The Sequence of Return Risk and the Bull Market: A Must-Have Conversation

Share this

“Sequence of return risk” (or more succinctly, "sequence risk") can be the mortal enemy of years of planning, advisor/client relationships, and—unfortunately—the standard of living of clients who fall victim to it. There are many schools of thought on the topic, and this blog is not intended to advocate one mitigation strategy over another as I believe each of our advisors (and, in turn, each of your clients) may need or want to take differing approaches or a combination of strategies. This blog is purely intended to instigate some thought and invite a conversation. If you would like to see some of the more technical aspects of sequence risk, I highly recommend Michael Kitces’ two pieces on the subject: Retirement Date Risk – The Impact Of Sequence Of Returns Risk On Those Still Accumulating For Retirement and Understanding Sequence Of Return Risk – Safe Withdrawal Rates, Bear Market Crashes, And Bad Decades. My goal is simply to highlight some practical ways to have this conversation with your clients to foster a stronger decision-making process.

Given the extended bull market, somewhat stretched equity valuations, and ever-increasing geopolitical tension, near-term expectations for equity returns are likely to be on the low end, with risk therefore skewed to the downside. As such, we must protect our most vulnerable clients by understanding the potential of anything that might be lurking on the horizon. To clarify, I am not a market-timer and do not believe that long-term investors should pare back their stock holdings, especially if they are diversified internationally. It is, however, a good time to pay close attention for those clients with goals that may have shorter time horizons in the context of sequence risk.

While we can’t control the markets, and thus the timing of returns, there are some ways to mitigate sequence risk. It all goes back to controlling what you can. Consider the five factors over which we have control in every single plan we put together: spending, saving, timing (when we want certain things to occur), safety net, and risk (either in the form of portfolio allocation or even insurance strategies). Even the slightest change of any of these levers impacts the outcome of the plan. I am going to focus primarily on the risk lever, specifically with the portfolio of investments.

I suggest looking across your client base for those who may have near-term goals, let's say within five years. This may apply to clients saving for college, buying a house, taking a sabbatical or looking to launch a new business/side hustle, or other near-term goals that might have difficulty recovering from a decline. I recommend ensuring their portfolio allocation and cash-like holdings could support their first few years of income needs without undue strain in the event of a market downturn. I tend to avoid rules of thumb (such as having three years' worth of income in cash) because every client and situation is different. But if you know your clients well and look across their holdings with their risk-capacity in mind, you should have a good idea of whether or not they are properly insulated.

Using the Plan

One of the best ways to illustrate this with clients is to look at their plan and consider the various “trade-off” scenarios in real-time. Because we are talking about markets, let’s look at the risk lever in the form of portfolio allocation. Again, I am not talking about timing the market but rather looking at short-term goals and reviewing the impact a reduction in risk/allocation could have on the success of a potential goal.

Take this example from my own firm back in 2007. Many of our clients at the time had experienced a great run from 2002 to 2007 and were what we called in our firm “overfunded” when it came to reaching some of their goals. All this meant was that we needed to make adjustments to the factors we could control. While some clients elected to adjust their goals (take the bigger vacation, extend their giving, etc.), most simply elected to reduce the risk of their portfolios.

Then 2008 happened.

And we looked like geniuses. Not because we timed the market. Not because we adjusted their risk tolerance (that would have been detrimental because everyone’s risk was artificially high after years of good markets). We looked like masterminds because we used the plan to drive our decision-making process.

Now is a great time to have this discussion with your clients.

