5-Part Marketing Plan for Independent Advisors: Why, What & How

Share this

As an independent financial advisor, you’re like so busy that you barely have enough time for marketing. You might shoot from the hip, squeezing in time here or there to crank out a blog or post on social media. Is taking the time to put together an actual marketing plan really necessary? Before I get into the ‘why’ of marketing plans, allow me to digress for just a moment about what you don’t need.

I’ve seen many marketing plans during my time as a ‘marketeer’ with XYPN that have more bark than bite. They tend to be too fluffy, too basic, or too high-level to be useful on the front lines. Large companies have marketing plans with hundreds of pages including an executive summary, an analysis of the market situation, a SWOT analysis, and more. I wouldn’t dissuade you from working on any of those pieces if they’re meaningful to you, but keep this in mind: large companies have teams of people putting together their marketing plans and they spend at least a couple of months doing them.

But that doesn’t necessarily mean you should forego making a plan altogether. For you, a shortcut is in order. In this post, I’ll cover the five essential pieces you must have in your plan. Make it as formal or informal as you wish, just be sure to cover the crucial pieces.

But first, let’s jump into the why.

Why Should I Spend Precious Time Writing a Marketing Plan?

Above all else, the marketing plan is a thought exercise. It will help you market more efficiently in the long run. As you work through each of the five parts, you’ll ensure you’re not missing opportunities to get the most out of your time and money. You’ll think creatively and proactively and you’ll undoubtedly have some lightbulb moments. The plan will get you organized so your marketing initiatives are executed flawlessly, maximizing the return.

If you work on a team, the marketing plan is your chance to get buy in, support and accountability. Everyone who plays a role should understand the big picture. If those on board understand why each piece is important, balls are less likely to get dropped.

What: The 5 Crucial Parts

Part 1: Strategy by Segment

Start with your strategy by segment. Don’t get too into the details just yet. When I put together a marketing plan for a new initiative, my strategy by segment is just one page (with plenty of white space to boot). This part of your plan is a brainstorming exercise.

Focus on the important part: segment. When I say segment, I don’t mean your niche. Drill down to the various segments of your niche. An easy way to do this is to ask, “What do they want from me?” Here’s an example of what your segments might be if your niche is “women in tech”:

- Segment 1: Those who want advice about RSUs

- Segment 2: Those focused on investing

- Segment 3: Those planning for early retirement

When you think about the help your prospective clients need, it becomes quite simple to plan a strategy to market to them. Those who want help with RSUs might appreciate a guide covering the basics, an offer to evaluate their employment agreement, or a free webinar on the subject. For each segment, define what they want and how you can help them.

Part 2: Creatives

If your marketing efforts have come up short in the past, it might be because you didn’t give enough attention to the key pieces you need to execute your strategy. If you want to advertise on Facebook, for example, you’ll need an ad image of the right proportions, a compelling call to action, solid copy, and a dedicated landing page that will allow you to clearly track success. Your plan might also include an automated email drip campaign to follow a free download. All of those emails should be carefully crafted for the segment you’re targeting. If you throw money at Facebook without pulling together these pieces first, you may be disappointed by the results.

You don’t need to create everything at once, but spend at least some time conceptualizing what you need and build a solid list of pieces to create. In your marketing plan, include at least one creative that defines the look and tone of your initiative.

Part 3: RACI

Call it a RACI, or call it a to-do list—what matters here is having a clear plan of who does what and when. If you’re a solopreneur, you don’t need a RACI, but a project list with self-imposed deadlines is a smart idea.

