Firm Ownership: An In-Depth Look at the Journey from Start to Finish

Share this

So you've decided it's time to launch an RIA. What will the journey of your firm look like? What are some milestones you can look forward to? What are some of the challenges you will face? And what are some of the business decisions you'll have to make?

These are just a few of the many questions you’ve likely asked yourself as you've contemplated your decision to set out on your own.

At XYPN, we have helped entrepreneurs launch and run RIA businesses for the past 5+ years; in doing so, we have gained the insight to map out the journey of a firm from launch to sustainable business. We are able to provide new firm owners a roadmap for success, and have created specific resources to help guide them along the way.

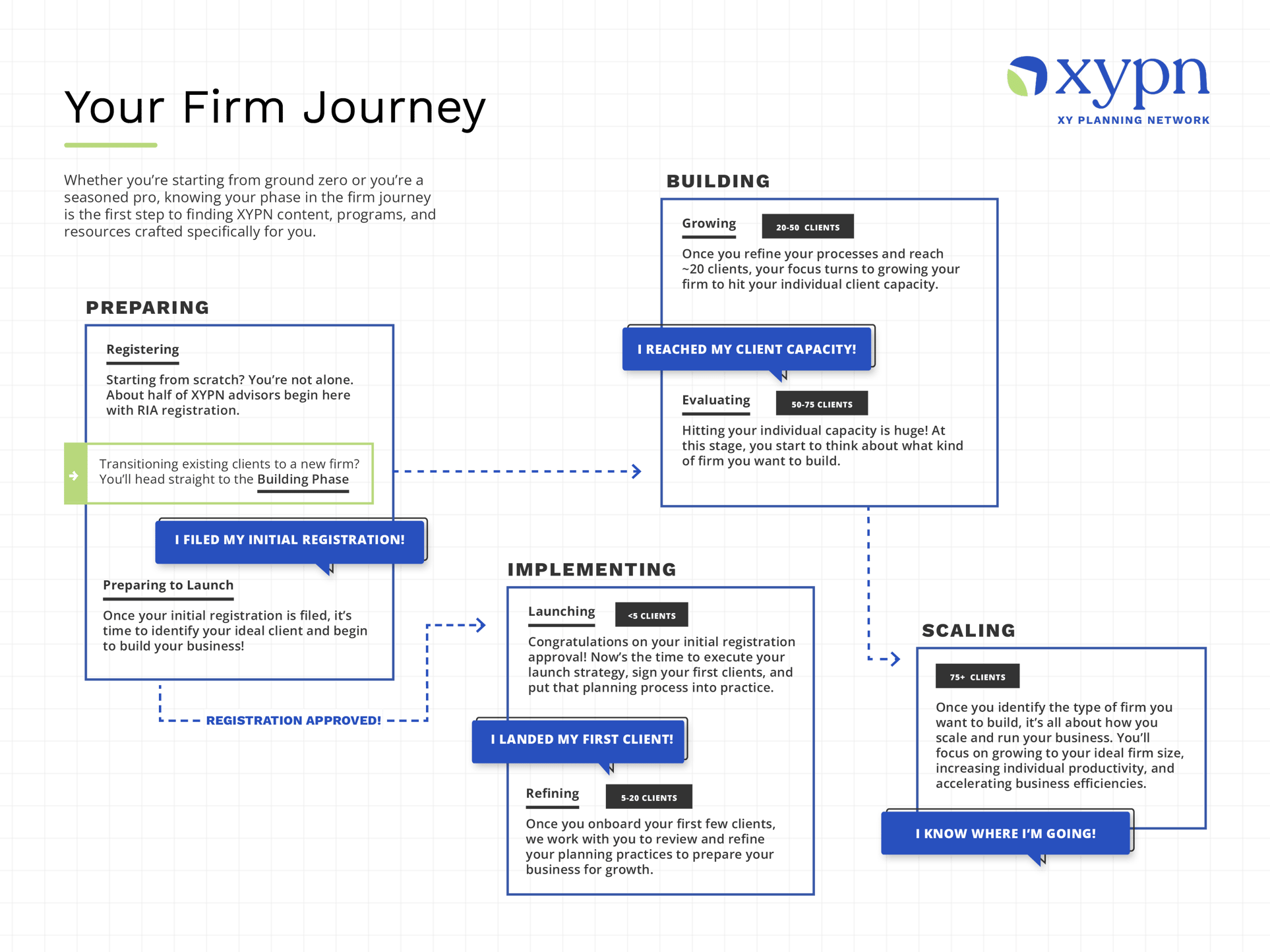

We have broken the RIA firm journey into four different business phases: Preparing, Implementing, Building, and Scaling. Before we walk through what a firm journey may look like for a new firm owner, let’s first define each of these business phases.

