodians. Does the TAMP get you access to a name brand custodian your clients recognize (if you’re a member of XYPN, you can use TD Ameritrade with no minimums!) or will you have to make sure you will be allowed to custody with the options a TAMP offers?

Also determine if this TAMP or their custodians require minimum account sizes or have a required level of assets to use their services. If account minimums apply, then you’ll need to either manage smaller accounts yourself or find another TAMP to take those on. Are you up for that task?

4. Technology

Technology is a huge component of the TAMP experience, both for you and your clients. Does this TAMP offer a client portal, means to accomplish account aggregation, risk tolerance questionnaires, or improved account opening and maintenance tools? Since TAMPs have moved so far beyond just offering trading services, it’s important to know what the full technology package includes. There might be components offered that save you from needing another subscription or incurring a monthly cost to provide a similar service.

5. Client Experience

Each TAMP has a different approach to how it integrates with your firm. Some can blend into the background and put your brand front and center, while others will be more client-facing with who they are. Many offer the ability to white label various parts of their platform. Make sure you know what can be branded to your firm and what has the TAMP’s name on it (think client portal, emails, reports, etc). Neither approach is necessarily better or worse; you have to decide how you want to approach this aspect of the client experience and understand how your TAMP will fit in.

Another aspect of the client experience to consider is if the TAMP will provide investment resources that you can brand and put in front of clients. Will you be able to leverage thought pieces, marketing materials, and ongoing resources that can be used in your day-to-day conversations with clients? These are valuable tools that can save you time and help you communicate effectively and confidently with your clients.

6. Support

Another crucial area to examine when talking to a TAMP is what support they offer. Support can mean many things but two main areas should be examined: support for technology (i.e. onboarding training, ongoing help desk availability, and self-service resources) and administrative support (i.e. investment management process tasks).

While we already covered technology, you might not have a great understanding of what is involved in administrative support. Does it include tools to improve and speed up the client onboarding process? When an account is in NIGO status, will they step in and help or will you be left to deal with it on your own? If you need to do basic account maintenance, how will your TAMP help, if at all? If a client has investment questions that you want to ask the TAMP about, is there someone you can contact? Ask for specifics when it comes to back office support and see what the TAMP will offer. This can have a big impact on your workload.

Support for you as the advisor extends into investment education as well. Will your TAMP offer resources to keep you up to date with investment news and best practices? If your TAMP can be an educational partner for you, you will have better conversations with clients and a smoother investment management process as you work together.

When it comes to technology support, it’s important to know if you’ll be on a technology island with Google as your only friend or if there will be support resources that you can access. Will you be offered any training on how to use the technology when getting started with the product? Does the TAMP have self-service articles and videos you can use when you run into a problem or have a question? Is there a dedicated team to help you succeed or is there just an anonymous inbox to reach out to when you need something?

7. Pricing

Last but certainly not least is the ever-important cost consideration. Price is a real factor for which direction you’ll go when outsourcing investment management. This affects the bottom line of your business and is one of the first things your will review when contemplating your services. TAMP pricing typically offers AUM-based or account-based options. AUM basis point pricing is still the primary way TAMP costs are structured but that will likely change as the industry continues to evolve.

Which pricing structure and level are right for your business model? To answer this question, take a moment to think about your revenue characteristics. Will financial planning fees be your core revenue or will AUM be your primary revenue driver?

Consider is the predictability of the revenue source. Planning fees tend to be more predictable as they’re tied to the number of clients you have while AUM-based revenues can be less predictable from one year to the next. The current market environment presents a great example of how planners with AUM-based fees need to be cognizant of this. Consider what it looks like if your primary source of revenue drops by 20%. What then happens if your expenses don’t adjust accordingly? Understand how your business model is impacted in different scenarios by TAMP pricing—this will inform your decision when comparing costs.

Navigating the vendor selection process is complicated. You may not know exactly what you’re looking for right now, but by asking some of the questions above, you can better understand what you need in a partner.

We hope this helps you if you’re exploring different TAMP solutions or even if you’re just defining your business model and considering whether or not you want to include investment management.

Have questions? Connect with the XYIS team. We are here to help you choose the right TAMP for your firm, even if it’s not us.

Share this

- Fee-only advisor (381)

- Advice (305)

- Business Development (248)

- Independent Financial Advisor (203)

- Growing Your Firm (161)

- Marketing (133)

- Financial Planning (129)

- What Would Arlene Say (WWAS) (81)

- Business Coach (80)

- Firm Ownership (78)

- Training (75)

- Compliance (72)

- Business (69)

- Building Your Firm (65)

- Financial Advisors (63)

- Online Marketing (61)

- Events (59)

- Starting a Firm (52)

- Staffing & HR (49)

- Technology (49)

- From XYPN Members (48)

- Launching a firm (46)

- Advisors (41)

- Entrepreneurship (38)

- Taxes (37)

- Networking & Community (33)

- Interviews and Case Studies (32)

- Investment Management (31)

- Sales (27)

- Social Responsibility (27)

- Tax Preparation (27)

- XYPN Invest (26)

- Business Owner (25)

- Small Business Owner (20)

- Financial Management & Investment (19)

- Industry Trends & Insights (19)

- Financial Education (17)

- Financial Planners (17)

- Independent Financial Planner (17)

- Tech Stack (17)

- XYPN (17)

- Leadership & Vision (16)

- Investing (15)

- Niche (15)

- How to be a Financial Advisor (14)

- NextGen (14)

- RIA (14)

- Media (13)

- Preparing to Launch (13)

- Press Mentions (13)

- RIA Operations (12)

- RIA Owner (12)

- XYPN Membership (12)

- Assets Under Management (AUM) (11)

- First Year (11)

- Goals (11)

- Scaling (10)

- Advisor Success (9)

- Building Your Firm (8)

- Communication (8)

- Lessons (8)

- Study Group (8)

- Time Management (8)

- Virtual Advisor (8)

- Behavioral Finance (7)

- Growth (7)

- Pricing Models (7)

- From Our Advisors (6)

- Independent RIA (6)

- Money Management (6)

- Motivation (6)

- Processes (6)

- Automation (5)

- Broker-Dealers (5)

- College Planning (5)

- Filing Status (5)

- How I Did It series (5)

- Investment Planner (5)

- Mental Health (5)

- Michael Kitces (5)

- Preparing to Launch (5)

- RIA Operations (5)

- Retirement (5)

- Risk and Investing (5)

- S Corpration (5)

- Support System (5)

- TAMP (5)

- Wealth (5)

- Year-End (5)

- Client Services (4)

- Outsourcing (4)

- Selling a Firm (4)

- Succession Plans (4)

- Benchmarking Study (3)

- Budgeting (3)

- Career Changers (3)

- Engagement (3)

- Fiduciary (3)

- Getting Leads (3)

- Membership (3)

- Millennials (3)

- Monthly Retainer Model (3)

- Partnership (3)

- Pricing (3)

- Recordkeeping (3)

- Risk Assessment (3)

- Small Business (3)

- Staying Relevant (3)

- Work Life Balance (3)

- Advice-Only Planning (2)

- Bookkeeping (2)

- Charitable Donations (2)

- Client Acquisition (2)

- Differentiation (2)

- Health Care (2)

- IRA (2)

- Inflation (2)

- Productivity (2)

- Implementing (1)

Subscribe by email

You May Also Like

These Related Stories

6 Steps to Fully Utilize Your Portfolio Management Software

How to Effectively Communicate with Your TAMP Back-Office Team