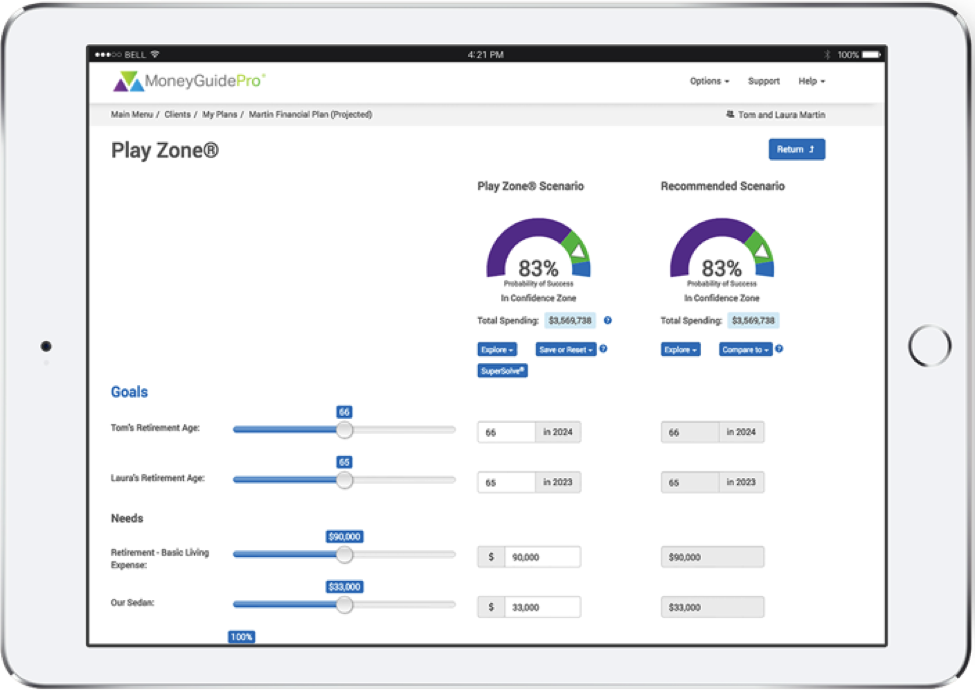

Below is an example of an interactive conversation with clients using MoneyGuidePro. Simply make small tweaks and ask, “How would taking the portfolio from 80% equity to 70% equity affect outcomes, and what other changes we would have to make? What if we only had to make those changes for a limited amount of time?” (There are similar capabilities with RightCapital, eMoney, etc.)

This is much easier said than done. Asking clients to “take less risk,” particularly when they are young and contributing, and even more so when all they have known is great markets, can be tough. Consider that many of our clients under 35-40 have yet to experience any semblance of a bad market as most didn’t yet have any skin in the game back in 2008/2009. And most of us have told them volatility works in their favor when they are dollar-cost averaging! Clearly this can quickly become an uphill battle, so let’s put another arrow in our quiver.

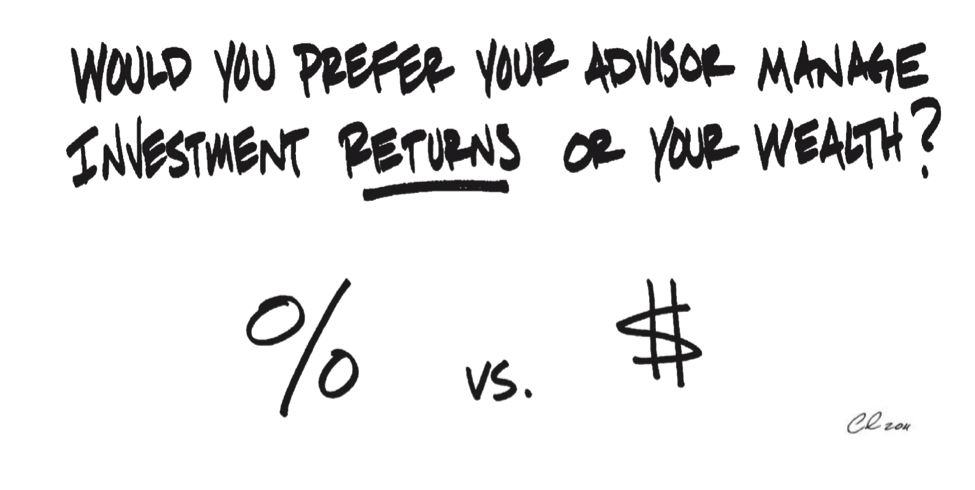

Dollars vs Returns

I like to use this sketch from our good friend Carl Richards when talking with clients about what we actually do as advisors and planners. When we ask clients this question, most say, “Well isn’t that the same thing?” Again, this is often tough for clients to understand particularly when the world has told them repeatedly, “returns, returns, returns, performance, performance, performance!” I’ve never been able to spend returns or percentages, but they seem to take my money just about everywhere. Don’t blame the clients; this is what the world teaches and for many it’s all they know when first seeking the help of a “financial person.”