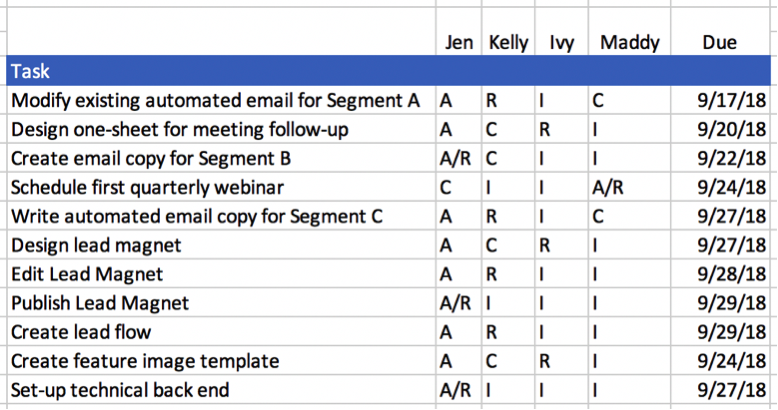

Teams of two or more can benefit from a RACI. We use RACI charts company-wide at XYPN for ongoing duties, but we also use them in marketing for new initiatives and big projects. If you’re not familiar, here’s how to set one up:

On a blank spreadsheet (Excel, Google Sheets, etc.) break down all of the work that needs to be done, giving each task its own row. Add a column for each contributor. For each task, mark the team member columns with an R, an A, a C or an I. The R’s are responsible for the project, meaning they do the work. The A’s are accountable; they oversee the work and stand behind it. The C’s need to be consulted on the task, and the I’s need to be informed.

For tasks that aren’t ongoing, we add a column for due dates to keep us on track. Here’s a peek at how one of our RACIs might look:

This is the part of your marketing plan where you dive into the details. Break down the work into steps, thinking through the entire plan from start to finish. Don’t forget to include data tracking, analysis, and revisions too! The work doesn’t end when the plan goes live.

Part 4: Projections

The hardest part of any marketing plan, projections are tricky yet vital. You have to look into your crystal ball and make an educated guess on what to expect from your effort. This is particularly difficult when you’re trying something new with no historical data for the ‘educated’ part. Although it may feel like you’re pulling numbers out of thin air at first, this is a crucial exercise and it will get easier.

When doing projections, I sometimes realize I need to go back to the drawing board because the expected results don’t justify the cost or effort. Putting the work into this exercise will tell you if your initiative is worthwhile. If using paid advertising, start tracking the cost of each lead and each client per initiative. This data will be invaluable as you allocate resources for future efforts.

But how can you possibly know what your conversion rates will be? If using Facebook, for example, you can do a little research to get industry averages for the platform. You can also look at conversion rates from other efforts to make an educated guess. The more you do this exercise, the better your projections will get.

Part 5: Dashboard

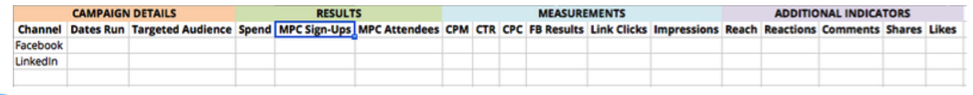

In the final part of my plan, I put together a dashboard that I’ll use to track success, because if you aren’t measuring, you aren’t marketing. It’s a matter of best practice to set up your dashboard on the front end of your plan to be sure you’re diligent about measuring.

Thinking through the data points that will speak to the effectiveness of your campaigns is also a good way to ensure you’re approaching your marketing right. If you aren’t able to get reliable data, you may choose to focus your resources elsewhere. Or, you may need to rethink your methodology. For example, a dedicated landing page may be necessary to measure traffic, or maybe an exclusive call-to-action will be the way to go. Building your dashboard is a good way to ensure you’ve crossed your t’s and dotted your i’s.

A dashboard for a social media campaign may look like this:

For ongoing initiatives, I’ll include data points in my monthly marketing data report to be sure I’m regularly checking the health of these efforts.

Avoid overcomplicating your data gathering; assessment is important but it shouldn’t dominate your time. Chart only the data points that are meaningful to you. Make sure you are able to establish a relevant baseline so if your efforts tank, the data will alert you of the problem.

