A Breakdown of the 5 Tax Filing Statuses

Share this

It’s that time of year again…taxes! Everyone’s favorite thing, right? (For tax nerds like us, it actually is!) Maybe you’ve heard of a tax filing status, or maybe you’re wondering what the heck a filing status even is. Either way, we’re going to discuss the five filing statuses and the requirements for each. This should clear up any confusion and help you get those taxes filed correctly with the biggest refund (or smallest tax liability) possible! Let’s dive right in.

What’s a tax filing status, anyways?

A filing status categorizes the tax return form a taxpayer uses to file his or her taxes. Your filing status determines your filing requirements, standard deduction, eligibility for certain credits, and the rate your income is taxed. For all you folks who have tied the knot, filing status is closely tied to marital status. The status you choose can affect how much you owe in taxes for the year, so it’s important to choose the right filing status when you file your tax return.

The five filing statuses:

- Single

- Married Filing Jointly

- Married Filing Separately

- Head of Household

- Qualifying Widow(er)

With that said, more than one tax status may apply to you. For example: married filing jointly and married filing separately. Choose the one that allows you to pay the least amount of taxes or the one that gets you the biggest refund. (Who doesn’t want to get more money back?)

If you get married on the last day of the year, then you will file as married filing jointly for that tax year. You would not file as single or head of household even if you were that status the majority of the year. Whatever your situation is as of December 31 is what you will use to determine your filing status for tax purposes.

Now, let’s break it down for each filing status!

Single

A taxpayer that is unmarried, divorced, a registered domestic partner, or legally separated according to state law as of the last day of the tax year (December 31) should file single on their tax return. To file single, you cannot have any dependents. Single is the most basic filing status with lower income limits for most exemptions. Head of household and widow(er) does not fall under the “single” category for tax purposes.

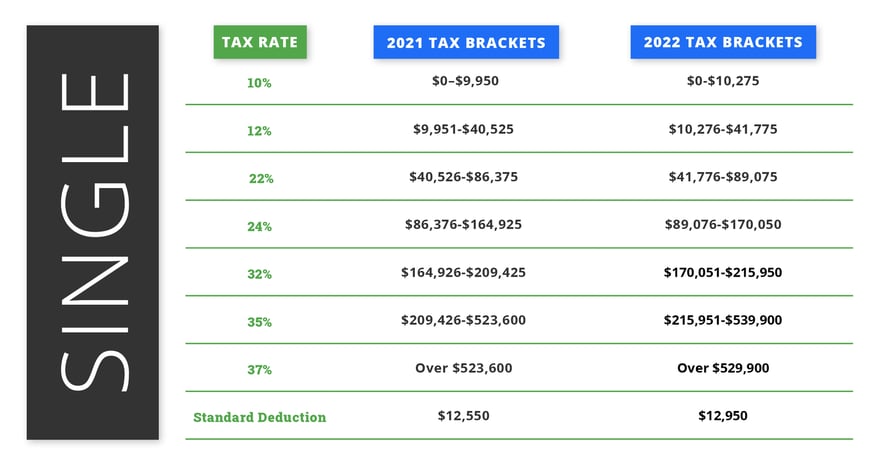

The standard deduction for single filers in 2021 is $12,550. In 2022, the standard deduction is $12,950. Each year, the IRS raises the standard deduction to account for inflation. The table below shows the federal income tax rate for single filers based on tax bracket.

A tax rate is a percentage at which income is taxed. (See the far-left column in the table.) A tax bracket has a marginal tax rate, which means you pay a different tax rate based on additional income. (See the middle and right columns in the table.) Except for those in the lowest tax bracket, a taxpayer’s income is taxed progressively.

For example: If a single filer makes less than $9,950 in taxable income in 2021, then they must pay at the 10% tax rate. If that same taxpayer makes more than $9,950, any income above $9,950 but less than $40,525 will be taxed at the 12% tax rate, which is the next tax bracket. Any income in the following tax bracket from $40,525 to $86,375 will be taxed at a rate of 22%. This pattern continues up the tax brackets.

Married filing jointly

This is the filing status used for most married couples. When married filing jointly (MFJ), you file together and report your combined incomes, exemptions, deductions, and credits. Both individuals are responsible for the taxes, interest, and/or penalties due.