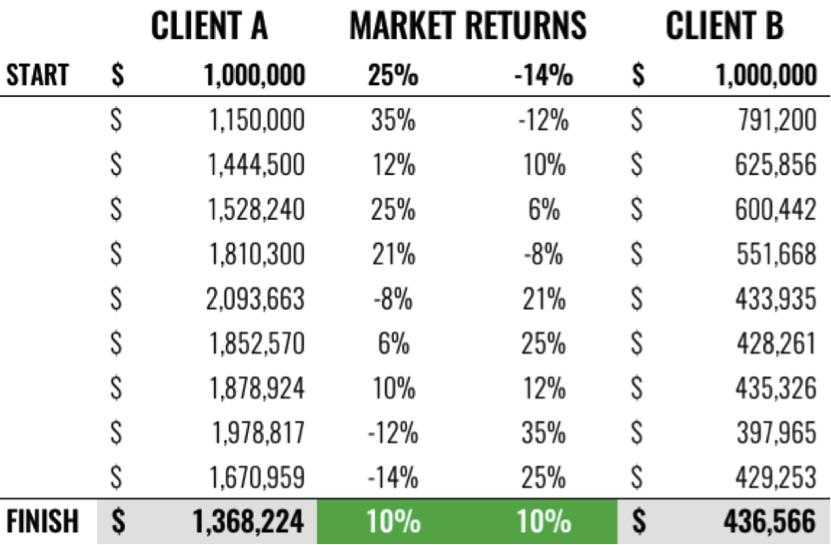

To help our clients make great decisions, we must lead them to a framework for better decision-making. One of the best tools I’ve found to illustrate this is what I call the Client A/B Chart. Horrible name, I know, but it gets the job done. Take a look:

The Client A/B Chart

*Same initial portfolio value. Annual withdrawals $80,000. Same time-weighted return, different dollar-weighted ending wealth. Average rates of return over a 10-year period using compound calculation.

We start with the same initial portfolio value and add some hefty withdrawals ($80k per year—yes, that’s high, but this exercise is meant to illustrate a point). So, what happens? The returns are identical—10%—but the money is most definitely not.

This isn’t new to many of you. You’ve seen this before and may even use it. But here’s the catch…

Which client is happier? Client A or Client B?

It’s a trick question because the answer is neither. And here’s where most advisors miss the point, and moreover why ongoing planning is the only way to go.

Sure, Client B is obviously unhappy. But why did Client A fire their advisor when they ended up with more money and a 10% average return? Who in their right mind wouldn’t take that?!

Client A fired their advisor because their advisor didn’t let them know they had choices. Client A had six years of amazing markets and growth in their portfolio (sound familiar?). This created choices and options for them. But what happened? Nothing.

Remember those abovementioned “control factors”? This is where you come in as advisor. This is why YOU are worth so much more than you charge your clients.

My favorite question to ask clients during these periods comes from my long-time friend and mentor. He would always ask during good times, “What is the risk you’re taking buying you that you value?” Whatever it may be—time, memories, you name it—if your clients are taking risk right now after years of good markets, be sure you know what that is.

Now is the time to challenge your clients with the “what if” and “trade-off” questions. We have no idea where the markets are headed. We never do. What we do know is that things have been good for a very, very long time. We hope it stays that way.

The strategies we have to address these risks and challenges are as numerous and unique as the client situations themselves, and we are standing by to help as they arise. My cohorts and I at XY Investment Solutions look forward to helping with situations like this, and any other unique investment and planning situations.

About the Author

A creative innovator and collaborator, Brandon Moss has had a front-row seat to the digital advice revolution, helping build one of the most innovative national RIAs on the planet. He’s acquired a 360* view of the RIA landscape, from being an advisor and running his own firm to designing and integrating some of the most innovative tools in the industry. He has lead, trained, coached, onboarded, integrated, transitioned, (you name it) over 100 RIA firms/wealth management teams. Additionally, he's evaluated, prospected, pitched (again...you name it) countless other firms. Consequently, he's an exceptional listener and comfortable in many different conversations! Occasionally, he's asked to opine on varying topics, typically Gen X+Y, innovation, client experience and technology. Beyond those topics, he's typically “winging it”. Brandon graduated from Texas Tech University's globally recognized personal financial planning program, then made it through some Executive Education at UC Berkeley's Haas School of Business. He’s also perpetually in online classes trying to figure out something new. Brandon resides in the Dallas/Ft. Worth area with his wife, Shelby, and his identical, mirror-image twin boys, Will and Reese. When he's not with them, he's probably in his garage tinkering, building, or buying way too much golf equipment.