In Summary

I challenge you to work through these five parts on your next marketing initiative, even if it’s on the back of a napkin. The thought exercise is worth the effort, even if informal. A little extra work on the front end will pay off in the long run. As your marketing becomes more efficient and more fruitful, you will be able to spend less time doing it!

About the Author

About the Author

As XYPN's Director of Marketing, Jennifer Mastrud is tasked with sharing the movement at XYPN. Her expertise is in branding, marketing, and public relations. She’s as passionate about the XYPN message as she is about innovating new ways to share it. Before joining XYPN, Jen accumulated several years of experience representing national brands in diverse sectors including technology, gaming, TV, and education. She’s based in Minnesota, but travels frequently to warm up.

Share this

- Fee-only advisor (381)

- Advice (305)

- Business Development (248)

- Independent Financial Advisor (203)

- Growing Your Firm (161)

- Marketing (133)

- Financial Planning (129)

- What Would Arlene Say (WWAS) (81)

- Business Coach (80)

- Firm Ownership (78)

- Training (75)

- Compliance (72)

- Business (69)

- Building Your Firm (65)

- Financial Advisors (63)

- Online Marketing (61)

- Events (59)

- Starting a Firm (52)

- Staffing & HR (49)

- Technology (49)

- From XYPN Members (48)

- Launching a firm (46)

- Advisors (41)

- Entrepreneurship (38)

- Taxes (37)

- Networking & Community (33)

- Interviews and Case Studies (32)

- Investment Management (31)

- Sales (27)

- Social Responsibility (27)

- Tax Preparation (27)

- XYPN Invest (26)

- Business Owner (25)

- Small Business Owner (20)

- Financial Management & Investment (19)

- Industry Trends & Insights (19)

- Financial Education (17)

- Financial Planners (17)

- Independent Financial Planner (17)

- Tech Stack (17)

- XYPN (17)

- Leadership & Vision (16)

- Investing (15)

- Niche (15)

- How to be a Financial Advisor (14)

- NextGen (14)

- RIA (14)

- Media (13)

- Preparing to Launch (13)

- Press Mentions (13)

- RIA Operations (12)

- RIA Owner (12)

- XYPN Membership (12)

- Assets Under Management (AUM) (11)

- First Year (11)

- Goals (11)

- Scaling (10)

- Advisor Success (9)

- Building Your Firm (8)

- Communication (8)

- Lessons (8)

- Study Group (8)

- Time Management (8)

- Virtual Advisor (8)

- Behavioral Finance (7)

- Growth (7)

- Pricing Models (7)

- From Our Advisors (6)

- Independent RIA (6)

- Money Management (6)

- Motivation (6)

- Processes (6)

- Automation (5)

- Broker-Dealers (5)

- College Planning (5)

- Filing Status (5)

- How I Did It series (5)

- Investment Planner (5)

- Mental Health (5)

- Michael Kitces (5)

- Preparing to Launch (5)

- RIA Operations (5)

- Retirement (5)

- Risk and Investing (5)

- S Corpration (5)

- Support System (5)

- TAMP (5)

- Wealth (5)

- Year-End (5)

- Client Services (4)

- Outsourcing (4)

- Selling a Firm (4)

- Succession Plans (4)

- Benchmarking Study (3)

- Budgeting (3)

- Career Changers (3)

- Engagement (3)

- Fiduciary (3)

- Getting Leads (3)

- Membership (3)

- Millennials (3)

- Monthly Retainer Model (3)

- Partnership (3)

- Pricing (3)

- Recordkeeping (3)

- Risk Assessment (3)

- Small Business (3)

- Staying Relevant (3)

- Work Life Balance (3)

- Advice-Only Planning (2)

- Bookkeeping (2)

- Charitable Donations (2)

- Client Acquisition (2)

- Differentiation (2)

- Health Care (2)

- IRA (2)

- Inflation (2)

- Productivity (2)

- Implementing (1)

Subscribe by email

You May Also Like

These Related Stories

The Independent Financial Advisor's Guide to Measuring Marketing

9 Experiments to Try When Marketing Your RIA