A joint return is typically more beneficial than another filing status if you are married because your standard deduction will be higher and there are deductions and credits that you can take that aren’t usually available if you file another way. It often provides a bigger tax refund or lower tax liability if you file married filing jointly. (More perks to that married life!)

Who qualifies as a married couple?

- Anyone legally married and living together as husband and wife on December 31, including same-sex couples (see the IRS note below).

- For tax purposes, the IRS has “a general rule recognizing the marriage of same-sex spouses that was validly entered into in a domestic or foreign jurisdiction whose laws authorize the marriage of two individuals of the same sex even if the married couple resides in a domestic or foreign jurisdiction that does not recognize the validity of same-sex marriages.” (Reference)

- Anyone living together as “spouses” in a state that recognizes common-law marriage.

- The IRS recognizes common-law marriages as legal marriages. If you have a valid common-law marriage in your state, you are considered married for tax purposes. (Reference)

- Check out this website to learn more about which states recognize common law marriage.

- Anyone still legally married on December 31 that has not legalized their separation or whose divorce has not yet been finalized.

- An individual whose spouse died during the tax year and has not remarried.

You do not qualify if you were an unmarried partner or legally divorced on or before December 31. According to the IRS, “For Federal tax purposes, the term ‘marriage’ does not include registered domestic partnerships, civil unions, or other similar formal relationships recognized under state law that are not denominated as a marriage.” (Reference)

