ESG Investing

Share this

ESG investing means something different to just about everyone. While all can agree that the acronym stands for Environmental, Social, and Governance, beyond that, things start to get hazy. There are mountains of data, hundreds if not thousands of academic pieces, and a seemingly infinite number of opinions on the topic. I am not here to settle any debates or draw definitive conclusions, but as the Head of XY Investment Solutions’ (XYIS) Investment Committee, I would like to illustrate how we approach ESG investing in the XYIS Cause series of portfolio models.

One of the most debated points in this topic area is whether it is better to exclude companies from the portfolio if they do not adhere to or espouse one’s ESG principles (known as a “negative” screening), or to channel assets only to the leaders in these areas (“positive” screening).

Another approach is to invest and take an active role to influence the companies’ policies and practices.

Still another version is known as “Impact Investing,” whereby we may not just seek to identify generically “good” or “bad” companies, but invest in projects that are exclusively focused on a specific positive outcome. An example of this is Apple’s issuance of $1BN worth of “green bonds” to fund construction of wind and solar projects to power their facilities (shares of this bond are held by Praxis Impact Bond Fund in the XYIS Cause portfolio).

All of these approaches have merit, for sure, and it is impossible to choose whether one way is superior to another on behalf of another values-oriented investor.

Another component for consideration is whether or how to weigh one of the ESG factors over another. For example, what if a company is lauded for its environmental record, but does not do well in governance areas like gender or racial diversity? In this scenario, an investor taking the very popular “Fossil Fuel Free” approach would likely not want the same holdings as one whose primary interest is to see more female directors and officers at their portfolio companies.

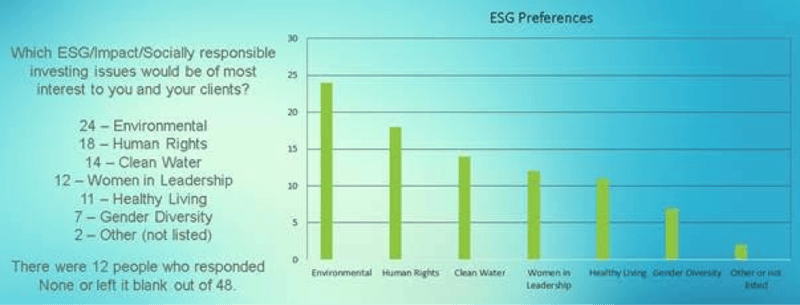

A recent survey of XYPN indicated that our members are split among the most important factor:

As you can see, once you include all the variables, and consider that the “E,” the “S,” and the “G” have dozens of individual sub-categories each, there are as many combinations and iterations of approaches to ESG investing as there are opinions among investors.

To make matters more difficult, a significant challenge for any ESG investor is how, and how stringently, to perform the required due diligence. One only need to consider the Volkswagen emissions scandal from a few years ago as an example. On the surface, VW looked like the darling of the auto industry for environment-minded investors (not to mention car buyers!) based on their emissions scores. That is until it was disclosed that they cheated on the tests.

The depth and breadth of the scandal is enough to generate concern that similar “greenwashing” may be happening in more places and going unnoticed.

How, then, is a Main Street investor supposed to have the access and knowledge to foil such a devious plan by the likes of Volkswagen?

To be sure, we do not think we should throw our hands up on ESG simply because it is difficult.On the contrary, we believe it is important not to rely on the self-reported virtues of Earth’s corporate citizens, but instead to partner with firms whose sole mission is to hold these companies to a higher standard on behalf of interested investors.

Specifically, this is why the XYIS Cause portfolios use professionally-managed mutual funds by companies with established track records and the seal of approval from investors who believe that “doing well by doing good” is more than just a catch phrase.

For many of the reasons cited above, our approach is not to try to create a separate flavor ESG portfolio for every palate, but rather build portfolios that satisfy investors with a broader approach. For investors who want a custom-tailored portfolio according to their own specific values, please contact the XYIS team about constructing a unique portfolio under our “Craft” umbrella.

For XYIS advisors approved for Dimensional Fund Advisors’ portfolios (the “Cause DFA” series), XYIS utilizes a blend of Sustainability and Social Core funds. DFA has a proprietary approach to each type; we encourage reaching out to your contact for detailed information.

