Inverted Value: Focusing on Financial Life Management

Share this

Anyone who has seen Top Gun can recall, with a laugh, the scene where Maverick (Tom Cruise) and Charlie (Kelly McGillis) first meet and Maverick delivers his famous “Because I was inverted” line. He does so with an unabashed confidence and unforgiving brashness that he manages to get away with because, well, he’s Tom Cruise.

This might seem like a strange opening to a financial blog, but guess what? You can actually drop that same line right now! Like Maverick, you too are inverted! Unlike other financial advisors who lead with investment management, you lead with planning, advice, and guidance that draws clients in because you help them navigate and make better decisions about their entire financial life. As a result, clients don’t simply see you as someone who manages their money; they see you as someone who enhances their life. You’re not like every other financial advisor; you’re different—you’re inverted—and you can own that.

A Shifting Paradigm

We are standing at an interesting and pivotal moment in financial services. The value is being flipped (or inverted) from managing money to managing all of the points where money and our lives intersect. Unlike traditional investment management, financial life management is about more than managing a client’s “wealth;” it’s about managing the intersections of a client’s life and financial decisions.

It’s much like 30 or so years ago when the first fee-based advisors began cropping up. This was a massive shift, largely driven by advancements in technology and products, from door-to-door insurance agents to stockbrokers who dominated the financial services industry. Decades later, we’re again seeing a paradigm shift, this time away from investment management and towards financial life management as the primary focus of financial planning.

Today, new advancements in technology and products are again disrupting the standard and simultaneously driving the profession batsh*t crazy. You can’t read, watch, listen or attend anything in the industry without hearing about “the demise of the human advisor” or the “rise of the robos.” It all starts to sound like fire-and-brimstone-coming-down-from-the-skies stuff! Advisors should be afraid. Be very afraid.

But should you be afraid? No. You should be mindful. You should be paying very close attention. You should be considering slight changes and adjustments to your firm and offerings. But you shouldn’t be afraid because you are leading with financial life management, making you better positioned than 99% of other advisors. Everyone wants to be you.

You are positioned to win in this new environment thanks in large part to this inverted ratio:

75/25

(New Paradigm)

Financial Life Management/Investment Management

25/75

(Old Paradigm)

For the last 30 or so years, the pitch, even from fee-only advisors, has been some version of “wealth management” centered on managing money. This traditional paradigm positions advisors with almost all of their “perceived value” (let’s call it 75% or more) on the management of assets, with advice and guidance as an ancillary, one-time or even free service (25% or less). Here, the perception is, as an advisor, you are mostly a money manager. The perception should really match the reality: as an advisor, you are a financial life manager.

That’s why so many $50 million, $100 million, $500 million and north of $1 billion firms are trying to invert that ratio to focus their value away from investment management and towards financial life management. They realize the value of focusing on a subscription- or retainer-based model with planning and financial life management as the focus, and other ancillary services (like investment management) as additives.

They all secretly want to be you. They all want to be “inverted” and match their value perception to yours: 75% focused on financial life management and 25% focused on the execution and stewardship of assets. But changing upwards of 30 years of success, experience, processes, ego and lifestyle is hard. Trust me, I’ve been there, done that (about 100 times over). It’s not impossible, but it certainly isn’t easy.

Positioning Investment Management for Success

How do I hold on to this envied position? How do I leverage it? Is my client experience and the value I provide actually worth the cost I am charging? How should I even be charging? Particularly, how should I be charging for investment management services as someone who leads with financial life management? These are questions we hear from advisors all the time.

Here’s the thing: investments still matter! More than that, they matter a lot. While we have made some great strides in promoting subscription- and retainer-based services focused on advice, planning and overall financial life management, most clients still come to us because they have a money problem, not a planning problem. Luckily, we’re in a position to help fix their money problem along with all of their other financial life problems.

We have written previously about ways to integrate investment management into your practice, questions to ask before doing so, and how to choose the right fee structure. But everyone still wants to know the best way. And because no one likes to hear, “it depends,” let’s try it this way: as long as you get the value perception right, the rest falls into place.

Sorry if that’s a little too Carl Richards simplistic for you, but it’s all about getting your value perception correct. Your ratio may not be exactly 75/25. It might be 70/30 or 80/20. As long as your value perception is focused on overall financial life management, with investment management as a small piece of the collective pie, you win. It’s that simple.