The Preparing phase involves everything that needs to be done prior to the launch of your firm. We like to break this into two different sub-phases: getting registered and getting ready to launch. This phase will include preparing your initial registration, filing with your regulator, preparing your launch strategy, and ultimately your firm approval.

You’ve entered the Implementing phase once your initial registration has been approved and it's time to launch your firm. The firm owner takes the launch strategy developed during the preparing phase and starts to implement (hence the name). We also like to break this phase into two sub-phases: launching (0-5 clients) and refining (5-20 clients). We do this because while it's important to get those first few clients in the door, once you have done that, you most likely will need to refine your processes and services to position yourself for growth.

Building is the growth phase you enter when you have approximately 20 clients; you will remain in this phase until you have reached your individual capacity as an advisor (75 clients). Like the Preparing and Implementing phases before it, the Building phase is broken into two sub-phases: growing and evaluating. The first phase occurs as you grow your firm; the second phase occurs as you approach your individual capacity and start to evaluate what type of firm you want to build.

Scaling is the business ownership phase that occurs once you have reached your individual capacity as an advisor, decided what type of firm you want to run, and started to scale your firm. Generally we see firm owners at this point start to gravitate towards three different types of firms: a lifestyle practice (or solopreneur), a boutique firm, or an enterprise firm.

If you’re building a lifestyle practice or are a solo entrepreneur, you continue to act as the lead advisor with all your clients, you may cap the number of clients you bring on, and you focus on refining your services and who you work with.

As a boutique firm, you want to grow intentionally. You may hire an associate advisor or staff member as you start to build a small firm. Generally in this role, the firm owner acts as the lead advisor with some clients but also runs the business.

In an enterprise firm, the focus is growth. In this role, the firm owner will hire additional advisors to grow their firm and will transition from working with clients to completely running the business.

The term scaling is generally associated with scaling up and building large enterprise firms, however, it can be applied to all three of these firm types.

Now that you understand the different firm phases, let’s walk through an RIA firm journey from Preparing to Scaling and highlight some of the key milestones and considerations that an RIA owner should be aware of.

The first thing to acknowledge is not all new RIA owners launch their firms under the same circumstances. Some come from a wirehouse or broker-dealer and have significant experience managing assets and/or providing financial planning along with an existing client base. Some are associate/support advisors at existing RIAs or financial firms and are ready to run their own firms. Some are employees at other financial services institutions. One of the key differentiators between the p\Preparing and Implementing phases is whether or not you have clients to transition to your new RIA.

While one of the most exciting milestones of firm ownership is the launch of the firm, it’s also incredibly challenging. You need to put in a lot of work and planning upfront for a successful launch, and this starts with the Preparing phase.

There are two major milestones that need to be accomplished in the Preparing phase. First, you need to get your firm’s initial registration approved by your regulator. To do this, you need to know the fees you will charge and services you will provide and you must be able to document them for the regulator. This includes how you plan to manage client assets, how you will determine billing, who your custodian will be, and if you will use a TAMP. You must be able to clearly define your financial planning services and how you plan to charge for these services (e.g. monthly, quarterly, annually). Determining and documenting a firm fee schedule can be one of the more difficult aspects of the Preparing phase.

Once you have prepared your initial registration, there are two key milestones: filing with your regulator and approval (these milestones will not happen simultaneously). Once you have filed your initial registration, it's time to finalize the launch plan for your firm. It's one thing to document your business model for a regulator; it's another to actually implement that model with clients.

There are three key areas to focus on as you launch your firm.

First is your marketing plan—who are you going to market to and how?

Next is your planning process—what does your client onboarding process look like and what is being delivered to your clients? (Don’t spend too much time here as you will refine in the Implementing phase.)

Third is getting your business essentials set up to operate your firm, including but not limited to banking/accounting details, insurance, and your base technology platform.

Once you have received your firm approval from your regulator and your launch plan is complete, it's time to implement. In the first part of the Implementing phase, you will focus on launching and signing your first few clients.

During this phase the priority should be marketing and sales—getting your message in front of as many prospects as possible, and talking to them about what you are doing and why you are doing it. Tell your story! Many times during this phase firm owners focus too much on processes and workflows and not enough on marketing. The marketing launch plan should focus on who will want your services, how to generate interest, and what assets you will need for the launch.

Once you have onboarded a few clients (for this example we will say approximately five), you should review and refine some of your processes. You do this while you have 5–20 clients because once your firm starts to grow beyond 20 clients, you must have effective and efficient processes in place to be able to effectively manage the growth.

Generally we see firms as this point refine their marketing. Is the initial target audience you outlined in your launch plan still your ideal client base or has that shifted? This is also a good time to refine your client onboarding process, planning process, and possibly your fees. Did you price your services too low based on the value you are providing? (The answer to this question is often yes.)

