Entrepreneurship and Pricing in the Wake of Inflation

Share this

Inflation has become one of the dirtiest words of the year. We feel it at the pump, at the grocery store, and we feel it within our firms. But in the lead-up to some of the highest inflation rates we have seen in many members’ lifetimes, there is an opportunity for strategic adjustments within your firm that can lead to more innovation, higher profitability, and more inclusion.

Here’s a guide to entrepreneurship in the wake of increasing inflation, including what it means for your firm, and how to counterbalance its effects.

Inflation is a measure of the rate at which prices rise over a period of time. This rise in prices translates into a decline in purchasing power for the consumer—usually measured by the Consumer Price Index. Despite the prevailing narrative of today, small amounts of inflation create the conditions for healthy economic growth, and can cause the value of tangible assets—like homes—to rise in value.

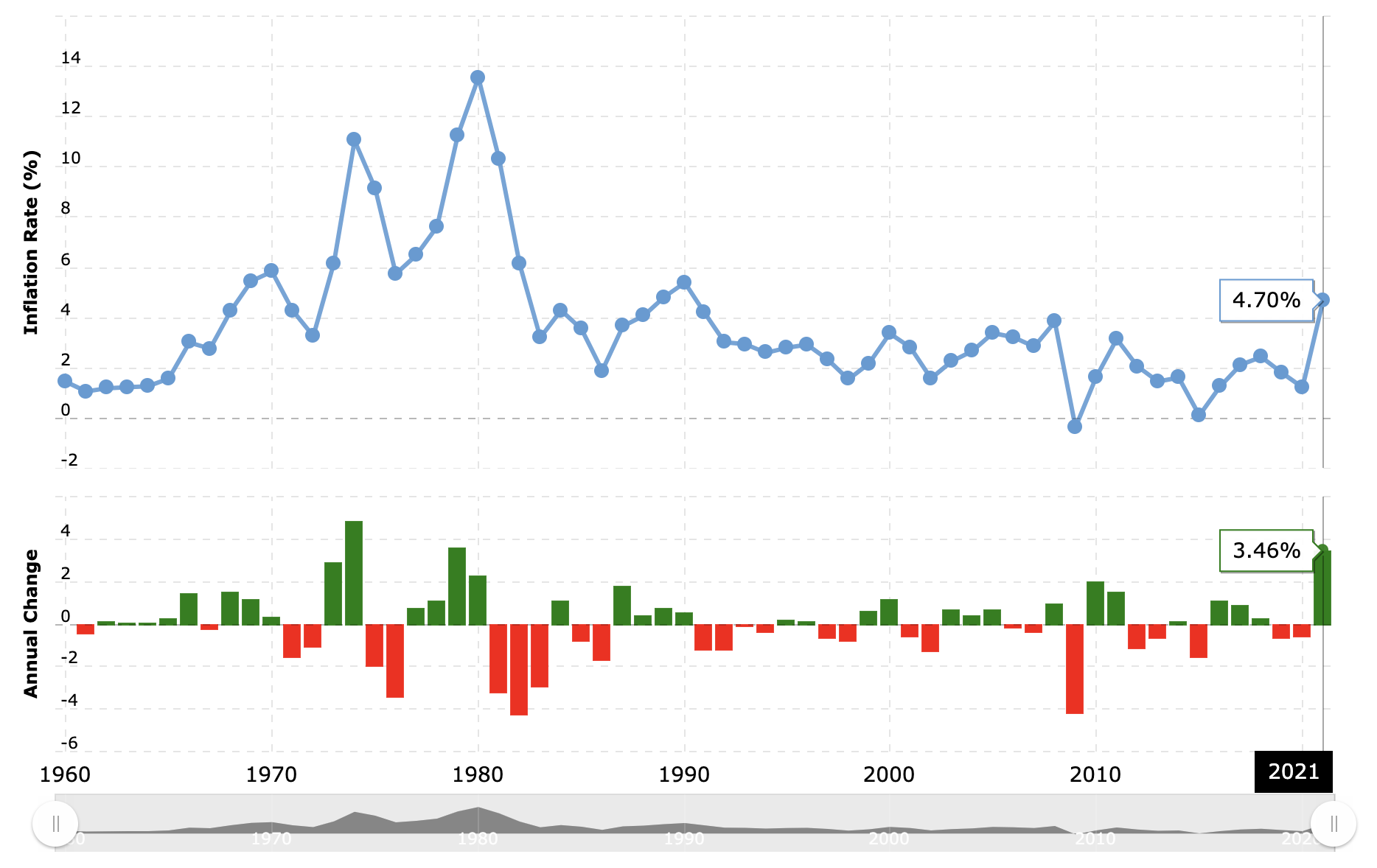

Inflation in Perspective

Historically, the annual inflation rate in the United States averaged 3.27 percent between 1914 and 2022, with notable peaks in 1974 and 1980. In the Spring of 2022, however, the annual inflation rate in the US accelerated to 9.06 percent, reaching the highest since December of 1981. This sharp acceleration—far beyond recent historical trends and the recommendations of the Federal Reserve—has created a wave of concern that is affecting many aspects of the economy and your firm.

Inflation rose to 11.05 percent in 1974 and 13.55 percent in 1980. Graph Credit: Macrotrends.net

The Impact of Inflation on Market Prices

Let’s start with the impact these changes have had on businesses. In the wake of rising prices of inputs (think employee wages, software subscriptions, membership dues, travel costs, and educational materials) firms have important choices to make to protect their bottom line. As the price of inputs increases, the cost to supply financial planning services increases.

In layman’s terms, what was profitable to provide at 2020 inputs price levels, is no longer profitable in 2022.

The effect is a shift in your willingness to supply services at pre-inflationary prices. To provide the same product, you must now command a higher price to recoup your costs and cover your other entrepreneurial opportunities.

That is, however, only half of the story.