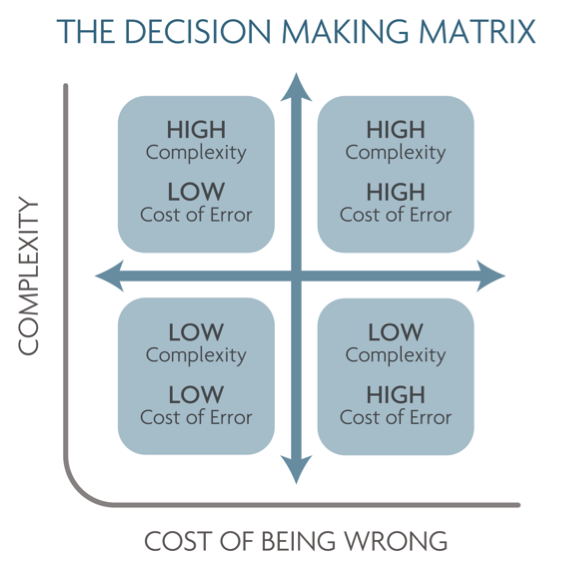

The Decision-Making Matrix

When thinking about how to position yourself, consider this decision-making matrix. It looks at two variables: complexity and the cost of being wrong. As an advisor, you want to live and breathe every day in the upper right quadrant. The highest and best use of your time is spent working with clients on things that are complex in nature, where the cost for clients to be wrong is high. Clients are willing to pay more for things they don’t understand, where being wrong will cause great discomfort, stress and potential lifestyle change.

On the flip side, if you’re spending your time on things that are not that difficult (if your client is wrong, the consequence for your client is marginal), how much value are you actually adding to your client’s life? Probably not a whole lot.

Ask yourself this: What is more impactful to your clients - a 10% market decline or not having disability insurance when an accident happens? Is it more impactful to spend more time managing and making sure your DFA model is slightly different than another one, or being able to address the changes in your client’s financial life when cancer comes? The answers here should be obvious. The takeaway? Use your time wisely to provide guidance that consistently positions you as a value-add in the minds of your clients.

Source: InvestmentNews

So where does investment management fall on this matrix?

I’m sure we could debate the merits of where exactly investment management sits, but for my money and my clients, there are plenty of high-class solutions (SHAMELESS PLUG ALERT) that allow advisors to either outsource or greatly systematize this portion of their business while still providing a great experience for clients. This allows you to focus on much more complex areas where you can add tremendous value by providing discipline, empathy and judgement to help your clients make sound and informed decisions. Moreover, this helps you achieve, and maintain, that value perception sweet spot. Whether you price your services via monthly subscription, annual retainer, complexity, AUM-based or some other way, as long as your value perception is correct (roughly 75% of the value on financial life management and 25% on investment management), you, and most importantly your clients, will win. Like Maverick, be proud to be inverted.

About the Author

A creative innovator and collaborator, Brandon Moss has had a front-row seat to the digital advice revolution, helping build one of the most innovative national RIAs on the planet. He’s acquired a 360* view of the RIA landscape, from being an advisor and running his own firm to designing and integrating some of the most innovative tools in the industry. He has lead, trained, coached, onboarded, integrated, transitioned, (you name it) over 100 RIA firms/wealth management teams. Additionally, he's evaluated, prospected, pitched (again...you name it) countless other firms. Consequently, he's an exceptional listener and comfortable in many different conversations! Occasionally, he's asked to opine on varying topics, typically Gen X+Y, innovation, client experience and technology. Beyond those topics, he's typically “winging it”. Brandon graduated from Texas Tech University's globally recognized personal financial planning program, then made it through some Executive Education at UC Berkeley's Haas School of Business. He’s also perpetually in online classes trying to figure out something new. Brandon resides in the Dallas/Ft. Worth area with his wife, Shelby, and his identical, mirror-image twin boys, Will and Reese. When he's not with them, he's probably in his garage tinkering, building, or buying way too much golf equipment.

Brandon is the Director of XY Investment Solutions (XYIS), XY Planning Network’s digital hybrid investment platform. It’s a turnkey asset management platform (TAMP) designed and curated to the specific needs of XYPN members.

This information is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, XY Investment Solutions, LLC (referred to as "XYIS") disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement and suitability for a particular purpose. XYIS does not warrant that the information will be free from error. None of the information provided is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall XYIS be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if XYIS or an XYIS authorized representative has been advised of the possibility of such damages. In no event shall XY Investment Solutions, LLC have any liability to you for damages, losses and causes of action for this information. This information should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.

Share this

- Advisor Posts (433)

- Fee-only advisor (388)

- Advice (316)

- Business Development (245)

- Independent Financial Advisor (204)

- Growing Your Firm (160)

- Marketing (132)

- Financial Planning (104)

- What Would Arlene Say (WWAS) (81)

- Firm Ownership (78)

- Business Coach (77)

- Training (76)

- Compliance (71)

- Business (69)

- Building Your Firm (68)

- Financial Advisors (65)

- Online Marketing (61)

- Events (60)

- Starting a Firm (50)

- From XYPN Members (48)

- Technology (48)

- Launching a firm (45)

- Advisors (42)

- Entrepreneurship (39)

- Taxes (39)

- Staffing & HR (38)

- Networking & Community (33)

- Interviews and Case Studies (32)

- Investment Management (32)

- XYPN Invest (28)

- Tax Preparation (27)

- Business Owner (25)

- Social Responsibility (25)

- Sales (24)

- Small Business Owner (20)

- Industry Trends & Insights (19)

- From XYPN Invest (18)

- Financial Planners (17)

- Independent Financial Planner (17)

- XYPN (17)

- Leadership & Vision (16)

- XYPN News (16)

- Tech Stack (15)

- How to be a Financial Advisor (14)

- RIA (14)

- Investing (13)