Once you have refined your processes after your initial launch, it's time to start building. During the Building phase, you will focus on growing your firm to its individual capacity. At this point you should have a good idea of who your ideal client is and your marketing, sales, and planning services are catered to that ideal client. (Realistically the refining of your business never really stops.)

During this phase, it's important to review your existing KPIs and set your firm growth goals. After reviewing and refining your sales and marketing efforts, you need to focus on your marketing and sales funnels. This includes designing the intended paths for your client (”buyer”) personas, as well as tracking your close rate. From a planning perspective, this is the time to improve your meeting structure, processes, and workflows, with the goal of having repeatable processes that can support your growth.

As your firm grows and you start to approach your individual capacity as an advisor (this may be around 50-75 clients), it's important to step back and start evaluating the strategic direction of your firm. One of the reasons we encourage firm owners to start this evaluation in the Building phase is because many will wait until they have reached capacity to start thinking about what’s next, and in many cases this will lead to slow or flat growth while you scramble to figure out your next steps.

Generally we see firm owners evaluate three different options as they start to approach their individual capacity: the lifestyle practice, boutique firm, or enterprise firm (as defined above). Each can be profitable and rewarding businesses, but you should recognize that the type of firm you build will drive the decisions you make. Do you want to outsource certain activities such as bookkeeping and compliance? Do you want to hire staff or advisors to take over some of the marketing and planning work? These are just some of the decisions you will make depending on the type of firm you are building.

We see many firm owners make these decisions based on what they enjoy doing and what they want out of their firm—do they want to remain the lead planner and continue to work directly with clients (lifestyle/boutique) or do they want to run the business and start building a team that works with the clients (enterprise)?

Once you have gone beyond your individual capacity as an advisor (75 clients) and determined the type of firm you want to run, you enter the Scaling phase, where you will focus on running your business.

Each firm type has its own focus along with its own definition of scaling up. The lifestyle practice owner may start to get very specific about who they work with to provide the most value to the client, enhance the client experience, and maximize the revenue per client. In many cases we see these solopreneurs cap the number of clients they work with and create waitlists.

The boutique firm owner generally starts to shift their mindset from that of a solopreneur to that of a firm owner with a team. They will evaluate what they enjoy doing and are good at, and will start to build their team to complement their talents and supplement their weaknesses. Continued growth is important to support the expanding team, but it's not the number one priority.

The enterprise firm owner’s focus shifts to hiring, team building, and scaling their business. Their number one priority is growth, and they must focus on hiring advisors to work with clients and putting systems and processes in place to sustain that growth.

While lifestyle, boutique, and enterprise firms ultimately end up looking like very different businesses, the journey to start, run, and grow these firms is very similar. Nearly every financial advisor who has launched or who is looking to launch an RIA firm will work their way through the Preparing, Implementing, Building, and Scaling phases. Each phase has its unique challenges, but if you are able to successfully work through them, you will ultimately have the infrastructure in place to build the business you have also dreamed of.

About the Author

About the Author

As XYPN's Director of Advisor Success, Malcolm is tasked with doing just that—helping advisors succeed. After graduating from Gettysburg College with a B.A in Management, Malcolm jumped straight into the financial services industry and never looked back. With a drive to help shape the future of financial planning and a passion for bringing financial advice to the next generation of clients, he has a lot in common with the advisors in the Network.

Share this

- Advisor Posts (433)

- Fee-only advisor (388)

- Advice (316)

- Business Development (245)

- Independent Financial Advisor (204)

- Growing Your Firm (160)

- Marketing (132)

- Financial Planning (104)

- What Would Arlene Say (WWAS) (81)

- Firm Ownership (78)

- Business Coach (77)

- Training (76)

- Compliance (71)

- Business (69)

- Building Your Firm (68)

- Financial Advisors (65)

- Online Marketing (61)

- Events (60)

- Starting a Firm (50)

- From XYPN Members (48)

- Technology (48)

- Launching a firm (45)

- Advisors (42)

- Entrepreneurship (39)

- Taxes (39)

- Staffing & HR (38)

- Networking & Community (33)

- Interviews and Case Studies (32)

- Investment Management (32)

- XYPN Invest (28)

- Tax Preparation (27)

- Business Owner (25)

- Social Responsibility (25)

- Sales (24)

- Small Business Owner (20)

- Industry Trends & Insights (19)

- From XYPN Invest (18)

- Financial Planners (17)

- Independent Financial Planner (17)

- XYPN (17)

- Leadership & Vision (16)

- XYPN News (16)

- Tech Stack (15)

- How to be a Financial Advisor (14)

- RIA (14)

- Investing (13)

- Media (13)

- NextGen (13)

- Press Mentions (13)

- Financial Education (12)

- Goals (12)

- RIA Owner (12)

- XYPN Membership (12)

- Assets Under Management (AUM) (11)

- First Year (11)

- Niche (11)

- SEC (10)

- Advisor Success (9)