Brandon is the Director of XY Investment Solutions (XYIS), XY Planning Network’s digital hybrid investment platform. It’s a turnkey asset management platform (TAMP) designed and curated to the specific needs of XYPN members.

This information is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, XY Investment Solutions, LLC (referred to as "XYIS") disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement and suitability for a particular purpose. XYIS does not warrant that the information will be free from error. None of the information provided is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall XYIS be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if XYIS or an XYIS authorized representative has been advised of the possibility of such damages. In no event shall XY Investment Solutions, LLC have any liability to you for damages, losses and causes of action for this information. This information should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.

Share this

- Fee-only advisor (381)

- Advice (305)

- Business Development (248)

- Independent Financial Advisor (203)

- Growing Your Firm (161)

- Marketing (133)

- Financial Planning (129)

- What Would Arlene Say (WWAS) (81)

- Business Coach (80)

- Firm Ownership (78)

- Training (75)

- Compliance (72)

- Business (69)

- Building Your Firm (65)

- Financial Advisors (63)

- Online Marketing (61)

- Events (59)

- Starting a Firm (52)

- Staffing & HR (49)

- Technology (49)

- From XYPN Members (48)

- Launching a firm (46)

- Advisors (41)

- Entrepreneurship (38)

- Taxes (37)

- Networking & Community (33)

- Interviews and Case Studies (32)

- Investment Management (31)

- Sales (27)

- Social Responsibility (27)

- Tax Preparation (27)

- XYPN Invest (26)

- Business Owner (25)

- Small Business Owner (20)

- Financial Management & Investment (19)

- Industry Trends & Insights (19)

- Financial Education (17)

- Financial Planners (17)

- Independent Financial Planner (17)

- Tech Stack (17)

- XYPN (17)

- Leadership & Vision (16)

- Investing (15)

- Niche (15)

- How to be a Financial Advisor (14)

- NextGen (14)

- RIA (14)

- Media (13)

- Preparing to Launch (13)

- Press Mentions (13)

- RIA Operations (12)

- RIA Owner (12)

- XYPN Membership (12)

- Assets Under Management (AUM) (11)

- First Year (11)

- Goals (11)

- Scaling (10)

- Advisor Success (9)

- Building Your Firm (8)

- Communication (8)

- Lessons (8)

- Study Group (8)

- Time Management (8)

- Virtual Advisor (8)

- Behavioral Finance (7)

- Growth (7)

- Pricing Models (7)

- From Our Advisors (6)

- Independent RIA (6)

- Money Management (6)

- Motivation (6)

- Processes (6)

- Automation (5)

- Broker-Dealers (5)

- College Planning (5)

- Filing Status (5)

- How I Did It series (5)

- Investment Planner (5)

- Mental Health (5)

- Michael Kitces (5)

- Preparing to Launch (5)

- RIA Operations (5)

- Retirement (5)

- Risk and Investing (5)

- S Corpration (5)

- Support System (5)

- TAMP (5)

- Wealth (5)

- Year-End (5)

- Client Services (4)

- Outsourcing (4)

- Selling a Firm (4)

- Succession Plans (4)

- Benchmarking Study (3)

- Budgeting (3)

- Career Changers (3)

- Engagement (3)

- Fiduciary (3)

- Getting Leads (3)

- Membership (3)

- Millennials (3)

- Monthly Retainer Model (3)

- Partnership (3)

- Pricing (3)

- Recordkeeping (3)

- Risk Assessment (3)

- Small Business (3)

- Staying Relevant (3)

- Work Life Balance (3)

- Advice-Only Planning (2)

- Bookkeeping (2)

- Charitable Donations (2)

- Client Acquisition (2)

- Differentiation (2)

- Health Care (2)

- IRA (2)

- Inflation (2)

- Productivity (2)

- Implementing (1)

Subscribe by email

You May Also Like

These Related Stories

A Total Return Approach to Investing

ESG Investing: An Investment Expert's High-level Review