Business Considerations For Firm Owners During Tough Times

Share this

The past few weeks have brought a tremendous amount of uncertainty in all aspects of our lives. As a financial planner, you are balancing working with your clients and helping them stick to the financial plan that you developed, shifting to a virtual service model, and thinking about the short- and long-term implications for your business.

Over the coming weeks, the focus will mostly be on your clients to ensure they are staying on track with their financial plan and goals. This may be a time to revisit their budgeting and cash flow analysis to determine if any updates are needed allowing you to make small adjustment to help provide your clients some assurances during this stressful time. Michael Kitces covers Ten Planning Conversations To Help Clients Now During the COVID-19 Pandemic in a recent article.

While the focus will be on your clients, it’s also important to think strategically about your business and the small adjustments, both short- and long-term, that will allow you to continue to serve your clients effectively and run a sustainable business.

If you are no longer able to work out of your office, one of your first steps is to review your business contingency plan to ensure you have documented procedures to continue to serve your clients and operate your business. This includes: secure access to your client information, including your CRM and any file secure file storage your firms uses, access to your planning software and custodian to review and update plans and investment accounts, and access to voicemail, email, and your schedule.

If you do have to move your office location and start to work out of your home, you should notify your regulator as well. All of this needs to be documented and tested as part of your firm contingency plan. If you haven’t established a firm contingency plan now is the time to do it. This is different from a succession and continuity plan, which is equally as important; both are requirements for running an RIA and acting as a fiduciary for your clients.

The next may seem obvious but if you haven’t shifted to a virtual service model with your clients, you will need to do so quickly. This includes providing virtual services to your clients as well as communicating with your team and key business partners.

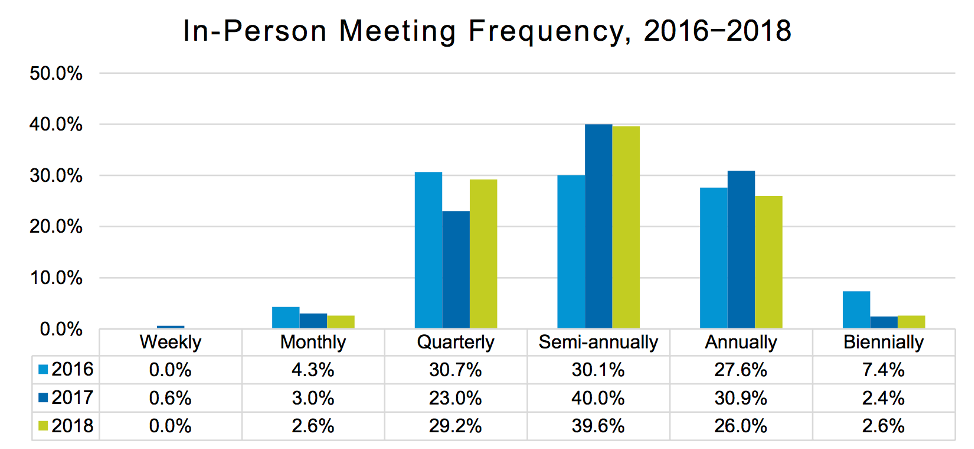

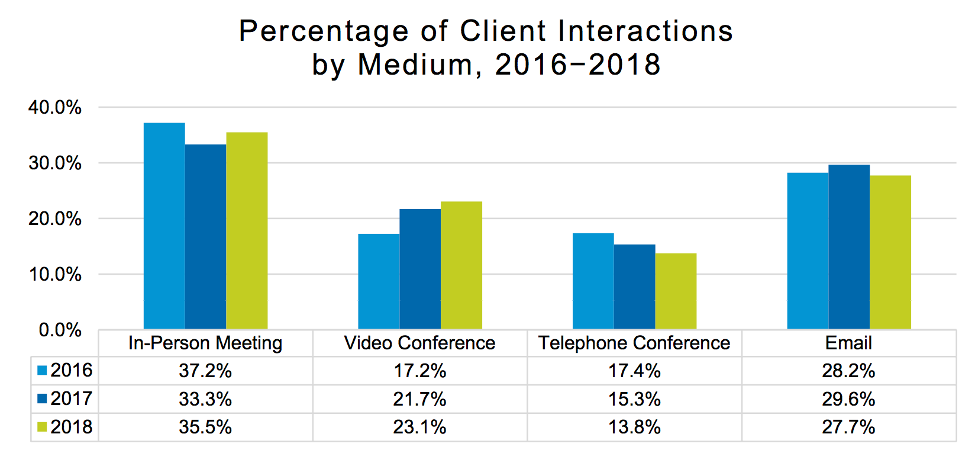

According to the 2019 XYPN Benchmarking Study, planners are still holding 35.5% of their client interactions in person, followed by email, video conference, and telephone conference. The majority of planners meet with their clients in-person quarterly or semiannually.