The XYIS “Cause” portfolios attempt to mimic our Core models in their overall global allocation by using ESG funds on TD Ameritrade’s No Transaction Fee fund list. We presently use funds from household names in the space such as Calvert, Parnassus, PAX, Praxis, and TIAA-CREF. We will continue to monitor the available funds to improve based on investment and ESG criteria.

As always, we welcome any contribution from our advisor community to help improve our offerings.

About the Author

Mario Nardone, CFA, began his investment career in 1999 with Vanguard mutual funds in Valley Forge, PA, where he consulted institutions and financial advisors on investment policy, portfolio construction, and Exchange-Traded Funds (ETFs). He also held roles as a research analyst, a municipal bond fund specialist, among others during his tenure. In 2003 he earned the Chartered Financial Analyst designation, and he continues to mentor aspiring Charter candidates and young investment professionals.

Mario relocated to Charleston in 2010 to serve as Chief Investment Officer for a financial planning firm before establishing East Bay, the collaborative partner firm of (insert firm name), in 2014. As a Partner at East Bay, Mario serves a select group of Registered Investment Advisor firms as their outsourced Chief Investment Strategist. Responsibilities of this role include continuous oversight of advisor clients’ investments, bespoke strategies for unique situations, client communications, and more.

Mario is Past President of CFA Society South Carolina and Former Chairman of the College of Charleston Finance Department Advisory Board. His approach to investments and the industry has been featured in Investment News, NAPFA Advisor Magazine, South Carolina Public Radio, and other publications and media outlets.

Mario enjoys early morning basketball games, the Charleston beaches and restaurant scene, and spending summers in coastal Maine. He is an avid world traveler and SCUBA diver, but also enjoys the simpler joys of life with his wife Piper, their daughter Pepper, and son Santino.

Share this

- Advisor Posts (433)

- Fee-only advisor (388)

- Advice (316)

- Business Development (245)

- Independent Financial Advisor (204)

- Growing Your Firm (160)

- Marketing (132)

- Financial Planning (104)

- What Would Arlene Say (WWAS) (81)

- Firm Ownership (78)

- Business Coach (77)

- Training (76)

- Compliance (71)

- Business (69)

- Building Your Firm (68)

- Financial Advisors (65)

- Online Marketing (61)

- Events (60)

- Starting a Firm (50)

- From XYPN Members (48)

- Technology (48)

- Launching a firm (45)

- Advisors (42)

- Entrepreneurship (39)

- Taxes (39)

- Staffing & HR (38)

- Networking & Community (33)

- Interviews and Case Studies (32)

- Investment Management (32)

- XYPN Invest (28)

- Tax Preparation (27)

- Business Owner (25)

- Social Responsibility (25)

- Sales (24)

- Small Business Owner (20)

- Industry Trends & Insights (19)

- From XYPN Invest (18)

- Financial Planners (17)

- Independent Financial Planner (17)

- XYPN (17)

- Leadership & Vision (16)

- XYPN News (16)

- Tech Stack (15)

- How to be a Financial Advisor (14)

- RIA (14)

- Investing (13)

- Media (13)

- NextGen (13)

- Press Mentions (13)

- Financial Education (12)

- Goals (12)

- RIA Owner (12)

- XYPN Membership (12)

- Assets Under Management (AUM) (11)

- First Year (11)

- Niche (11)

- SEC (10)

- Advisor Success (9)

- RIA Registration (9)

- Communication (8)

- Lessons (8)

- Study Group (8)

- Time Management (8)

- Virtual Advisor (8)

- Growth (7)

- Mental Health (7)

- Pricing Models (7)

- From Our Advisors (6)

- Independent RIA (6)

- Money Management (6)

- Motivation (6)

- Preparing to Launch (6)

- Processes (6)

- Risk and Investing (6)

- Automation (5)

- Behavioral Finance (5)

- Broker-Dealers (5)

- College Planning (5)

- Filing Status (5)

- How I Did It series (5)

- Investment Planner (5)

- Michael Kitces (5)

- Preparing to Launch (5)