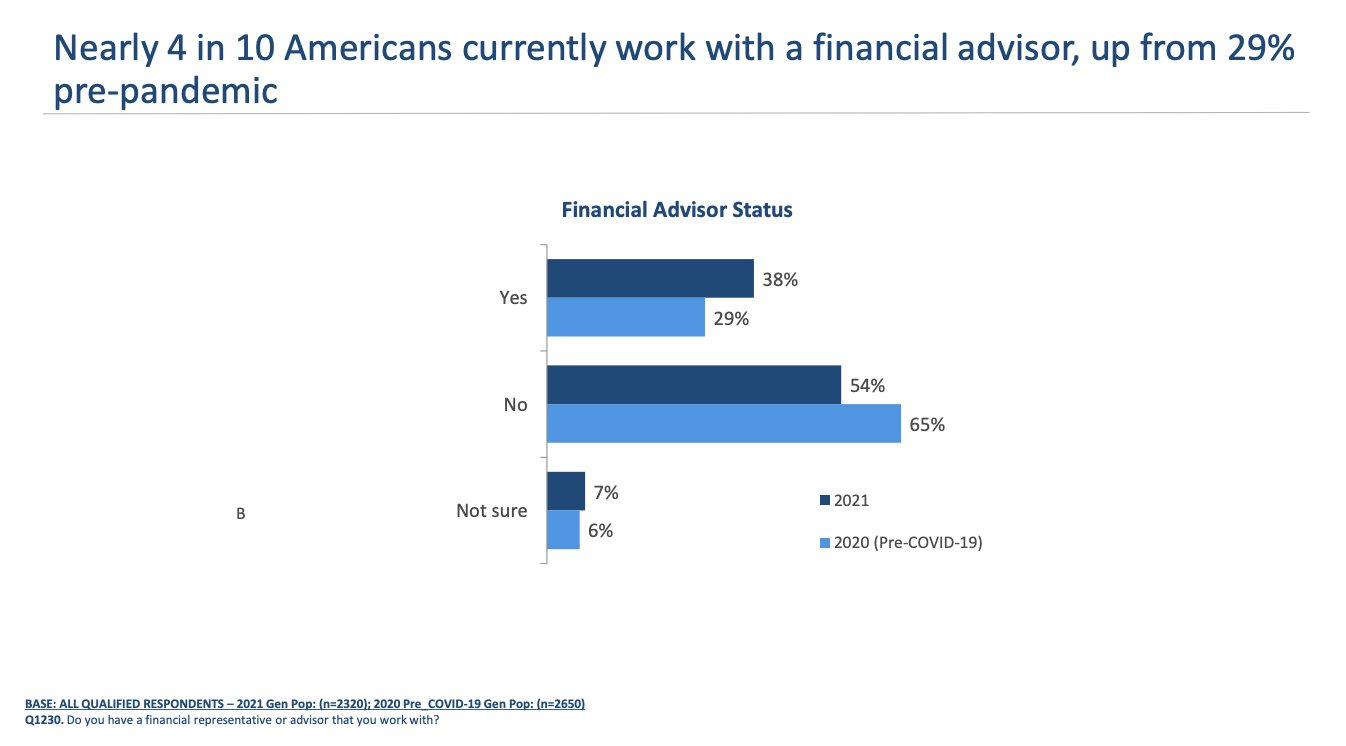

Growth in the Demand for Financial Planning

Coupled with the increase in the cost to do business has been an increase in the market demand for financial planning. As a result, the industry size—as measured by revenue—has grown significantly in the last decade. In fact, during the time period between 2019 and 2021 the market size grew by roughly 15 percent. This increase was in part due to both increased AUM revenue and an influx of new consumers working with financial advisors. According to a Harris Poll research series, in 2020 nearly 40 percent of Americans worked with a financial advisor—up from 26 percent in 2018.

Source: Northwestern Mutual: 2021 Planning & Progress Study

There are numerous reasons for this including the aging population seeking assistance with retirement and estate planning, financial market volatility that has driven informed consumers to value financial planning and asset management, and the fee-only fiduciary model of financial planning that has expanded the scope of consumers entering the market. The combination of these components has worked to increase consumer demand for financial planning services and as this rises, prices follow.

The Overall Impact:

Inflation and consumer demand—seemingly opposing forces—are seen working together in a tsunami-like motion to raise the price consumers will pay for financial planning services in the next 12 to 24 months. If consumer demand continues at its current pace, it suggests that the market price for these services should increase by more than the increased cost of inputs. The result could lead to greater levels of profitability in the long run.

This prediction is not without acknowledging that interim losses and transitional hardship are to be expected. In the wake of all consumer prices increasing, many consumers will need to make trade-offs to work within their new budget constraints. Not all consumers will be able to absorb this market shock and new consumer growth will temporarily slow during times of economic downturn. In response, it is prudent to use innovative pricing strategies and redefine your target market

Potential Response to Changing Market Conditions:

- Differential Pricing Strategy

- Redefine Your Target Market

#1: An Introduction to Differential Pricing

One approach is to deploy differential pricing strategies by presenting different pricing to different market segments either based upon tiered service offerings or some other identifier. The strategy here is to maximize revenue not simply by increasing the number of clients, but instead by charging customers different prices based on their willingness to pay using identifiable characteristics or consumer self-selection.