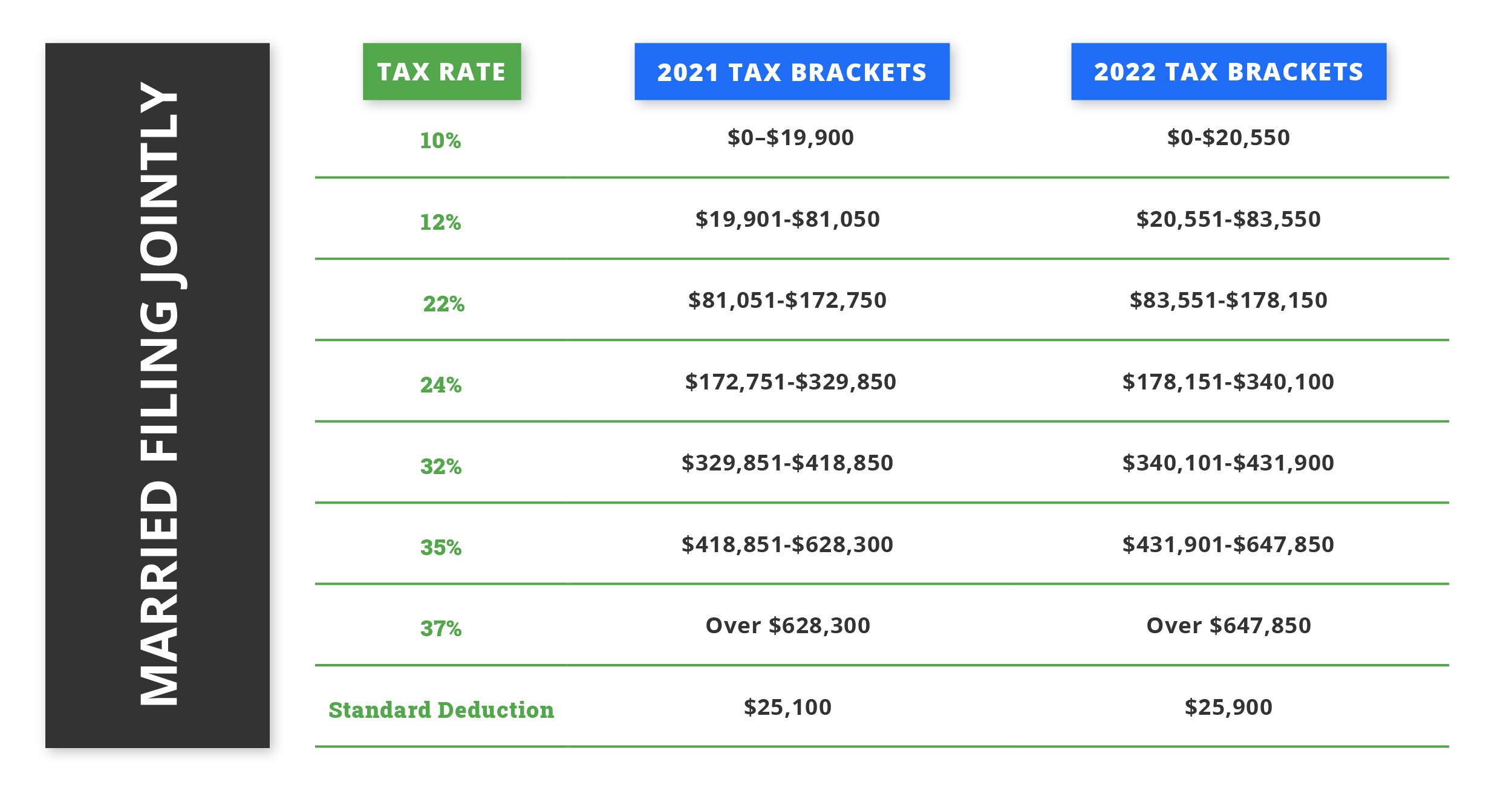

The standard deduction when married filing jointly is $25,100 in 2021 and $25,900 in 2022. This chart shows the tax rates and income tax brackets for those married filing jointly.

Married filing separately

Married filing separately is a filing status for legally married couples, but otherwise, there are no special qualifications. Both spouses must choose the SAME filing status. That means both spouses must file married filing separately or married filing jointly. One spouse cannot file married filing separately while the other spouse files married filing jointly.

Reasons to file separately:

- One reason someone might choose to file separately is if you only want to be responsible for your own tax liability and not your spouse’s liability. For example: if you recently married and your spouse has tax liability issues. Another example would be if you think your spouse might be hiding income.

- If you and your spouse were married on December 31 but have a pending divorce and cannot agree to file a joint return, then that is another instance you might choose to file separately.

- When one spouse has significant miscellaneous deductions or medical expenses, filing separately may benefit those couples.

Typically, married filing jointly will be more tax beneficial than married filing separately by resulting in a larger tax refund or a smaller tax liability. However, there are certain circumstances where that may not be the case.

The 2021 and 2022 standard deductions for married filing separately are the same as for single filers–$12,550 and $12,950, respectively.

Head of household

To meet the requirements for head of household (HOH) status, the taxpayer should be unmarried and have a qualifying dependent. Heads of household benefit from a lower tax rate and higher standard deduction than single filers.

A qualifying dependent may involve a dependent child, grandchild, sibling, grandparent, or individuals who can be claimed as an exemption. To be considered for this category, the taxpayer must have the qualifying dependent living with them for more than half the year. They must also have paid more than 50% of the costs of home upkeep for the qualifying dependent, including rent or mortgage, utilities, insurance, property taxes, groceries, repairs, and other regular household expenses.

Special provision: In certain situations, you may be able to file as head of household even if you are still legally married. If you are separated from your spouse for the last half of the year or longer and you keep up a home for a dependent child, you could potentially qualify.