- Retirement (5)

- S Corpration (5)

- Scaling (5)

- Support System (5)

- TAMP (5)

- Wealth (5)

- Year-End (5)

- Bear Market (4)

- CFP Certification (4)

- Outsourcing (4)

- Selling a Firm (4)

- Small Business (4)

- State Registration (4)

- Succession Plans (4)

- Benchmarking Study (3)

- Bookkeeping (3)

- Budgeting (3)

- ESG Investing (3)

- Emotional Decisions (3)

- Engagement (3)

- Fiduciary (3)

- Financial Life Planning (3)

- Getting Leads (3)

- IRA (3)

- Life planning (3)

- Lifestyle practice (3)

- Membership (3)

- Millennials (3)

- Monthly Retainer Model (3)

- Monthly Subscription Model (3)

- Partnership (3)

- Pricing (3)

- RIA Audit (3)

- Recordkeeping (3)

- Risk Assessment (3)

- Staying Relevant (3)

- Wellness (3)

- Work Life Balance (3)

- Advice-Only Planning (2)

- Building Your Firm (2)

- Career Changers (2)

- Charitable Donations (2)

- Community Property (2)

- Design (2)

- Differentiation (2)

- Exchange-Traded Funds (ETF) (2)

- FINRA (2)

- Finding Your Why (2)

- Graphic design (2)

- Growing Income (2)

- Health Care (2)

- Inflation (2)

- Key performance indicator (KPI) (2)

- Keynote (2)

- Negative Rates (2)

- Operations (2)

- Organization (2)

- Outsourced Asset Management (2)

- Outsourced Bookkeeping (2)

- Portfolio Management (2)

- Productivity (2)

- Psychology (2)

- Quickbooks (2)

- Recommended Reading (2)

- Recruiting (2)

- Registered Representative (2)

- Registration (2)

- Restricted Stock Units (RSU) (2)

- Start Ups (2)

- Stock Options (2)

- Team Communication (2)

- Virtual Assistant (2)

- Virtual Paraplanner (2)

- Accounting (1)

- Arlene Moss (1)

- Assistant (1)

- Bonds (1)

- Bull Market (1)

- Careers (1)

- Certified Public Accountant (CPA) (1)

- Childcare (1)

- Client Acquisition (1)

- Client Services (1)

- Common Financial Mistakes (1)

- Consulting (1)

- Consumerism (1)

- Credit (1)

- Custodians (1)

- Custody Rule (1)

- Data (1)

- Daycare (1)

- Definitions (1)

- Designations (1)

- Direct Indexing (1)

- Disasters (1)

- Earn More (1)

- Family (1)

- Fidelity (1)

- Finance (1)

- Financial Freedom (1)

- Financial Goals (1)

- Financial Life Management (1)

- Financial Success (1)

- Financial Wellness (1)

- Form 8606 (1)

- Form 8915-E (1)

- Grief (1)

- Guide (1)

- How to Budget (1)

- Impostor Syndrome (1)

- Interns (1)

- Investor Policy Statement (IPS) (1)

- Job burnout (1)

- Liquidating your business (1)

- Loans (1)

- Moving Forward (1)

- Part Time (1)

- Paying Yourself (1)

- Paystub (1)

- Perfectionism (1)

- Project Management (1)

- Projecting Returns (1)

- Purpose (1)

- Quarterly Estimated Payments (1)

- RIA Operations (1)

- Recession (1)

- Referrals (1)

- Regulations (1)

- Regulators (1)

- Reinvention (1)

- Relationships (1)

- Remote (1)

- Required Minimum Distributions (RMD) (1)

- Risk Management (1)

- Roth Conversations (1)

- Roth IRA (1)

- Sabbatical (1)

- Spending (1)

- Strategy (1)

- Systems (1)

- Target Audience (1)

- Teamwork (1)

- Terms (1)

- To-Do List (1)

- Traditional IRA (1)

- Transitions (1)

- Virtual (1)

- Vulnerability (1)

- XYPN Books (1)

Subscribe by email

You May Also Like

These Related Stories

ESG Investing: An Investment Expert's High-level Review

A Total Return Approach to Investing