If you have ever gone to the movies, you have been a victim of this pricing structure. At the movies, you see several different prices based upon age and affiliations. For instance, theaters charge students less because they assume that students have a lower income than others and might otherwise be priced out of the theater without the discount. Here, theaters are assuming their customers' willingness to pay through an identifiable characteristic. Theaters also use the same peak pricing strategies as Ski Resorts when they charge less for matinees and more during peak hours—after 6 pm. The following table demonstrates how this pricing strategy can be used by financial advisors:

#1: Differentiate Your Offerings by Type |

Ongoing Planning might include all your services like tax planning, estate planning, cash flow analysis, and retirement planning. Snapshot Planning might include basic analysis and a list of recommendations within each category but no ongoing meetings or support. This engagement might end after only 3 or 4 meetings. Targeted Planning might include targeted support like helping someone analyze credit card debt, student loans, or household budgeting. In this case, you can use your understanding of their issues to price accordingly or charge a flat rate for this type of engagement and limit the number of hours that come with the package. Defining carefully what is and is not included in each package is essential for this model to succeed. |

#2: Segment Consumers by Life-Stage |

Life-Stage Segmentation might help divide up your clients into fairly standard age groups, each with unique planning needs. These might include: New Grad, Established or Working Professional, Pre-Retiree, and Retiree. |

#3: Segment

|

If your firm experiences a consistent demand increase during a specific period of time every year—such as during end-of-year tax planning—you may be able to consider charging higher project-based fees in busier seasons. This segmentation would look a lot like peak load pricing strategies and would charge an increased rate for those signing on just before tax season, for example. *Regulators will still look for some consistency and fairness in the fees being charged to clients for similar services. |

The first approach demonstrates that in the case of differentiated offerings if Client A can no longer afford to consume the same level of financial services when the market price rises, you can choose to reduce your offering and move Client A into a different tiered package. Using this approach, you can offer tiered packages that correlate with reduced meeting times, reduced analytics, or packages in which the consumer is the implementer and not you.