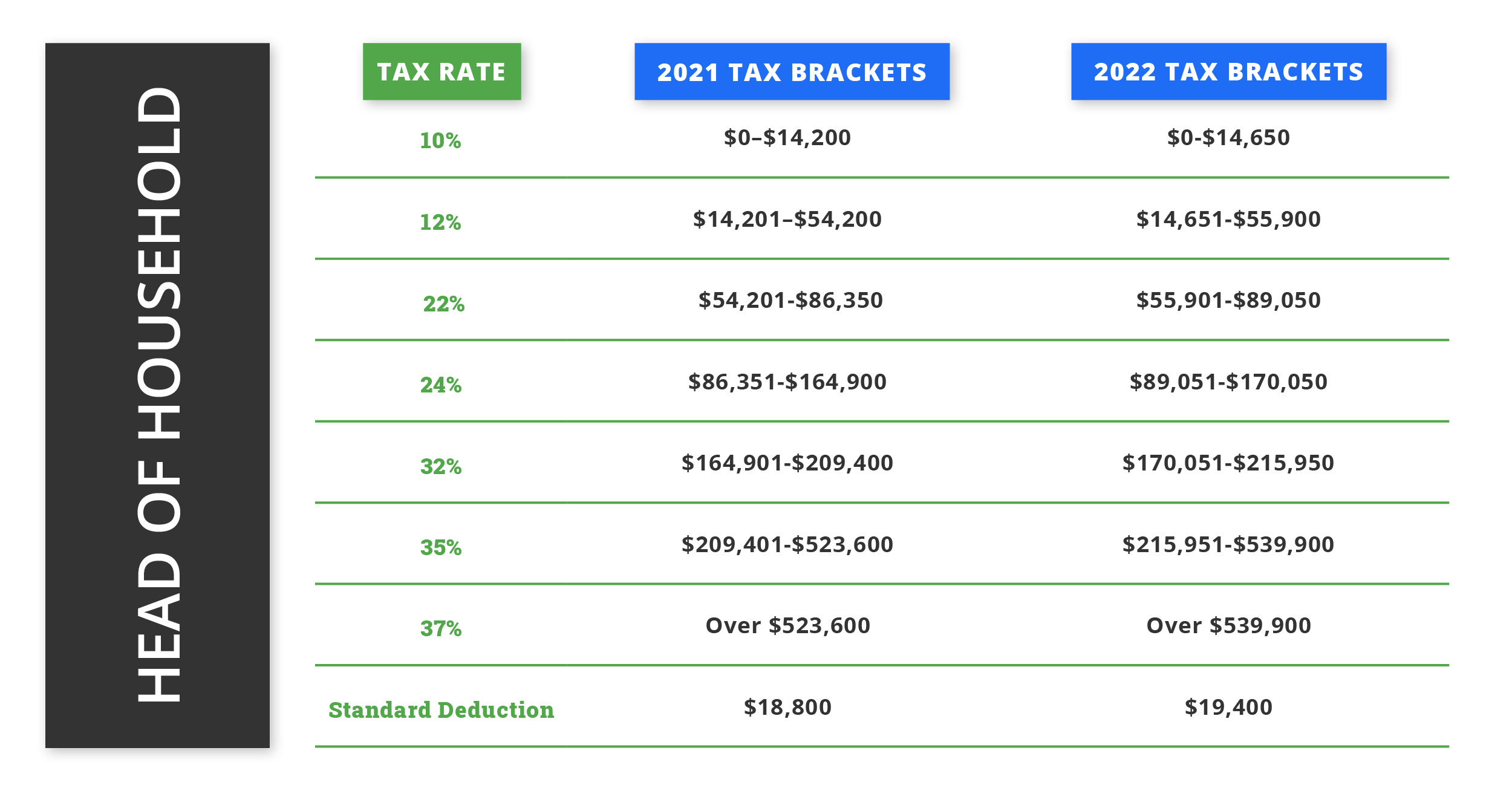

In 2021, the standard deduction for head of household is $18,800, while the standard deduction increases to $19,400 for 2022. The table below provides information on tax rates and income ranges for HOH status.

Qualifying widow(er)

For the two years after the death of a spouse, the surviving husband or wife can file as a qualifying widow or widower if they remain unmarried and have a dependent child living with them for whom they provide 50% or more of their support. The kids are the main consideration here, as you probably won’t qualify for this filing status if your kids are already out of the house (over 18 years old, or over 24 years old for full-time students) when your spouse dies.

With the qualifying widow(er) status, you can file as if you were married filing jointly. When a spouse is deceased, the surviving widow(er) cannot claim an exemption for them. However, the taxpayer can still claim the standard deduction for married filing jointly. This puts you in a better tax bracket with a higher standard deduction than if you filed as single or head of household.

The 2021 standard deduction is $25,100, and the 2022 standard deduction will be $25,900.

The bottom line

It’s important to know which tax filing status you qualify for because it will determine your standard deduction and the rate at which your income is taxed. The status you choose will impact how much you owe in taxes or how big your refund will be. These filing status basics are a great reference point when doing your taxes. Of course, it’s always best practice to consult with your tax professional to determine which is the right filing status for your specific situation.