Shifting to virtual meeting may seem daunting at first if you are conducting all your meetings in person, but in many cases, your clients are already communicating regularly this way with friends, family, and other professionals. I would encourage you to use video conferencing whenever possible. It allows you to not only hear but see your client, which will help you connect with them and give your client comfort that you are there and working for them during this time.

From a technology perspective, shifting to virtual meetings and running a virtual office has gotten much easier because the majority of planning software, investment platforms, custodians, and CRMS are cloud-based and can be accessed from a secure internet connection. If you don't already have a video conferencing software, you'll likely want one—77% of XYPN members, and 100% of Team XYPN, use Zoom. You can integrate Zoom with your calendar (including scheduling software such as Calendly), allowing you to seamlessly set up meetings with clients and provide them your virtual conference information.

If you haven’t established a single place for your client to login and view their plan and account information, now's the time to do it; 66% of XYPN members currently use their financial planning software as their primary client portal. One of the advantages of this is the vault in the planning software is a great place to share secure documents with your clients and reinforces them going there to get their financial information.

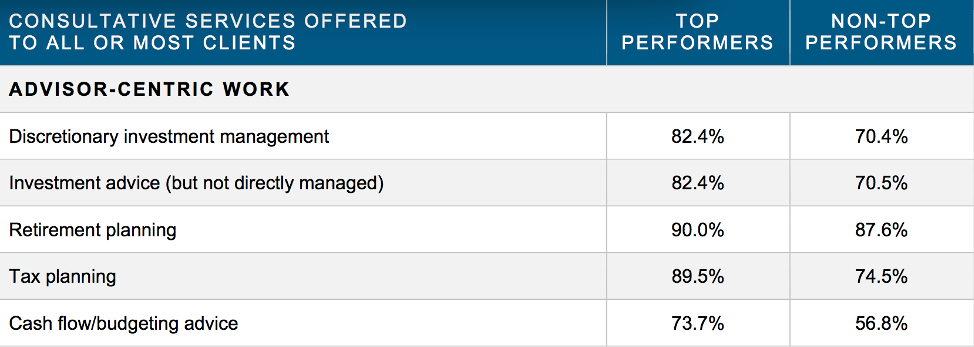

Another area that you may want to evaluate during this time are the services you are providing and how you are charging for those services. This is not the time to completely change your business model. However, businesses that are able to adapt to and move with their customers' needs are able to stay relevant and valuable during difficult times. Most XYPN firms offer four to eight services on top of financial planning, and when you look at top performing firms, they primarily focus on their core advisor-centric work:

Other areas that top performing firms tend to focus on are Life/DI/LTC planning (58.8%), estate planning (55%), property and casualty insurance (50%), and employee benefit advice (42.1%).

Cashflow/budgeting advice is incorporated into 73.7% of top performing firms and is something that may be particularly valuable for your current and future clients.

This could also be an opportunity to review your pricing options and determine if you want to add some additional options for clients. For example, you might add an hourly or project-based option for clients. While generally this option may not be the best to scale a business, it can be a great way to engage with a client on a specific area that is important to them. This could allow you to provide immediate value to clients in need without a long-term commitment, show your value as a planner, and create some additional revenue for your firm as other revenue streams (AUM) have decreased.

Diversifying your sources of revenue is also an important consideration for your business. If all of your firm revenue is generated from a percentage of AUM, then your firm revenue will fluctuate with the market. Firms that are able to create recurring revenue streams from planning and ongoing advice are able to demonstrate value beyond the investment management with clients and have businesses that are better positioned for market downturns. Creating multiple recurring revenue streams will ultimately make your business more sustainable and also valuable from a valuation perspective.

The last area that is key to the long-term sustainability of your firm is profit management. While businesses and the economy are doing well, many firms focus on their growth rate year over year. However, while growth is important, when businesses face difficult times, profitability becomes the focus.