This method of pricing is actually highly profitable and allows you to capture more of the consumer market than a single pricing system. In a sense, it is more inclusive than charging one high price that can often price many groups out of the marketplace. However, be cautious. Implementing this type of pricing system demands careful process consideration to ensure you are not just providing the same client service model for less profit or ouch…a loss. You must also consider how much lead time you wish to provide your current clients and invest time in carefully communicating your new pricing strategies to your existing clients. Finally, it is important to understand that any changes to your pricing model necessitates an update to your ADV and your client agreement(s).

#2: Redefine your Target Market

Alternatively, you can always decide to replace some current clients with ones that have the willingness and ability to pay the new higher market rate for your services. Many firms find it prudent to use this type of market shock to reevaluate their ideal client and help offboard current clients that do not fit that mold. Again, historically, many new consumers are entering the market for financial planning services, so finding new clients should be feasible—though not free.

The key here is knowing that the cost of doing business and the value of your time in the business has gone up, and thus, recalibrating your pricing is necessary. Innovation is a key component of maintaining clients and expanding your practice during this time. In fact, it is during these economic shocks that we often see restless innovation channeled to propel firms to higher ground. Inventing and creating alternative pricing structures in these moments is not only kind, it is smart business.

What initiatives have you taken in your own firm to anticipate the wake of inflation?

Further reads:

https://www.napa-net.org/news-info/daily-news/why-consumers-use%E2%80%94and-dont-use%E2%80%94financial-advisors

About Monique Dutkowsky, XYPN's Director of Strategic Initiatives

About Monique Dutkowsky, XYPN's Director of Strategic Initiatives

Monique Dutkowsky is XYPN's Director of Strategic Initiatives. In her role, she researches and develops new service lines for XYPN’s 1600 members (and counting!) to help them live their best lives. She is an economist and former adjunct professor of economics at Montana State University. When she’s not playing with her three kids, she spends her time enjoying the beauty of Montana through trail running, backpacking, and skiing.

Share this

- Advisor Posts (433)

- Fee-only advisor (388)

- Advice (316)

- Business Development (245)

- Independent Financial Advisor (204)

- Growing Your Firm (160)

- Marketing (132)

- Financial Planning (104)

- What Would Arlene Say (WWAS) (81)

- Firm Ownership (78)

- Business Coach (77)

- Training (76)

- Compliance (71)

- Business (69)

- Building Your Firm (68)

- Financial Advisors (65)

- Online Marketing (61)

- Events (60)

- Starting a Firm (50)

- From XYPN Members (48)

- Technology (48)

- Launching a firm (45)

- Advisors (42)

- Entrepreneurship (39)

- Taxes (39)

- Staffing & HR (38)

- Networking & Community (33)

- Interviews and Case Studies (32)

- Investment Management (32)

- XYPN Invest (28)

- Tax Preparation (27)

- Business Owner (25)

- Social Responsibility (25)

- Sales (24)

- Small Business Owner (20)

- Industry Trends & Insights (19)

- From XYPN Invest (18)

- Financial Planners (17)

- Independent Financial Planner (17)

- XYPN (17)

- Leadership & Vision (16)

- XYPN News (16)

- Tech Stack (15)

- How to be a Financial Advisor (14)

- RIA (14)

- Investing (13)

- Media (13)

- NextGen (13)

- Press Mentions (13)

- Financial Education (12)

- Goals (12)

- RIA Owner (12)

- XYPN Membership (12)

- Assets Under Management (AUM) (11)

- First Year (11)

- Niche (11)

- SEC (10)

- Advisor Success (9)

- RIA Registration (9)

- Communication (8)

- Lessons (8)

- Study Group (8)

- Time Management (8)

- Virtual Advisor (8)

- Growth (7)

- Mental Health (7)

- Pricing Models (7)

- From Our Advisors (6)

- Independent RIA (6)

- Money Management (6)

- Motivation (6)

- Preparing to Launch (6)

- Processes (6)

- Risk and Investing (6)

- Automation (5)

- Behavioral Finance (5)

- Broker-Dealers (5)

- College Planning (5)