- RIA Registration (9)

- Communication (8)

- Lessons (8)

- Study Group (8)

- Time Management (8)

- Virtual Advisor (8)

- Growth (7)

- Mental Health (7)

- Pricing Models (7)

- From Our Advisors (6)

- Independent RIA (6)

- Money Management (6)

- Motivation (6)

- Preparing to Launch (6)

- Processes (6)

- Risk and Investing (6)

- Automation (5)

- Behavioral Finance (5)

- Broker-Dealers (5)

- College Planning (5)

- Filing Status (5)

- How I Did It series (5)

- Investment Planner (5)

- Michael Kitces (5)

- Preparing to Launch (5)

- Retirement (5)

- S Corpration (5)

- Scaling (5)

- Support System (5)

- TAMP (5)

- Wealth (5)

- Year-End (5)

- Bear Market (4)

- CFP Certification (4)

- Outsourcing (4)

- Selling a Firm (4)

- Small Business (4)

- State Registration (4)

- Succession Plans (4)

- Benchmarking Study (3)

- Bookkeeping (3)

- Budgeting (3)

- ESG Investing (3)

- Emotional Decisions (3)

- Engagement (3)

- Fiduciary (3)

- Financial Life Planning (3)

- Getting Leads (3)

- IRA (3)

- Life planning (3)

- Lifestyle practice (3)

- Membership (3)

- Millennials (3)

- Monthly Retainer Model (3)

- Monthly Subscription Model (3)

- Partnership (3)

- Pricing (3)

- RIA Audit (3)

- Recordkeeping (3)

- Risk Assessment (3)

- Staying Relevant (3)

- Wellness (3)

- Work Life Balance (3)

- Advice-Only Planning (2)

- Building Your Firm (2)

- Career Changers (2)

- Charitable Donations (2)

- Community Property (2)

- Design (2)

- Differentiation (2)

- Exchange-Traded Funds (ETF) (2)

- FINRA (2)

- Finding Your Why (2)

- Graphic design (2)

- Growing Income (2)

- Health Care (2)

- Inflation (2)

- Key performance indicator (KPI) (2)

- Keynote (2)

- Negative Rates (2)

- Operations (2)

- Organization (2)

- Outsourced Asset Management (2)

- Outsourced Bookkeeping (2)

- Portfolio Management (2)

- Productivity (2)

- Psychology (2)

- Quickbooks (2)

- Recommended Reading (2)

- Recruiting (2)

- Registered Representative (2)

- Registration (2)

- Restricted Stock Units (RSU) (2)

- Start Ups (2)

- Stock Options (2)

- Team Communication (2)

- Virtual Assistant (2)

- Virtual Paraplanner (2)

- Accounting (1)

- Arlene Moss (1)

- Assistant (1)

- Bonds (1)

- Bull Market (1)

- Careers (1)

- Certified Public Accountant (CPA) (1)

- Childcare (1)

- Client Acquisition (1)

- Client Services (1)

- Common Financial Mistakes (1)

- Consulting (1)

- Consumerism (1)

- Credit (1)

- Custodians (1)

- Custody Rule (1)

- Data (1)

- Daycare (1)

- Definitions (1)

- Designations (1)

- Direct Indexing (1)

- Disasters (1)

- Earn More (1)

- Family (1)

- Fidelity (1)

- Finance (1)

- Financial Freedom (1)

- Financial Goals (1)

- Financial Life Management (1)

- Financial Success (1)

- Financial Wellness (1)

- Form 8606 (1)

- Form 8915-E (1)

- Grief (1)

- Guide (1)

- How to Budget (1)

- Impostor Syndrome (1)

- Interns (1)

- Investor Policy Statement (IPS) (1)

- Job burnout (1)

- Liquidating your business (1)

- Loans (1)

- Moving Forward (1)

- Part Time (1)

- Paying Yourself (1)

- Paystub (1)

- Perfectionism (1)

- Project Management (1)

- Projecting Returns (1)

- Purpose (1)

- Quarterly Estimated Payments (1)

- RIA Operations (1)

- Recession (1)

- Referrals (1)

- Regulations (1)

- Regulators (1)

- Reinvention (1)

- Relationships (1)

- Remote (1)

- Required Minimum Distributions (RMD) (1)

- Risk Management (1)

- Roth Conversations (1)

- Roth IRA (1)

- Sabbatical (1)

- Spending (1)

- Strategy (1)

- Systems (1)

- Target Audience (1)

- Teamwork (1)

- Terms (1)

- To-Do List (1)

- Traditional IRA (1)

- Transitions (1)

- Virtual (1)

- Vulnerability (1)

- XYPN Books (1)

Subscribe by email

You May Also Like

These Related Stories

Avoiding Common Regulatory Filing Deficiencies for Your RIA

Business Considerations For Firm Owners During Tough Times