To keep this simple we will define profitability as:

Revenue – Direct Expenses – Overhead Expenses = Profit

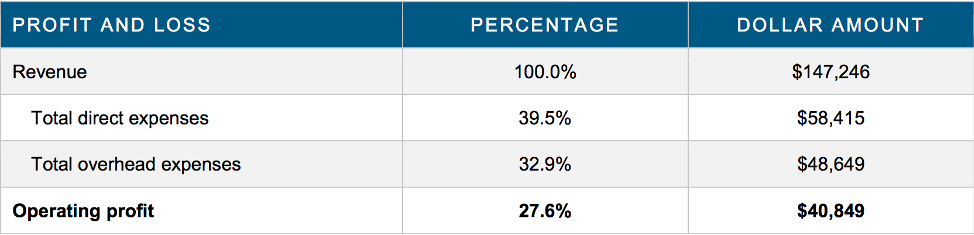

Direct expenses in a planning business can be defined as salary, bonus, and commissions paid to the professional delivering of advice to clients. This generally includes advisors, support advisors, investment managers, outside referral fees, and owner/advisor compensation. Overhead expenses include all other expenses required to operate the business, staff compensation, benefits, rent, technology, licensing, insurance, etc. For benchmarking perspective, in 2018, the average XYPN firm had the following breakdown of revenue, expenses, and profit:

The direct expenses can generally be broken into owner compensation and compensation paid top other client-facing professionals. As the owner of a firm, it’s important to model compensation for yourself; this gives you a clearer picture of your gross profit and allows you to take compensation for personal living expenses and still have profit to grow the business.

You should also review your overhead expenses, just as as you do for your clients. Some are fixed costs—rent, staff, technology—while others are variable, such as marketing, business development, conferences, and travel.

Monitoring and adjusting (where needed) your revenue, direct and overhead expenses, and ultimately your profit are key to continuing to run a planning firm that will effectively service your clients through these difficult times and build a business that will last well into the future.

While the past few weeks have been difficult for everyone, it's time like these that clients need financial advice and planning more than ever. If you can find ways to make small adjustments to your business to meet your clients' (and prospects'!) current needs, you will be able to provide them the value they need while also putting your business in position to succeed long term.

About the Author

As XYPN's Director of Advisor Success, Malcolm is tasked with doing just that—helping advisors succeed. After graduating from Gettysburg College with a B.A in Management, Malcolm jumped straight into the financial services industry and never looked back. With a drive to help shape the future of financial planning and a passion for bringing financial advice to the next generation of clients, he has a lot in common with the advisors in the Network.

Share this

- Advisor Posts (433)

- Fee-only advisor (388)

- Advice (316)

- Business Development (245)

- Independent Financial Advisor (204)

- Growing Your Firm (160)

- Marketing (132)

- Financial Planning (104)

- What Would Arlene Say (WWAS) (81)

- Firm Ownership (78)

- Business Coach (77)

- Training (76)

- Compliance (71)

- Business (69)

- Building Your Firm (68)

- Financial Advisors (65)

- Online Marketing (61)

- Events (60)

- Starting a Firm (50)

- From XYPN Members (48)

- Technology (48)

- Launching a firm (45)

- Advisors (42)

- Entrepreneurship (39)

- Taxes (39)

- Staffing & HR (38)

- Networking & Community (33)

- Interviews and Case Studies (32)

- Investment Management (32)

- XYPN Invest (28)

- Tax Preparation (27)

- Business Owner (25)

- Social Responsibility (25)

- Sales (24)

- Small Business Owner (20)

- Industry Trends & Insights (19)

- From XYPN Invest (18)

- Financial Planners (17)

- Independent Financial Planner (17)

- XYPN (17)

- Leadership & Vision (16)

- XYPN News (16)

- Tech Stack (15)

- How to be a Financial Advisor (14)

- RIA (14)

- Investing (13)

- Media (13)

- NextGen (13)

- Press Mentions (13)

- Financial Education (12)

- Goals (12)

- RIA Owner (12)

- XYPN Membership (12)

- Assets Under Management (AUM) (11)

- First Year (11)

- Niche (11)

- SEC (10)

- Advisor Success (9)

- RIA Registration (9)

- Communication (8)

- Lessons (8)

- Study Group (8)

- Time Management (8)

- Virtual Advisor (8)

- Growth (7)

- Mental Health (7)

- Pricing Models (7)

- From Our Advisors (6)

- Independent RIA (6)

- Money Management (6)

- Motivation (6)

- Preparing to Launch (6)

- Processes (6)

- Risk and Investing (6)