- Filing Status (5)

- How I Did It series (5)

- Investment Planner (5)

- Michael Kitces (5)

- Preparing to Launch (5)

- Retirement (5)

- S Corpration (5)

- Scaling (5)

- Support System (5)

- TAMP (5)

- Wealth (5)

- Year-End (5)

- Bear Market (4)

- CFP Certification (4)

- Outsourcing (4)

- Selling a Firm (4)

- Small Business (4)

- State Registration (4)

- Succession Plans (4)

- Benchmarking Study (3)

- Bookkeeping (3)

- Budgeting (3)

- ESG Investing (3)

- Emotional Decisions (3)

- Engagement (3)

- Fiduciary (3)

- Financial Life Planning (3)

- Getting Leads (3)

- IRA (3)

- Life planning (3)

- Lifestyle practice (3)

- Membership (3)

- Millennials (3)

- Monthly Retainer Model (3)

- Monthly Subscription Model (3)

- Partnership (3)

- Pricing (3)

- RIA Audit (3)

- Recordkeeping (3)

- Risk Assessment (3)

- Staying Relevant (3)

- Wellness (3)

- Work Life Balance (3)

- Advice-Only Planning (2)

- Building Your Firm (2)

- Career Changers (2)

- Charitable Donations (2)

- Community Property (2)

- Design (2)

- Differentiation (2)

- Exchange-Traded Funds (ETF) (2)

- FINRA (2)

- Finding Your Why (2)

- Graphic design (2)

- Growing Income (2)

- Health Care (2)

- Inflation (2)

- Key performance indicator (KPI) (2)

- Keynote (2)

- Negative Rates (2)

- Operations (2)

- Organization (2)

- Outsourced Asset Management (2)

- Outsourced Bookkeeping (2)

- Portfolio Management (2)

- Productivity (2)

- Psychology (2)

- Quickbooks (2)

- Recommended Reading (2)

- Recruiting (2)

- Registered Representative (2)

- Registration (2)

- Restricted Stock Units (RSU) (2)

- Start Ups (2)

- Stock Options (2)

- Team Communication (2)

- Virtual Assistant (2)

- Virtual Paraplanner (2)

- Accounting (1)

- Arlene Moss (1)

- Assistant (1)

- Bonds (1)

- Bull Market (1)

- Careers (1)

- Certified Public Accountant (CPA) (1)

- Childcare (1)

- Client Acquisition (1)

- Client Services (1)

- Common Financial Mistakes (1)

- Consulting (1)

- Consumerism (1)

- Credit (1)

- Custodians (1)

- Custody Rule (1)

- Data (1)

- Daycare (1)

- Definitions (1)

- Designations (1)

- Direct Indexing (1)

- Disasters (1)

- Earn More (1)

- Family (1)

- Fidelity (1)

- Finance (1)

- Financial Freedom (1)

- Financial Goals (1)

- Financial Life Management (1)

- Financial Success (1)

- Financial Wellness (1)

- Form 8606 (1)

- Form 8915-E (1)

- Grief (1)

- Guide (1)

- How to Budget (1)

- Impostor Syndrome (1)

- Interns (1)

- Investor Policy Statement (IPS) (1)

- Job burnout (1)

- Liquidating your business (1)

- Loans (1)

- Moving Forward (1)

- Part Time (1)

- Paying Yourself (1)

- Paystub (1)

- Perfectionism (1)

- Project Management (1)

- Projecting Returns (1)

- Purpose (1)

- Quarterly Estimated Payments (1)

- RIA Operations (1)

- Recession (1)

- Referrals (1)

- Regulations (1)

- Regulators (1)

- Reinvention (1)

- Relationships (1)

- Remote (1)

- Required Minimum Distributions (RMD) (1)

- Risk Management (1)

- Roth Conversations (1)

- Roth IRA (1)

- Sabbatical (1)

- Spending (1)

- Strategy (1)

- Systems (1)

- Target Audience (1)

- Teamwork (1)

- Terms (1)

- To-Do List (1)

- Traditional IRA (1)

- Transitions (1)

- Virtual (1)

- Vulnerability (1)

- XYPN Books (1)

Subscribe by email

You May Also Like

These Related Stories

4 Essential Tips to Safeguard Your Firm Against Inflation

How to Determine Your Pricing and Services as You Launch Your Firm