P.S. Interested in learning how to integrate tax prep and planning into your service model? Team XYTS and two XYPN member advisors did a webinar on just that, and you can watch it on-demand here.

About the Authors

Alli Whittle is a Tax Intern for XY Tax Solutions. Alli's favorite part about her job is working alongside her rockstar teammates on Team XYTS. The positive environment these tax experts cultivate every day makes it a pleasure to show up for work—even on Mondays. In her free time, you can often find Alli reading personal development books or binge-watching Netflix with her family, including her two kids, Emma and Jamie

Rubiyat Alam is a Tax Intern on Team XY Tax Solutions. His favorite part about his job is constantly learning from the next-level XYTS team, engaging with new tax topics, and always prioritizing clients. When Rubiyat is not working, he loves playing basketball, watching sports, and is a professional at relaxing on the beach.

Share this

- Fee-only advisor (381)

- Advice (305)

- Business Development (248)

- Independent Financial Advisor (203)

- Growing Your Firm (161)

- Marketing (133)

- Financial Planning (129)

- What Would Arlene Say (WWAS) (81)

- Business Coach (80)

- Firm Ownership (78)

- Training (75)

- Compliance (72)

- Business (69)

- Building Your Firm (65)

- Financial Advisors (63)

- Online Marketing (61)

- Events (59)

- Starting a Firm (52)

- Staffing & HR (49)

- Technology (49)

- From XYPN Members (48)

- Launching a firm (46)

- Advisors (41)

- Entrepreneurship (38)

- Taxes (37)

- Networking & Community (33)

- Interviews and Case Studies (32)

- Investment Management (31)

- Sales (27)

- Social Responsibility (27)

- Tax Preparation (27)

- XYPN Invest (26)

- Business Owner (25)

- Small Business Owner (20)

- Financial Management & Investment (19)

- Industry Trends & Insights (19)

- Financial Education (17)

- Financial Planners (17)

- Independent Financial Planner (17)

- Tech Stack (17)

- XYPN (17)

- Leadership & Vision (16)

- Investing (15)

- Niche (15)

- How to be a Financial Advisor (14)

- NextGen (14)

- RIA (14)

- Media (13)

- Preparing to Launch (13)

- Press Mentions (13)

- RIA Operations (12)

- RIA Owner (12)

- XYPN Membership (12)

- Assets Under Management (AUM) (11)

- First Year (11)

- Goals (11)

- Scaling (10)

- Advisor Success (9)

- Building Your Firm (8)

- Communication (8)

- Lessons (8)

- Study Group (8)

- Time Management (8)

- Virtual Advisor (8)

- Behavioral Finance (7)

- Growth (7)

- Pricing Models (7)

- From Our Advisors (6)

- Independent RIA (6)

- Money Management (6)

- Motivation (6)

- Processes (6)

- Automation (5)

- Broker-Dealers (5)

- College Planning (5)

- Filing Status (5)

- How I Did It series (5)

- Investment Planner (5)

- Mental Health (5)

- Michael Kitces (5)

- Preparing to Launch (5)

- RIA Operations (5)

- Retirement (5)

- Risk and Investing (5)

- S Corpration (5)

- Support System (5)

- TAMP (5)

- Wealth (5)

- Year-End (5)

- Client Services (4)

- Outsourcing (4)

- Selling a Firm (4)

- Succession Plans (4)

- Benchmarking Study (3)

- Budgeting (3)

- Career Changers (3)

- Engagement (3)

- Fiduciary (3)

- Getting Leads (3)

- Membership (3)

- Millennials (3)

- Monthly Retainer Model (3)

- Partnership (3)

- Pricing (3)

- Recordkeeping (3)

- Risk Assessment (3)

- Small Business (3)

- Staying Relevant (3)

- Work Life Balance (3)

- Advice-Only Planning (2)

- Bookkeeping (2)

- Charitable Donations (2)

- Client Acquisition (2)

- Differentiation (2)

- Health Care (2)

- IRA (2)

- Inflation (2)

- Productivity (2)

- Implementing (1)

Subscribe by email

You May Also Like

These Related Stories

Business Tax Return Deadlines: Your Guide as an Independent Financial Advisor

5 Best Practices for a Successful and Stress-Free Tax Season