- Media (13)

- NextGen (13)

- Press Mentions (13)

- Financial Education (12)

- Goals (12)

- RIA Owner (12)

- XYPN Membership (12)

- Assets Under Management (AUM) (11)

- First Year (11)

- Niche (11)

- SEC (10)

- Advisor Success (9)

- RIA Registration (9)

- Communication (8)

- Lessons (8)

- Study Group (8)

- Time Management (8)

- Virtual Advisor (8)

- Growth (7)

- Mental Health (7)

- Pricing Models (7)

- From Our Advisors (6)

- Independent RIA (6)

- Money Management (6)

- Motivation (6)

- Preparing to Launch (6)

- Processes (6)

- Risk and Investing (6)

- Automation (5)

- Behavioral Finance (5)

- Broker-Dealers (5)

- College Planning (5)

- Filing Status (5)

- How I Did It series (5)

- Investment Planner (5)

- Michael Kitces (5)

- Preparing to Launch (5)

- Retirement (5)

- S Corpration (5)

- Scaling (5)

- Support System (5)

- TAMP (5)

- Wealth (5)

- Year-End (5)

- Bear Market (4)

- CFP Certification (4)

- Outsourcing (4)

- Selling a Firm (4)

- Small Business (4)

- State Registration (4)

- Succession Plans (4)

- Benchmarking Study (3)

- Bookkeeping (3)

- Budgeting (3)

- ESG Investing (3)

- Emotional Decisions (3)

- Engagement (3)

- Fiduciary (3)

- Financial Life Planning (3)

- Getting Leads (3)

- IRA (3)

- Life planning (3)

- Lifestyle practice (3)

- Membership (3)

- Millennials (3)

- Monthly Retainer Model (3)

- Monthly Subscription Model (3)

- Partnership (3)

- Pricing (3)

- RIA Audit (3)

- Recordkeeping (3)

- Risk Assessment (3)

- Staying Relevant (3)

- Wellness (3)

- Work Life Balance (3)

- Advice-Only Planning (2)

- Building Your Firm (2)

- Career Changers (2)

- Charitable Donations (2)

- Community Property (2)

- Design (2)

- Differentiation (2)

- Exchange-Traded Funds (ETF) (2)

- FINRA (2)

- Finding Your Why (2)

- Graphic design (2)

- Growing Income (2)

- Health Care (2)

- Inflation (2)

- Key performance indicator (KPI) (2)

- Keynote (2)

- Negative Rates (2)

- Operations (2)

- Organization (2)

- Outsourced Asset Management (2)

- Outsourced Bookkeeping (2)

- Portfolio Management (2)

- Productivity (2)

- Psychology (2)

- Quickbooks (2)

- Recommended Reading (2)

- Recruiting (2)

- Registered Representative (2)

- Registration (2)

- Restricted Stock Units (RSU) (2)

- Start Ups (2)

- Stock Options (2)

- Team Communication (2)

- Virtual Assistant (2)

- Virtual Paraplanner (2)

- Accounting (1)

- Arlene Moss (1)

- Assistant (1)

- Bonds (1)

- Bull Market (1)

- Careers (1)

- Certified Public Accountant (CPA) (1)

- Childcare (1)

- Client Acquisition (1)

- Client Services (1)

- Common Financial Mistakes (1)

- Consulting (1)

- Consumerism (1)

- Credit (1)

- Custodians (1)

- Custody Rule (1)

- Data (1)

- Daycare (1)

- Definitions (1)

- Designations (1)

- Direct Indexing (1)

- Disasters (1)

- Earn More (1)

- Family (1)

- Fidelity (1)

- Finance (1)

- Financial Freedom (1)

- Financial Goals (1)

- Financial Life Management (1)

- Financial Success (1)

- Financial Wellness (1)

- Form 8606 (1)

- Form 8915-E (1)

- Grief (1)

- Guide (1)

- How to Budget (1)

- Impostor Syndrome (1)

- Interns (1)

- Investor Policy Statement (IPS) (1)

- Job burnout (1)

- Liquidating your business (1)

- Loans (1)

- Moving Forward (1)

- Part Time (1)

- Paying Yourself (1)

- Paystub (1)

- Perfectionism (1)

- Project Management (1)

- Projecting Returns (1)

- Purpose (1)

- Quarterly Estimated Payments (1)

- RIA Operations (1)

- Recession (1)

- Referrals (1)

- Regulations (1)

- Regulators (1)

- Reinvention (1)

- Relationships (1)

- Remote (1)

- Required Minimum Distributions (RMD) (1)

- Risk Management (1)

- Roth Conversations (1)

- Roth IRA (1)

- Sabbatical (1)

- Spending (1)

- Strategy (1)

- Systems (1)

- Target Audience (1)

- Teamwork (1)

- Terms (1)

- To-Do List (1)

- Traditional IRA (1)

- Transitions (1)

- Virtual (1)

- Vulnerability (1)

- XYPN Books (1)

Subscribe by email

You May Also Like

These Related Stories

Investment Management in a Consumer-Centric World

Networking in a Virtual World — Advice for Advisors