- Automation (5)

- Behavioral Finance (5)

- Broker-Dealers (5)

- College Planning (5)

- Filing Status (5)

- How I Did It series (5)

- Investment Planner (5)

- Michael Kitces (5)

- Preparing to Launch (5)

- Retirement (5)

- S Corpration (5)

- Scaling (5)

- Support System (5)

- TAMP (5)

- Wealth (5)

- Year-End (5)

- Bear Market (4)

- CFP Certification (4)

- Outsourcing (4)

- Selling a Firm (4)

- Small Business (4)

- State Registration (4)

- Succession Plans (4)

- Benchmarking Study (3)

- Bookkeeping (3)

- Budgeting (3)

- ESG Investing (3)

- Emotional Decisions (3)

- Engagement (3)

- Fiduciary (3)

- Financial Life Planning (3)

- Getting Leads (3)

- IRA (3)

- Life planning (3)

- Lifestyle practice (3)

- Membership (3)

- Millennials (3)

- Monthly Retainer Model (3)

- Monthly Subscription Model (3)

- Partnership (3)

- Pricing (3)

- RIA Audit (3)

- Recordkeeping (3)

- Risk Assessment (3)

- Staying Relevant (3)

- Wellness (3)

- Work Life Balance (3)

- Advice-Only Planning (2)

- Building Your Firm (2)

- Career Changers (2)

- Charitable Donations (2)

- Community Property (2)

- Design (2)

- Differentiation (2)

- Exchange-Traded Funds (ETF) (2)

- FINRA (2)

- Finding Your Why (2)

- Graphic design (2)

- Growing Income (2)

- Health Care (2)

- Inflation (2)

- Key performance indicator (KPI) (2)

- Keynote (2)

- Negative Rates (2)

- Operations (2)

- Organization (2)

- Outsourced Asset Management (2)

- Outsourced Bookkeeping (2)

- Portfolio Management (2)

- Productivity (2)

- Psychology (2)

- Quickbooks (2)

- Recommended Reading (2)

- Recruiting (2)

- Registered Representative (2)

- Registration (2)

- Restricted Stock Units (RSU) (2)

- Start Ups (2)

- Stock Options (2)

- Team Communication (2)

- Virtual Assistant (2)

- Virtual Paraplanner (2)

- Accounting (1)

- Arlene Moss (1)

- Assistant (1)

- Bonds (1)

- Bull Market (1)

- Careers (1)

- Certified Public Accountant (CPA) (1)

- Childcare (1)

- Client Acquisition (1)

- Client Services (1)

- Common Financial Mistakes (1)

- Consulting (1)

- Consumerism (1)

- Credit (1)

- Custodians (1)

- Custody Rule (1)

- Data (1)

- Daycare (1)

- Definitions (1)

- Designations (1)

- Direct Indexing (1)

- Disasters (1)

- Earn More (1)

- Family (1)

- Fidelity (1)

- Finance (1)

- Financial Freedom (1)

- Financial Goals (1)

- Financial Life Management (1)

- Financial Success (1)

- Financial Wellness (1)

- Form 8606 (1)

- Form 8915-E (1)

- Grief (1)

- Guide (1)

- How to Budget (1)

- Impostor Syndrome (1)

- Interns (1)

- Investor Policy Statement (IPS) (1)

- Job burnout (1)

- Liquidating your business (1)

- Loans (1)

- Moving Forward (1)

- Part Time (1)

- Paying Yourself (1)

- Paystub (1)

- Perfectionism (1)

- Project Management (1)

- Projecting Returns (1)

- Purpose (1)

- Quarterly Estimated Payments (1)

- RIA Operations (1)

- Recession (1)

- Referrals (1)

- Regulations (1)

- Regulators (1)

- Reinvention (1)

- Relationships (1)

- Remote (1)

- Required Minimum Distributions (RMD) (1)

- Risk Management (1)

- Roth Conversations (1)

- Roth IRA (1)

- Sabbatical (1)

- Spending (1)

- Strategy (1)

- Systems (1)

- Target Audience (1)

- Teamwork (1)

- Terms (1)

- To-Do List (1)

- Traditional IRA (1)

- Transitions (1)

- Virtual (1)

- Vulnerability (1)

- XYPN Books (1)

Subscribe by email

You May Also Like

These Related Stories

Firm Ownership: An In-Depth Look at the Journey from Start to Finish

Buying or Selling a Financial Planning Firm? Here's What You Need to Know